Prices

October 20, 2015

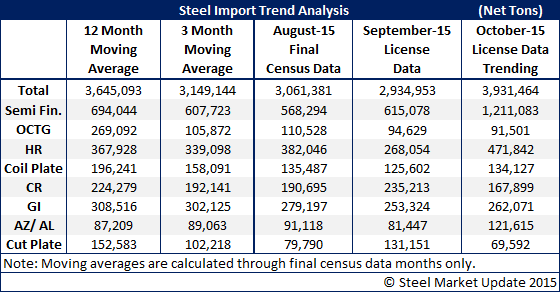

October Import Trend Still at 3.5+ Million Tons

Written by John Packard

The U.S. Department of Commerce (US DOC) released the latest import license data for the month of October. Based on the 2.5 million net tons of license requests through the 20th of the month we are on pace to exceed 3.5 million tons for the month of October.

Anything over 2.9 million net tons we consider a set-back for the domestic steel industry.

Why the surge – especially in light of the trade cases having been filed on corrosion resistant, cold rolled and hot rolled steels?

One suggestion is that the foreign mills are trying to beat the clock and get all of the tonnage into the United States before the Preliminary Determinations are announced. The first announcement on antidumping is on corrosion and is scheduled for a vote on December 21, 2015.

The largest single line item on the US DOC import license report are for semi-finished steels: blooms, billets and slabs with the vast majority of the imports being slabs destined for flat rolled rolling mills. With 781,343 net tons of semi-finished the U.S. steel and pipe mills are on pace for October to be the largest month for semi-finished so far this calendar year.

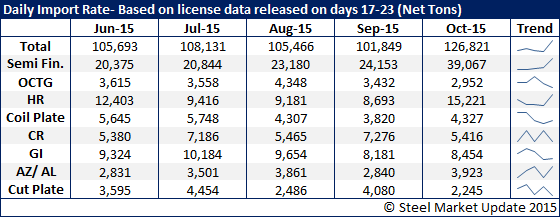

Hot rolled, of which a portion of the imports are also destined for domestic rolling mills (CSN in Terre Haute, IN; USS/Posco in California, Steelscape in Washington, etc.), is on pace to exceed 300,000 net tons having already collected 304,000 net tons of license requests.

We are seeing large numbers of hot rolled imports coming out of South Korea which has already requested 130,000 net tons of HRC licenses. Korea is on pace to be considered as “surging” as their 3 month average (June, July, August) was 72,794 net tons as the dumping suits on HRC were filed.

Brazil, which is another country named in the HRC antidumping suit, is also bringing in hot rolled coil at a higher than normal rate. Brazil has requested 67,256 net tons of HRC licenses for October up from 32,000 tons during September (however August was 85,000 net tons). Brazil’s three month average for June, July and August was 38,174 net tons.

Canada at 28,737 net tons and the Netherlands at 24,376 net tons rounded out the top four HRC license requests for the month.

Cold rolled licenses appear headed for less than 170,000 net tons for the month based on the 108,000 net tons of license requests to date. CR three month average (May, June, July as antidumping was filed in July) = 192,345 net tons.

Galvanized import licenses to date for the month of October are 169,000 net tons trending toward a 250,000+ net ton month. The three month average of April, May and June (antidumping was filed in June) was 302,617 net tons.

In the table below we are showing the trend as of the first 17-23 days of the month: