Market Data

October 1, 2015

End of Month Review: September 2015

Written by John Packard

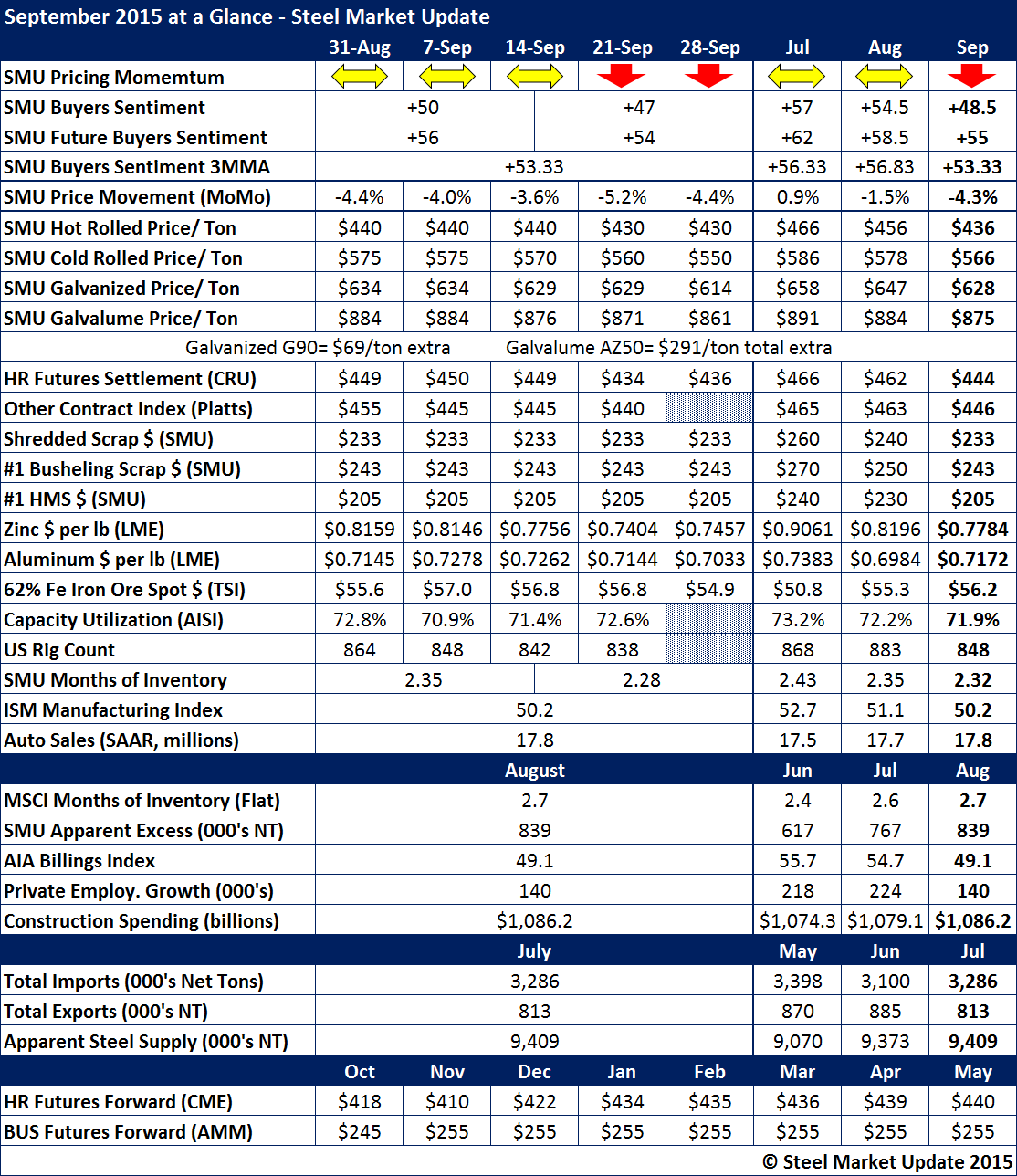

We ended the month of September recognizing that not only have steel prices been falling but the Momentum behind pricing turned negative during the month. Our SMU Price Momentum Indicator is now pointing toward Lower prices to be seen in the coming month or longer.

Sentiment, another Key Market Indicator, has been dropping as you can clearly see in the table below. Our three month moving average dropped by 3.5 points which is a significant move for our 3MMA.Stee

Prices moved lower with benchmark hot rolled coil prices ending the month at $430 per ton and our monthly average at $436 per ton, down $20 from the prior month.

When comparing our average to that of CRU ($444 per ton) and Platts ($446 per ton), we saw the market as slightly weaker than those two indexes.

Shredded scrap will be a big factor in October’s data. We had shredded at $233 per gross ton and we anticipate that it will be down close to $40 per ton once October settles.

Zinc and aluminum prices continued to be weak. Nucor made adjustments to their coating extras in a letter to their customers which referenced the weak zinc market as the reason for their move.

Iron ore spot prices in China were able to maintain their own during the month. Iron ore has been trading close to $55 per ton for a number of weeks.

Rig counts remain challenged and service center inventories did not shrink as expected but actually grew based on the SMU Service Center inventory analysis.