Market Segment

October 23, 2015

UK Steel lndustry in Crisis

Written by Sandy Williams

“The UK steel industry is struggling for survival in the face of extremely challenging market conditions.”

That’s how Tata Europe CEO Karl Koehler summed up the condition of the industry that is facing an onslaught of cheap steel imports, particularly from China, high energy costs and a weak export market due to a strong British pound.

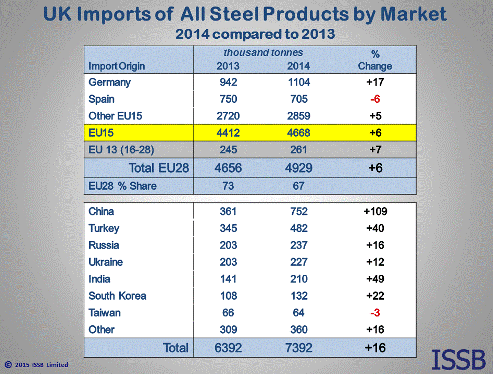

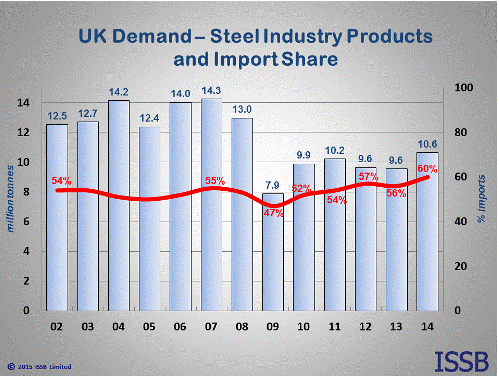

Steel imports from China into the UK rose 109 percent from 2013 to 2014. Imported steel accounted for 60 percent of market share last year.

Market pressure has forced Tata Steel to announce it will idle steel plate operations at Scunthorpe, Dalzell and Clydebridge along with a “small number” of jobs at Long Products Europe. Two coke ovens will also be closed at Scunthorpe. The closures will mean the loss of about 1200 jobs.

“This industry has a crucial role to play in rebalancing the UK economy, but we need a fairer system to encourage growth,” said Koehler. “The European Commission needs to do much more to deal with unfairly traded imports – inaction threatens the future of the entire European steel industry.”

The British government has been criticized for its weak reaction to trade inequities. The UK steel union said the government should “hang its head in shame” for not taking a strong position to stop Chinese steel dumping.

Kevin Brennan, business spokesperson for the Labour party agreed, “While the Chinese president is riding down the mall in a gilded state coach, British workers are being laid off because our government is not standing up for them.”

UK Business Secretary Sajid Javid said the government is doing what it can: “We will demand action wherever there is evidence of unfair trade. We will … look at what the government can to do to boost productivity and to cut production costs.”

“There are limits to what the government can do. No government can change the price of steel. No government can dictate foreign exchange rates and no government can simply disregard international regulations on free trade and state aid,” Javid added.

British steelmaker Caparo Industries entered “administration” (bankruptcy protection) on Oct. 19, putting 1,700 steel jobs at risk.

Teesside closed its Redcar blast furnace and coke ovens earlier this month eliminating 2,200 jobs. Owned by Thai steelmaker Sahaviriya Steel Industry UK (SSI), Teesside produces premium-grade steel slabs with an annual capacity of 3.6 million tons.

Teesside closed its Redcar blast furnace and coke ovens earlier this month eliminating 2,200 jobs. Owned by Thai steelmaker Sahaviriya Steel Industry UK (SSI), Teesside produces premium-grade steel slabs with an annual capacity of 3.6 million tons.

The closure of the Redcar facility has been an emotional one for a community entrenched in the steel industry. Redcar is the company that designed and built the Sydney Harbour Bridge in Australia in the 1930s and has left its engineering mark on bridges from Denmark to Africa.

In a recent BBC report, Historian Joan Heggie said the impact of Redcar’s closure on Teesside is “disastrous.”

“It is an immense employer here. It’s not a big area and does not have a huge population, so the affect of 2,000 directly-linked jobs going would be absolutely devastating,” she said. “But, also, steel and iron are a basic commodity of most manufacturing processes. To not have it locally sourced within the UK and to be constantly requiring it to be imported makes the UK a weaker economic force.”

Founded in 1917 by Dorman Long, the company became part of Britain’s nationalized steel company, British Steel Corporation, in 1967. After privatization in 1988, the company became British Steel Plc. and then Corus after merging with Netherlands steel maker Koninklijke Hoogovens in 1999.

In 2007, Tata Steel took over the plant and shut the furnace down three years later after the firm lost a major contract. SSI bought the site in 2011 and restarted the furnace in 2012.

Tata Steel still has its Long Products Europe operations in Teesside which it says will not be affected by the Redcar closure. Tata employs about 700 at its Teesside Beam mill and Skinningrove works and 500 at its Hartlepool Pipe Mill.