Prices

October 27, 2015

September and October Imports Seesaw

Written by John Packard

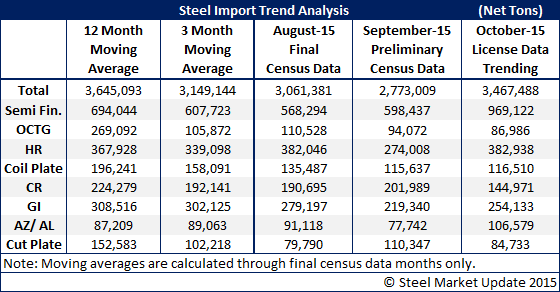

The U.S. Department of Commerce (US DOC) released Preliminary Census Data for September foreign steel imports on Monday. September imports dropped below 3.0 million net tons and at 2.77 million net tons they were down 5 percent month-over-month. As you can see by the table below hot rolled imports were down by 100,000 tons and galvanized and cold rolled imports were also down.

The bad news (if you are a steel mill) is October license data continues to point to a 3.0 million plus tonnage month and, at this moment, is trending toward 3.47 million tons. The biggest increase in tonnage, however, is due to the steel mills themselves as license data is trending just shy 1.0 million net tons of slabs and there is also an increase of hot rolled coil (a portion of which is also going to domestic steel mills).

Of the approximately 700,000 ton increase from September to October (trending) the vast majority is due to semi-finished steels (which all go to domestic steel or pipe producers) with close to 400,000 tons between the two months. Another 100,000 tons can be traced to hot rolled coil which is also used by the domestic steel industry. Most of the products identified by trade suits have either seen their tonnage drop or have remained relatively stationary.

We will dig into this subject in more detail once the Final Census data is released and we have produced our Imports by Product, Port and County report for our Premium level members.

Note: The tonnage shown in the table below are all in net tons (2,000#) as we have converted the metric tons released by the US DOC for the convenience of our members.