Government/Policy

November 1, 2015

Critical Circumstances Found on Corrosion Resistant Steels (Galvanized & Galvalume)

Written by John Packard

On Friday, October 30, 2015, the U.S. Department of Commerce announced their Preliminary Determination that critical circumstances existed on corrosion resistant steels from certain mills in the Peoples Republic of China (China), South Korea (Korea), Italy and Taiwan. Critical circumstances were not found for any company from India and only ILVA was identified from Italy.

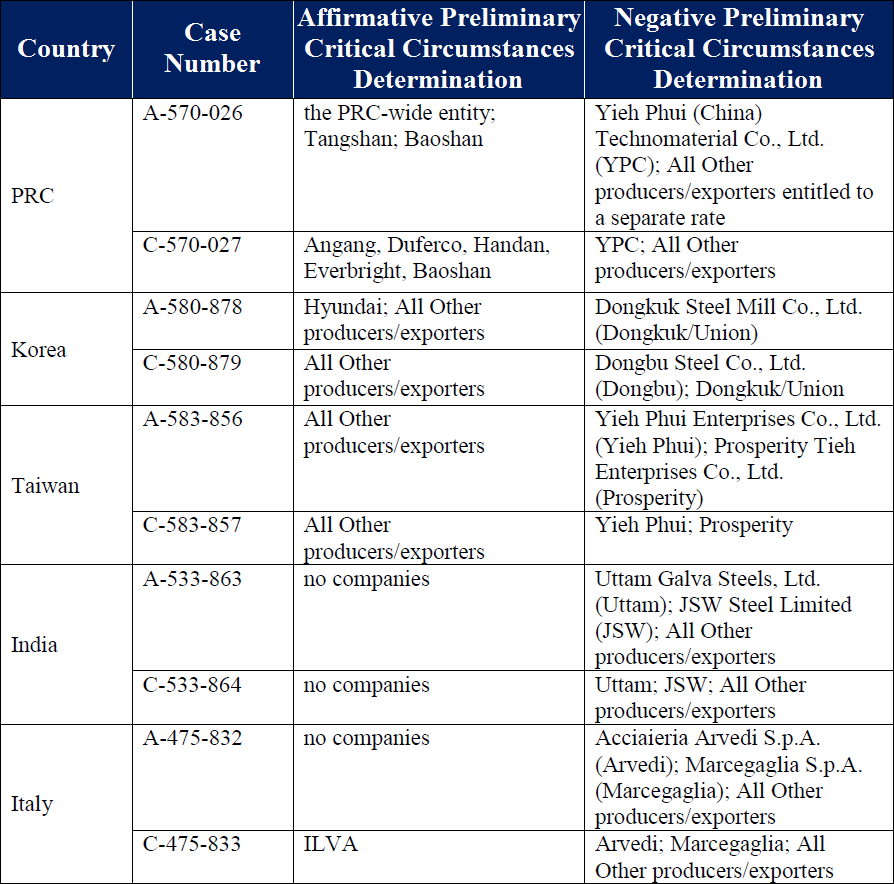

The table below was reproduced from the US DOC documents regarding their Preliminary Determination of Critical Circumstances on CORE (corrosion resistant steels – i.e. galvanized and Galvalume in particular).

Background

On June 3, 2015 an antidumping (AD) and countervailing duty (CVD) petition was filed by the domestic steel mills on corrosion resistant steels (CORE). The petition concerned imports of galvanized, aluminized and Galvalume from China, South Korea, Taiwan, India and Italy. On July 23, 2015 the US Department of Commerce received allegations that critical circumstances exist on the products referenced in the original petition.

Critical Circumstances

The U.S. Department of Commerce provided the following information regarding how they determine if critical circumstances exist in countervailing duty (CVD) investigations:

Section 703(e)(1) of the Tariff Act of 1930, as amended (the Act), provides that the Department will preliminarily determine that critical circumstances exist in CVD investigations if there is a reasonable basis to believe or suspect: (A) that “the alleged countervailable subsidy” is inconsistent with the Subsidies and Countervailing Measures (SCM) Agreement of the World Trade Organization, and (B) that there have been massive imports of the subject merchandise over a relatively short period.

The US DOC also provided the following information regarding critical circumstances in an antidumping investigation:

Section 733(e)(1) of the Act provides that the Department will preliminarily determine that critical circumstances exist in AD investigations if there is a reasonable basis to believe or suspect: (A)(i) that there is a history of dumping and material injury by reason of dumped imports in the United States or elsewhere of the subject merchandise, or (ii) that the person by whom, or for whose account, the merchandise was imported knew or should have known that the exporter was selling the subject merchandise at less than its fair value and that there was likely to be material injury by reason of such sales, and (B) that there have been massive imports of the subject merchandise over a relatively short period. Section 19 CFR 351.206 provides that imports must increase by at least 15 percent during the “relatively short period” to be considered “massive” and defines a “relatively short period” as normally being the period beginning on the date the proceeding begins (i.e., the date the petition is filed) and ending at least three months later.3 The regulations also provide, however, that, if the Department finds that importers, or exporters or producers, had reason to believe, at some time prior to the beginning of the proceeding, that a proceeding was likely, the Department may consider a period of not less than three months from that earlier time.

