Prices

November 5, 2015

Hot Rolled Futures: Commodities Cemented in Gloom

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets

We are actually in a pretty important moment for U.S. equities for we have rallied back from our 15% (S+P 500) correction to test the old highs at 2118.50 (Dec future), but we have not yet taken them out. Having reached only 2110.25 we are now day three in what looks like a failed attempt. Markets can only Change direction once they fail to take out old highs, by definition. Will we look back and go, that was the moment? We are last 2090 zone and under pressure for the moment. It seems like the argument that the market would rise as long as there wasn’t another place for money to go may not hold up any longer. With the Fed threatening to raise rates, maybe that’s the catalyst for further correction. We’ll see. For now Teflon U.S. equities prevail.

In Crude and Copper and commodities the world over, the charts are no longer hopeful. Whatever optimism came out of the rally off the bottom has dissipated as we have broken support and look like we want to test old lows. We are last $45.25/bbl zone on Dec. futures where old lows from the financial crisis era were low 30’s. We may have a little bear flag forming to launch us a bit lower. In Copper, we had a bit of a breakdown today as the market dropped almost 7-8 cts/lb on the day from $2.32/lb zone to $2.25/lb zone. Reality is that it’s probably the beginning of furthers tests of lower levels as fundamentals just don’t warrant surprise demand.

Steel

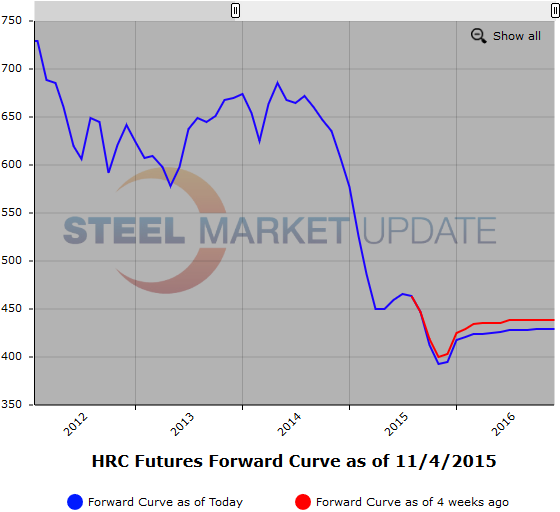

We have had a modest week in HR futures trading with 965 contracts or 19,300 ST trading in the week. Our week was accentuated by a Jan.17/Nov.17 trade @ $450/ST, which was the first 2017 trade. Additionally we saw Q1 trade down to $420/ST again, this on a spread trade to Q2, which brought that in at $425/ST, or about $2/ST below its last implied traded level. Meanwhile the back end of 2016 continues to trade just below $430/ST. On nearbys however, prices have come off further with both November and December trading $393-4/MT zone. CRU meanwhile came in at $393/ST down $5/ST as we appear ready to test the 2009 lows of $385/ST. It is interesting to note that this contract’s open interest remains at its highs at just under 23,000 contracts, a healthy sign for growth.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore

Has been a little more volatile of late with $1/MT plus moves down and then up again on the futures, but general trend is down. We are last $47.70/MT on the index, which is about $3-4/MT below the level where Iron Ore had stabilized for some time. Consensus is that whatever longs may have been built up waiting for a rally are now in liquidation mode as the market manifests its fundamental weakness. The real hope for Iron Ore prices is closures in production and that appears as though it may take some time. Let’s call Dec. either side of $44.55/MT, Q1 either side of $41.20/MT, Q3 either side of $40.20/MT, Cal ’16 either side of $41.00/MT and Cal ’17 either side of $39.25/MT.

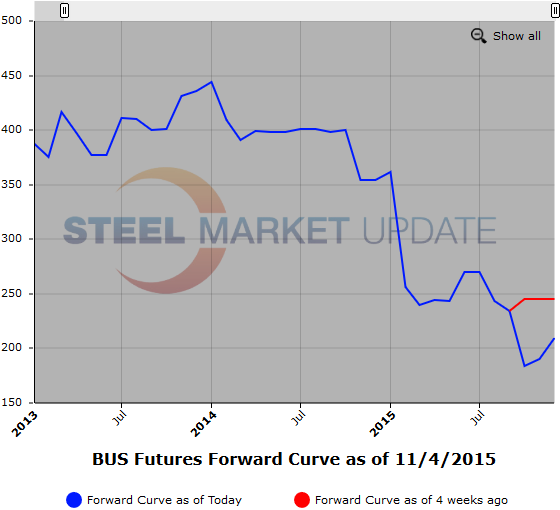

Scrap

It is difficult to establish a near term point of view in the scrap markets. The CFR Turkey scrap index has had some increased movement in the last month as it dropped $20 from $190GT down to $170/GT by mid October and then rebounded $25 in the latter part of October and the beginning of November to $195/MT today. While this may help some of the eastern Mid-Atlantic markets for obsolete scrap (which look to be sideways to last month) the same cannot be said for the scrap markets near Chicago. There is talk that Chicago premium grades will be down $20/$25 per GT due in part to mills easing back on buys for year end. First half of 2016 has seen offers for the BUS futures offers slip below @$225/GT.

Another graphic is below, to use it’s interactive features you must visit this page on our website.