Market Data

September 28, 2015

Gross Domestic Product for Q2 2015, Third Estimate

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released the third estimate of Q2 2015 Annual Revision of the National Income and Product Accounts on Friday. In the big picture, the change (delta, Δ) in GDP is equal to the change in population plus the change in productivity, that is Δ GDP = Δ Population + Δ Productivity.

![]()

The BEA has been criticized for the way they do seasonal analysis which has tended to penalize the first quarter. Revisions were made retrospectively at the time of the first estimate of Q2 with the result that Q1 2015 was revised up from negative 0.2 percent to positive 0.6 percent.

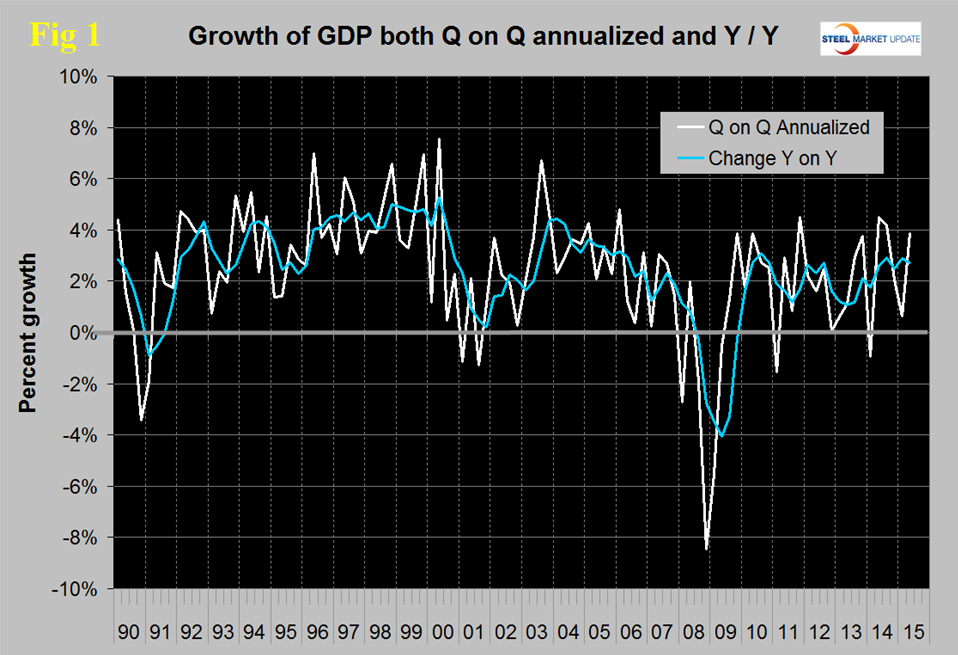

The annualized growth rate in the 3rd estimate of the 2nd quarter was 3.9 percent, up from 2.3 percent, in the first estimate and 3.7 percent in the 2nd estimate. GDP is measured and reported in chained 2009 dollars and in Q2 was estimated in this latest revision to be $16.334 trillion. The calculation is slightly misleading because it takes the Q over Q growth and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect.

The blue line is the trailing 12 months growth and the white line is the headline quarterly result. On a year over year basis GDP was 2.72 percent higher in the 2nd quarter than it was in Q2 2014 and that result is in line with performance since Mid-2010.

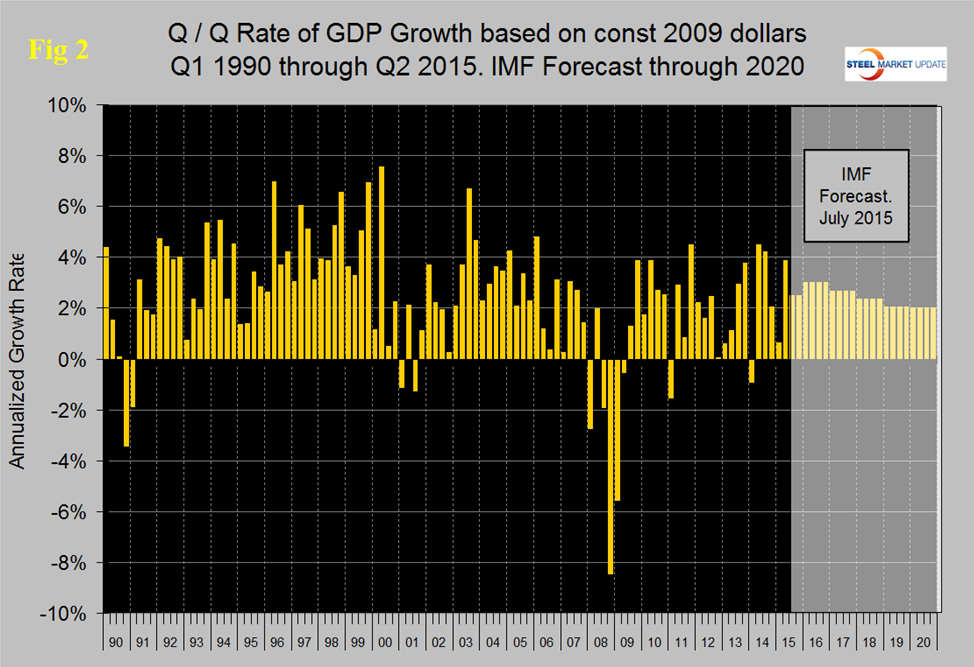

Figure 2 shows the headline quarterly results since 1990 and the latest IMF forecast through 2020.