In their opinion released on Friday (but not yet printed in the Federal Register), the US Department of Commerce pointed out a number of subsidy programs in India, Italy, China, Korea and Taiwan that are inconsistent with the SCM agreement (Subsidies and Countervailing Measures Agreement with the World Trade Organization).

The DOC also considered current orders or previous orders of antidumping on imports of the same merchandise. They found a history of dumping of corrosion resistant products from Korea, China and Taiwan.

The DOC considered if the countries knew they were selling at less than fair market value. To this end the DOC used the alleged dumping margins which exceeded the 15 to 25 percent threshold. The “alledged” dumping margins are 71.09 percent for India, 123.76 percent for Italy, 80.06 percent for Korea, 120.20 percent for China and 84.40 percent for Taiwan.

The Department of Commerce then looked at whether importers knew (or should have known) that there was likely to be material industry suffered by the domestic steel industry. They used trade and price statistics and/or press reports.

The DOC cited testimony by USS CEO Mario Lonhi where he warned of long-term damage to the steel industry and specifically pointed to China which, according to the DOC announcement, “…China’s state-subsidized industry continue to pump out steel, even as demand slows at home. That has led to surging exports, particularly to the United States.”

As the US DOC determined if there are “massive imports over a relatively short period,” the Department acknowledged that they normally consider the three month period prior to the filing of the petition as the “base period” which is then compared to the three months following the petition which is called the “comparison period.” For imports to be considered “massive” the comparison period has to have increased by 15 percent of more above the base period.

However, the allegation from the domestic mills was the importing countries knew well in advance of the filing that a proceeding was likely. The petitioners asked that March be considered as the date exporters of CORE products knew a filing was coming.

To make their case the steel mill attorneys referenced an article produced by Steel Market Update on March 10, 2015 where we referenced inquiries from importers of cold rolled and CORE steel products, “asking questions about the potential for a trade case or anti-dumping filing by the domestic mills against foreign steel imports.”

The DOC document also referenced two other press reports, one from the American Metal Market dated March 26, 2015 and a third from the Pittsburgh Tribune dated March 27, 2016. They also referenced an article published by Barron’s on March 30, 2016.

This is how the US DOC explained how they came to their determination of a “massive surge” in CORE imports from the countries named in the original petition:

“Thus, in order to determine whether there has been a massive surge in imports for each cooperating mandatory respondent, the Department compared the total volume of shipments from March 2015 through September 2015 (all months for which data was available) with the preceding seven-month period of August 2014 through February 2015. For “all others,” the Department compared Global Trade Atlas (GTA) data for the period March through August (the last month for which GTA data is currently available) with the proceeding six-month period of September 2014 through February 2015.50 We first subtracted shipments reported by the cooperating mandatory respondents from the GTA data. For non-cooperating mandatory respondents (i.e., those mandatory respondents that did not respond to our critical circumstances questionnaire or who otherwise indicated their unwillingness to participate in the investigations), we determined, on the basis of adverse facts available, that there has been a massive surge in imports. Accordingly, we preliminarily determined the following producers/exporters had massive surges in imports.”

This is how they determined that:

• Italy (ILVA only),

• Korea (all others)

• China (Hebei Iron & Steel Co, Ltd, (Tangshan Branch), Baoshan Iron & Steel Co., Ltd (Baoshan), Angang Group Hong Kong Company (Angang), Duferco S.A. (Duferco), Handan Iron & Steel Group (Handan), Changsu Everbright Material Technology (Everbright) and Baoshan.

• Taiwan (all others)

India was not found to have a massive surge in exports of CORE products.

The importing companies of record associated with those companies or countries determined to have an affirmative finding will need to post a cash deposit equal to the estimated preliminary subsidy rates reflected in the preliminary determination published in the Federal Register. The effective date due to critical circumstances will be 90 days prior to the effective date (“i.e. the date of publication in the Federal Register of the notice of preliminary determination that countervailable subsidies have been provided at above de minimis rates”).

According to trade attorney Lewis Leibowitz, “…. Note the that CORE CVD preliminary determination is due on November 2 and will be released on Tuesday Nov. 3 at midday. Thus, the preliminary critical circumstances finding does not precede the CVD preliminary determination by very much (two business days at most).”