Prices

September 27, 2015

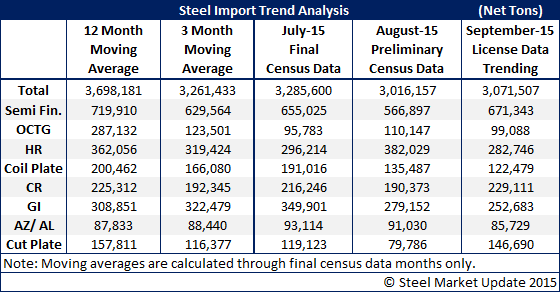

August Imports Pegged at 3.0 Million Tons

Written by John Packard

The U.S. Department of Commerce released August Preliminary Census Data showing August imports as being 3,016,157 net tons (2.7 million metric tons). August imports are down 200,000 tons compared to July and were below both the 3 month and 12 month moving averages.

When looking at flat rolled items we found a small reduction in total tonnage, down 2.1 percent month over month on a days-adjusted basis on cold rolled and 13.1 percent on galvanized. However, hot rolled imports rose 28.7 percent month over month as buyers attempted to beat the HRC trade case which was filed on August 11th.

Semi-finished imports (mostly slabs but also includes billets and blooms for long products and seamless tubes) which are purchased by the producing steel mills, were down in August but are expected to rebound in September based on license data through the 25th of September.

As we look at September imports are trending toward another 3.0 million net ton month for imported steels. Hot rolled imports look to be down 100,000 tons below August levels. Cold rolled imports, which also have antidumping trade actions filed against a number of countries, appear poised to exceed both the 3MMA and 12MMA.

Galvanized imports appear will be lower in September than what is being reported for August and almost 100,000 tons below July 2015 levels.

Galvalume in August was above the 3MMA and 12MMA and is trending to be slightly below the August levels.