Prices

October 6, 2015

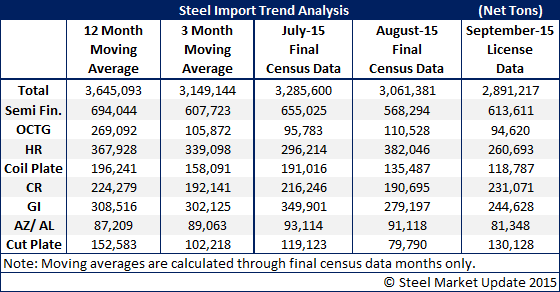

Imports: August Final 3.0 Million, September 2.8 Million

Written by John Packard

The U.S. Department of Commerce released new license data for the month of September and the latest number for foreign steel imports is 2,891,217 tons (net tons). September appears poised to drop 224,000 tons below the August number. The September license data was released at the same time the US DOC reported Final Census Data for the month of August and it came in at 3,061,381 tons – 220,000 tons less than July.

We are finally starting to see imports drop on a steady basis. Are we are seeing evidence of the trade suits or are we actually seeing evidence of the slowdown in demand on certain products (such as OCTG which is down to 94,620 tons in September, well below the 12 month moving average of 269,092 tons)?

Hot rolled ballooned in August to 382,046 tons and appears will come in close to 260,000 tons in September (the two months averaged together were 321,369 tons). We will be very interested in what happens in October. We anticipate lower tons on hot rolled going forward due to the antidumping suits and the weakness in the energy markets.

Cold rolled imports continued at high levels and have not started to come down to earth. Our opinion is this is due to the pipeline of orders already placed with China. We should know more in the next two months – we expect imports of cold rolled to begin to decline.

Galvanized and Galvalume were the first trade suits filed and the November 2nd date is hanging over traders’ heads. In galvanized we have begun to see imports dropping as both August and September are below both the 3 month and 12 month moving average. Galvalume, on the other hand, continues to be twice what it was a couple of years ago.

We will soon learn if the trade suits are truly the “game changer” the domestic mills believe them to be.