Prices

September 17, 2015

Hot Rolled Futures: Capitulation

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

Despite the recent turbulence in the stock market, and the fed’s decision to hold off on a fed hike, there is still no other game in town for the public really. There is no inflation despite the warnings that the Fed will raise rates at some point, and frankly who cares? as the costs for underlying commodities are dropping for companies and consumers alike. What’s to fear, well inventory reduction, which comes eventually, and protectionism, which may be here sooner. We had a turbulent post Fed decision day today with the market going up to 2011 on the Dec future from 1972 start only to settle right around 1975. We probably will test lower in immediate term first, but the chart still looks very positive. If we hold 1962, we are likely headed to 2050-60 zone before any breather before we are on our way to test old highs.

In Crude, the market decided to break out to upside from its sideways bull flag formation on news that a rate hike would be delayed. We are likely to test $49.33/bbl recent high on that bull flag and we should have technical support on this recent rally around $$44.25 mark. I’m not prepared to bet against recent trend so I will say “up” from here still, and we will likely work our way toward $55-57/bbl zone in the next 4 -8 weeks before this rally corrects. In Copper, same story really, lots of space to move into above before meeting resistance around $2.75/lb. We are last $2.475/lb basis a high today of $2.50/lb. Time frame to meet that resistance looks more like 4 weeks on the copper chart.

Steel:

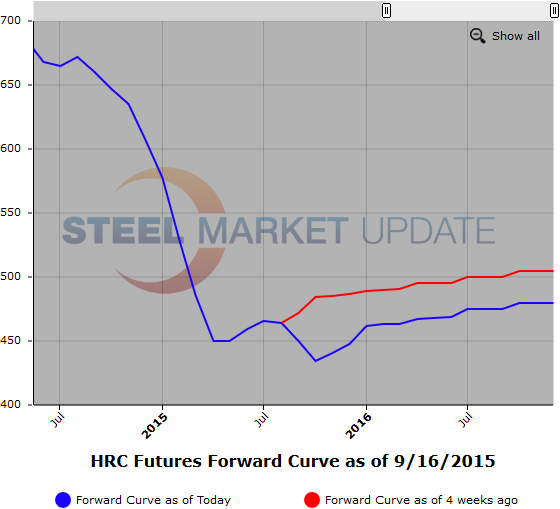

A really good week in steel futures. Today alone the market traded 34K ST done primarily as a spread trade Q4 to Q1, trading at $441/ST Q4 and $459/ST Q1. For the week, we have traded 58,500 ST in total which is good volume. The market is characterized as in capitulation mode, having dropped another $14/ST on the Q4 and another $11/ST on the Q1 in the week. The CRU came in at $449/ST down $1/ST, stagnant as there are no spot sales to pull it down from small posted sale from mills. Grim! Grimmer than grim really! Steel isn’t interested in the potential grass roots in global economies or commodity prices, and it is still squarely in grim. There’s no defying deflation and its grip, It has complete hold us, me included, and Capitulation is in full swing.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore:

Iron Ore has retraced a bit from its recent highs but is still in that recovery hopeful category, last around $56/MT zone on the index, and still backwardated on forwards down to $45 zone on Cal 16, and $41-42/MT zone on Cal 17 and 18. The drivers are the same, very low ports stocks which have recovered a bit, and more modest shipments that expected out of Australia and Brazil. Let’s call Oct either side of $54/MT, Nov. either side of $52/MT, Dec either side of $50.25/MT Q1 either side of $48/MT and Q2 either side of $45.50/MT.

Scrap:

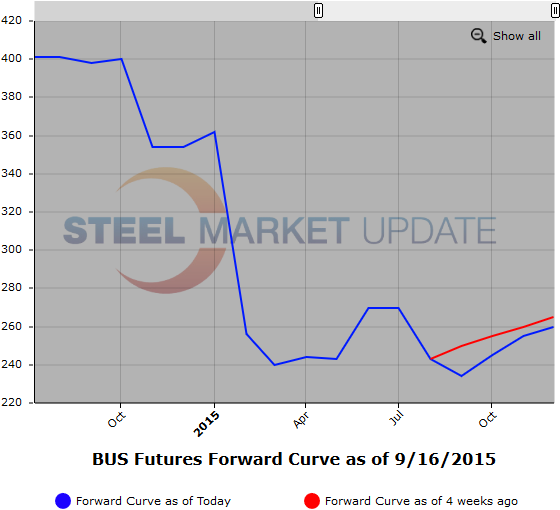

Scrap is beyond depressed, with the US still a bright spot in the world. Excuse me while I vomit. The market is so bad price wise that even doom scenarios fail because it’s hard for the market to go much lower, ie. Approx. only $10/GT down in Sep.. Some yards have just stopped collecting all together. Turkey is miserable and at $200/MT so supply off East Coast is going to Ohio Valley or South or just sitting, and this keeps the market depressed. Last we are $234/GT on bush approx.. and down to just below $200/GT on some shred obsolete types depending on region and grade, while HMS types are grounded in the sub $200/GT zone. Yuck.

Another graphic is below, to use it’s interactive features you must visit this page on our website.