Prices

September 10, 2015

Early Review of September Steel Import License Data Show No Change in Trend

Written by John Packard

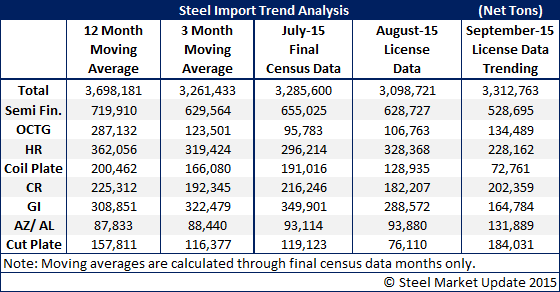

The U.S. Department of Commerce (US DOC) released final July Census Data which means they have announced the final steel import numbers for the month. Total steel imports for the month of July 2015 were 3,285,600 net tons (SMU converts the USDOC metric ton data into net tons for our readers).

The July totals were very close to our three month moving average (3MMA) of 3,261,433 net tons and well below the 12 month moving average of 3,698,181 net tons. This shows us that imports are beginning to decline from the highs seen in late 2014 and early 2015.

August license data through Tuesday, September 8th, is indicating that August imports will be down compared to July as well as against the 3MMA and 12MMA. License data has the month trending toward just over 3.0 million tons (3,098,721 net tons).

In the table below we are also providing a very early peak at September license data and how it is trending. I would not put any credibility to the number shown as it is only through the first 8 days of the month. What we are looking for is to see if there is any break in the trend indicating lower volumes of imports for the month of September vs. July/August. We are not seeing any break in the cycle based on the first 8 days and, at this moment it appears September imports will be similar to the prior two months.