Prices

September 10, 2015

Hot Rolled Futures: Showing Limited Upside

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

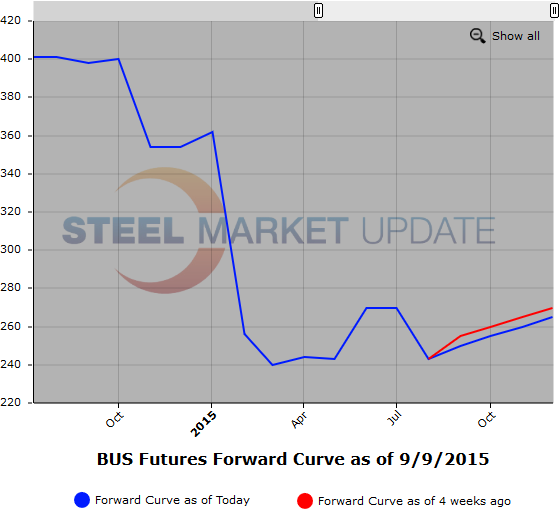

Sometimes when we offer articles for this publication we worry that they may strike some readers as overly pessimistic or bearish in their outlook. Our first reply to this is that the market DOES remain in a contango, even if that contango appears to be decaying rather rapidly. Upside is expected, its just that the amount of it has been dwindling along with the spot price.

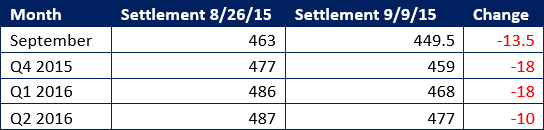

Our last piece about the increasingly unlikely scenario of a near-term return to $500/ton HRC here in the US was one of those articles that made us wonder if we were being too pessimistic. It is at those times that we must remind both ourselves and our readers that it is not FCStone LLC or its brokers and analysts’ personal opinion that HRC prices are showing increasingly limited upside. That is the current statement of the forward curve in the market itself, and …yes, it’s still getting weaker:

While many spot index prices have stabilized in the last week, we continue to see downward pressure on several (though certainly not all) products in the ferrous commodity complex, but two downside moves have stood out; finished flat-rolled steel prices and scrap prices. Of the two, scrap prices are naturally more disconcerting for the forward outlook for steel markets generally. Cheap billet and slab from struggling export nations like China and Russia have decimated Turkish import HMS pricing as they allow conversion mills to offset HSM purchases. The result has been an abundance of scrap for domestic mills here in the US as tons that would normally see competition between inland mills and export docks no longer have such an enviable position. With scrap now at prices that are dramatically cutting down flows into yards, the current combination of weaker domestic steel production and even weaker export demand has been a one-two punch that has prevented these weaker flows from having any supply related impact on price. Many yards will tell us that this is not going to last forever, and if there was a ferrous scrap forward curve that was supported by any substantive liquidity, I imagine it would agree.

Bears will note that there are however some signs and events on the horizon that might give pause to the halt we have described above, even if they don’t set off any significant rally. First, it has been encouraging that Chinese steel prices have shown some stability in the last few weeks; Shanghai rebar prices are actually showing a slight uptick in both of the most active contracts over the last two weeks. January futures are up a $1.56/tonne during that period. Given the weaker currency, exports should indeed pick up and we can expect that China will settle for just about any place on the map they can manage to dump tons at this point.

Another market that has seen some decent upside in the last two weeks? Surprisingly enough that would be iron ore, which has moved from a spot month settlement of $55.71/tonne on August 26th to $56.59/tonne on September 9th. It’s not much, but it’s the best news there is to report on this particular beat in the last few weeks.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.