Following Fed meeting on 17th, their staff has downgraded forecasts through 2018. Although the estimated growth of real GDP for 2015 has been upgraded from 1.9 percent to 2.1 percent, the growth rates for 2016 and 2017 have both been shaved to 2.3 percent and 2.2 percent respectively. In 2018 the growth rate is expected to drop to 2.0. Thus, the Fed’s forecast for future US economic growth is worse than what has achieved annually since the end of the Great Recession. Historically it has been necessary to have about a 2.5 percent growth in GDP to get any growth in steel demand so this forecast is not good for our businesses. As far as inflation is concerned, the Fed’s primary index, the PCE index, the personal consumption expenditure deflator, has now been revised downward for 2015 to 0.4 percent. The expectation had previously been 0.7 percent. For 2016, expected inflation is 1.7 percent. It moves to 1.9 percent in 2017 before returning to 2.0 percent thereafter.

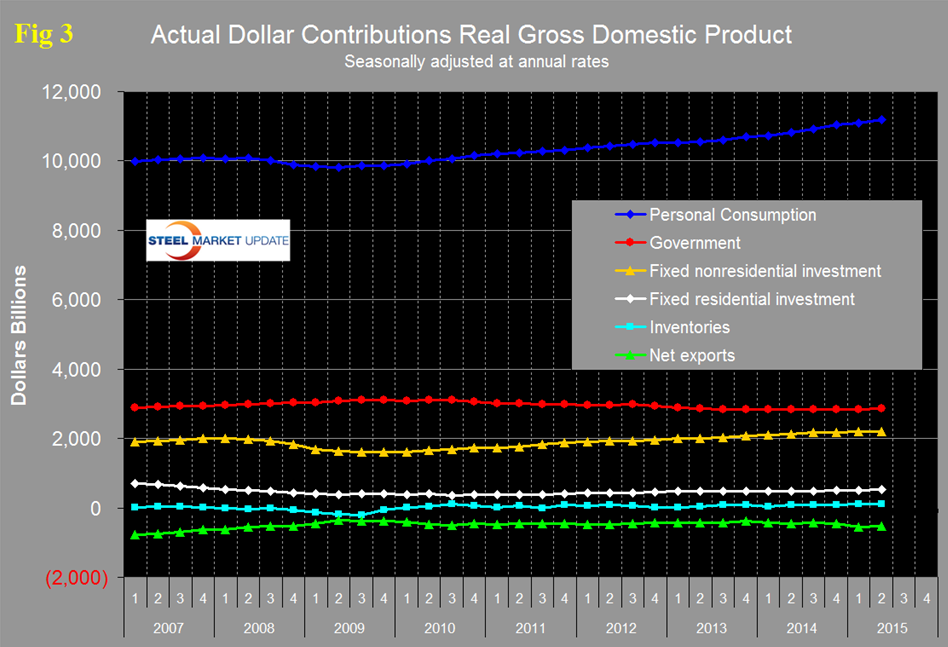

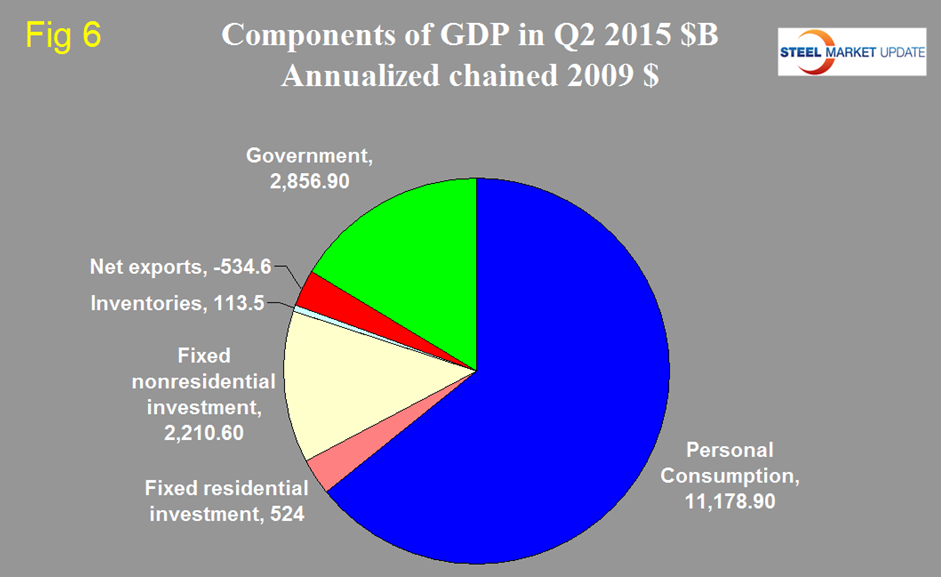

There are six major sub-components of the GDP calculation and the magnitude of these is shown in Figure 3.

