Prices

September 10, 2015

Optimism Fading in the Manufacturing Industry

Written by Sandy Williams

Manufacturing expanded at its slowest pace in two years, according to August data from the Institute for Supply Management (ISM). On the domestic front, consumer spending remains strong bolstered by low gas prices and job growth but manufacturing for export has suffered from ailing global economies and the strength of the US dollar. The export index registered 46.5, falling from 48 in July and has been on a downward trend since May.

ISM notes that new orders fell 4.8 percent to 51.7 in August. Some of that decline can be attributed to manufacturing for the energy industry which has seen a drop in production due to low oil prices that impact products used for drilling, storage and transmission.

The Markit US Manufacturing Purchasing Managers Index also fell in August, dropping from 53.8 to 53.0 for a 22month low.

Commenting on the final PMI data, Tim Moore, senior economist at Markit said: “August’s survey highlights that the U.S. manufacturing sector continues to struggle under the weight of the strong dollar and heightened global economic uncertainty, but resilient domestic spending and subdued cost pressures are keeping the recovery on track. Reflecting this, new orders from abroad have now fallen in four of the past five months, which represents the weakest phase of manufacturing export performance since late-2012.”

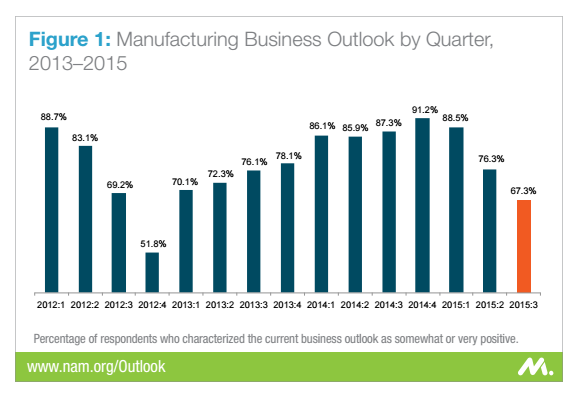

Nearly 80 percent of manufacturers in the third quarter National Association of Manufacturers Outlook Survey cite an “unfavorable business climate” as the top business challenge. The Survey Outlook Index dropped to 45.6 from 51.8 in June with small, medium and large manufacturers all expressing declining optimism.

“The global economic climate continues to pose challenges to manufacturers,” said NAM Chief Economist Chad Moutray. “This latest survey highlights the anxiety manufacturers continue to feel in the face of headwinds like the strong dollar and weaker growth in key international markets. The Federal Reserve has said that it is data-dependent, and manufacturers in this survey have cited a preference for the Federal Open Market Committee to wait until these headwinds die down a bit before beginning the process of raising short-term interest rates.”

The survey also showed sales, production and employment slowed in the third quarter. Sales are expected to grow by just 2 percent in the next 12 months, down from 4.5 percent in the December survey and 2.7 percent in June. Production numbers were down 2.8 percent from June and employment growth slowed from 2 percent in December to 0.3 percent in third quarter.

Survey respondents also expressed concern with imports, government over-regulation, lack of comprehensive tax reform and government over-regulation.

At the Steel Market Update 2015 Steel Summit, former Nucor CEO Dan DiMicco called manufacturing “core to our economy” and said we need to get back to a “nation that innovates, makes and builds things.”

DiMicco perceives manufacturing as key to healthy GDP growth for America. In 2014, the Dept. of Commerce estimated that manufacturing accounted for 12.3 percent of GDP and 12.1 million jobs, levels that DiMicco says are too low. Creation of manufacturing jobs must be the number one priority, says DiMicco.