Prices

November 1, 2015

Hot Rolled Futures: Will the 2009 Lows Provide Support for HRC?

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

In our last salvo for Steel Market Update, we touched on the distinct possibility that the psychologically important $400/ton level may not hold on HRC. That turned out to be the case, as every major index print now has spot prices at least slightly below that mark.

{loadposition reserved_message}

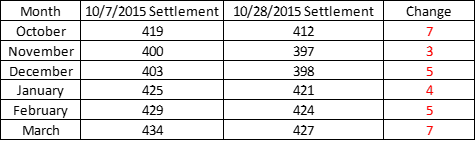

Indeed this week we can report some trades done for Nov/Dec below that level at $398/ton, so on both a spot and nearby futures basis, we are trading below $400. Let’s take a look back to the beginning of the month to get an idea of where we were and where we are now:

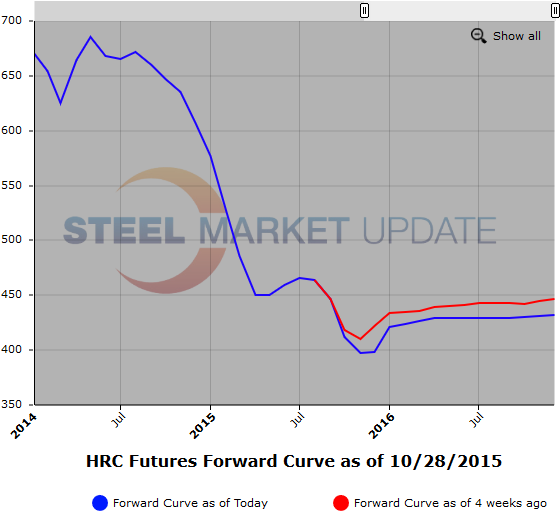

Also echoing what we had noted in our last comment, the market has slowed its descent substantially, even though it is still clearly under pressure. The declines noted above will certainly look muted compared to our last few editions of this piece. If there is one overarching reason for this, it is simply because there isn’t a whole lot of perceived room to the downside. We are already within $25/ton or so of the all-time contract low, which is by our record a $372/ton settlement back in June of 2009, during the darkest moments of the recession.

While we continue to expect that the lows from 2009 are likely to hold this year, and HRC prices are unlikely to sink below $370 in the near-term, the price of scrap could end up being the key to this forecast. As it stands, calls for November settlements are highly mixed but the overall sentiment is that further declines are inevitable, it is only a matter of how sizable they are. Raw materials in general have been under pressure this year, but unfortunately for integrated mills, iron ore prices have not fallen as much as one would think. The reason for that of course is China, and that brings us to our most concerning data points.

Last month China exported 11.25 MILLION tons of steel. That is an all-time high, and just in case you need some perspective, that total also comes to about 80 percent of the total output of the entire European Union in 2014. That is not 80 percent of EU exports mind you, that is 80 percent of total EU production. Another important note for perspective, China is not just the elephant in the room; it’s more analogous to all the elephants in the world, crammed into one room the size of my old midtown studio apartment. In more precise terms, the 823 million tonnes of steel China produced in 2014 is more than the entire rest of the world produced combined.

And even though Chinese output is dropping (about 2 percent through the first nine months of the year), this pace is not even remotely close to matching the declines in Chinese demand, and the result is the record flood of exports which are sinking steel industry all over the planet, not just the producers here in the US. It is this context that brings us to our main point; nothing the US does right now seems to be of much significance compared to what China does. The only caveat there of course is trade protectionism, but there appears to be as much in the pipeline on that front as there reasonably could be. We will all be anxiously awaiting the outcomes, but until then it looks like a good time to be properly hedged.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

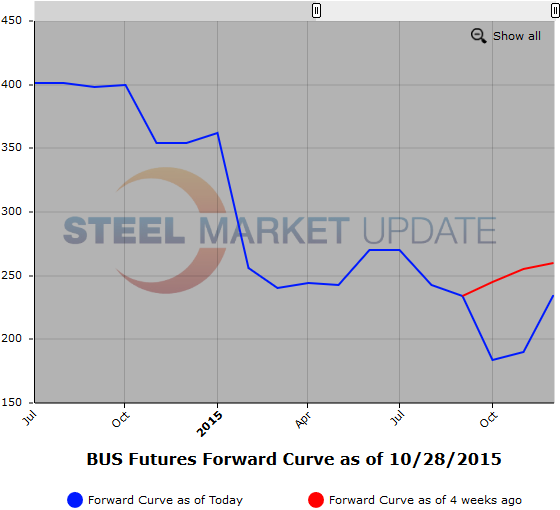

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.