Personal consumption is dominant and in Q2 accounted for 68.44 percent of the total. Figure 4 shows the change in the major sub-components of GDP in Q2 2015.

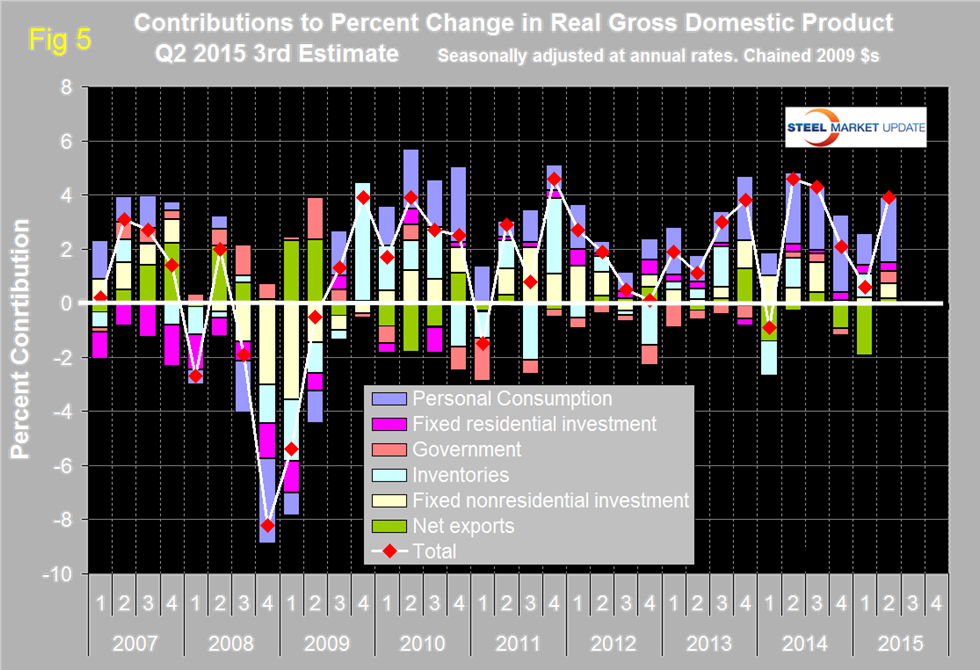

This shows how dominant the contribution of personal consumption was in the 2nd quarter and also that there were no negative contributors. Figure 5 shows the same data as Figure 4 extended back through Q1 2007 and describes the quarterly change in the six major sub-components of GDP.

In the latest data there has been a dramatic change in net exports for which we have seen no explanation in our other investigations. In Q1 net exports contributed negative 1.92 percent and in Q2 contributed positive 0.18 percent. The contribution of personal consumption increased from 1.19 percent in Q1 to 2.42 in Q2. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. Government expenditures contributed negative 0.01 percent to growth in Q1 and positive 0.46 percent in Q2. The contribution of fixed residential investment at 0.30 percent in Q2 has been unchanged for the last three quarters. The contribution of fixed nonresidential investment increased from O.20 percent in Q1 to 0.53 in the 2nd. Inventories which had contributed negative 0.87 percent in Q1 contributed 0.02 percent in Q2. Increasing inventories make a positive contribution to GDP and over the long run inventory changes are a wash and simply move growth from one period to another. Figure 6 shows the breakdown of the $16 trillion economy.

The official press release from the BEA reads as follows:

Real gross domestic product — the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes — increased at an annual rate of 3.9 percent in the second quarter of 2015, according to the “third” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.6 percent.

The GDP estimate released today is based on more complete source data than were available for the “second” estimate issued last month. In the second estimate, the increase in real GDP was 3.7 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE) and nonresidential fixed investment increased more than previously estimated.

The acceleration in real GDP in the second quarter reflected an upturn in exports, an acceleration in PCE, a deceleration in imports, an upturn in state and local government spending, and an acceleration in nonresidential fixed investment that were partly offset by decelerations in private inventory investment and in federal government spending.

SMU Comment: We have reported frequently in the past on the relationship between GDP and steel consumption. Steel growth follows economic growth but is very much more volatile. In addition over the long run about a 2.5 percent growth of GDP is necessary to get any growth in steel consumption. Based on the trailing 12 month growth of GDP which in Q2 was 2.72 percent we should be seeing a small increase in steel consumption at present. The problem with this observation is that there is a wide spread in the data and the 2.5 percent is based on a trend line through quite erratic data points. However if the Fed is correct in its forecast through 2018 the probability is that steel demand growth in the next three years will be minimal at best. Next month we will get the latest IMF revision of GDP both globally and by nations.