Prices

October 6, 2015

Pressure Will Continue on Ferrous Scrap Prices

Written by John Packard

The U.S. is not (yet) a closed market and therefore we have to remain aware of what is going on around the rest of the world and especially in China (iron ore/billets/steel) and Turkey (scrap).

Ferrous scrap prices are expected to drop significantly for October 2015 shipment. When we checked with a couple of our scrap sources early in the week we were told many of the deals with the mills are still based on TBD (to be determined) pricing. The expectation is for the market to firm up by the end of the week and we should have a better handle on ferrous scrap pricing as we head into Thursday or Sunday’s issue of Steel Market Update.

The expectation is for scrap to drop by as much as $50 per ton with shredded scrap coming in below $200 per gross ton.

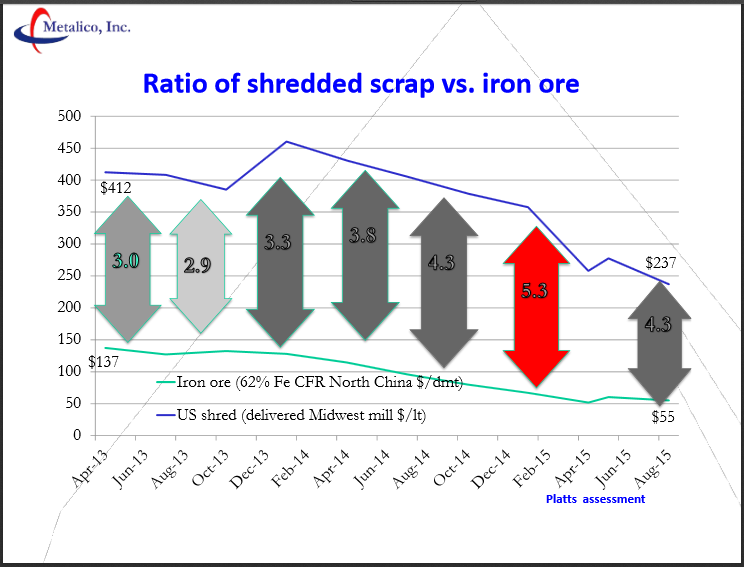

As we worked on this article, we remembered that Pete Meyers of Metalico had spoken about the relationship between billet prices delivered into Turkey and its impact on the price of U.S. scrap. We also remembered that there is a relationship between iron ore spot pricing and the domestic scrap markets.

Based on these relationships we spoke to one of our iron ore and billet contacts in China to see what the going rate is today as well as what are the expectations (bids to buy) for pricing once the Chinese Holidays are over at the end of this week.

We learned that the last billet orders were done at $285 per metric ton and the expectation is that new deals will be done at least $10 per ton less than that when the Chinese Holidays are over.

We learned from one of our Ohio Valley scrap sources, “Current billet offers into Turkey are $275-280MT CFR Turkey. Most think there is room to drop $10mt further in coming weeks. Even so at this level scrap @ $190mt is “overpriced” by $35mt vs the billets. I expect 80/20 prices to continue to fall.”

To illustrate the relationship between billet and scrap prices we went back to the Metalico presentation at our Steel Summit Conference at the beginning of September. The conversion relationship still exists even though both scrap and billet prices have fallen since then. This will help you understand where scrap prices may be headed based on the relationship between what the Chinese are selling billet for delivered into Turkey vs. what an 80/20 shipment of scrap from the U.S. (or elsewhere) would cost.

Based on the above model – HMS would need to trade around $155 per metric ton in order to match a Chinese billet number of $275 per metric ton.

Our scrap source went on to discuss the relationship between iron ore and domestic scrap prices, “Regarding the scrap/iron ore ratio my feeling is the ratio will not drop much below current levels as ore price levels fall. Broadly speaking, if scrap prices drop to <$160 I believe scrap collection will be severely curtailed which would floor the market. So at $40 for ore the ration would be four.” He then told us, “FYI we are anticipating our inbound scrap levels off 50% MTM on $180-190gtd sales.”

From Asia we learned that iron ore prices are expected to weaken as billet price offer to Turkey drop. The current $54 per dry metric ton (dmt) for 62% Fe ore is anticipated will break into the $40’s level as the Chinese mills fight to export their oversupply problems to the rest of the world.

Here is what the relationship between iron ore and shredded scrap prices looked like based on the presentation made during our Steel Summit Conference in September: