Prices

September 8, 2015

Flat, Long, and Semi-Finished Steel Imports Analysis

Written by Peter Wright

This data is normally reserved for our Premium members, but we wanted to give our Executive readers a view of what a Premium subscription includes. This is one of many additional data points available to our Premium level members.

Licensed data for August was updated on September 4th through the Steel Import Monitoring System of the US Commerce Department. Steel Market Update publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by district of entry and source nation which is available to our premium members.

![]() The early look, the latest of which you are reading now has been based on three month moving averages (3MMA) using August licensed data and June and July final data. We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. The main issue with the license data is that the month in which the tonnage arrives is often not the same month in which the license was recorded. In 2014 as a whole our data showed that the reported licensed tonnage of all carbon and low alloy products was 2.3 percent less than actually receipts, close enough we believe to confidently include licensed data in this current update. Total rolled product licensed imports in the single month of August were 2,282,930 short tons with a 3MMA of 2,393,674 tons. August licenses were down by 9.3 percent from the final July volume. On this basis flat rolled was down by 12.2 percent, long products down by 1.2 percent and pipe and tube down by 3.6 percent. At SMU we prefer not to dwell on single months results because of the extreme monthly variability that can occur in individual products. In the comments below we use three month moving averages to get a more representative picture.

The early look, the latest of which you are reading now has been based on three month moving averages (3MMA) using August licensed data and June and July final data. We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. The main issue with the license data is that the month in which the tonnage arrives is often not the same month in which the license was recorded. In 2014 as a whole our data showed that the reported licensed tonnage of all carbon and low alloy products was 2.3 percent less than actually receipts, close enough we believe to confidently include licensed data in this current update. Total rolled product licensed imports in the single month of August were 2,282,930 short tons with a 3MMA of 2,393,674 tons. August licenses were down by 9.3 percent from the final July volume. On this basis flat rolled was down by 12.2 percent, long products down by 1.2 percent and pipe and tube down by 3.6 percent. At SMU we prefer not to dwell on single months results because of the extreme monthly variability that can occur in individual products. In the comments below we use three month moving averages to get a more representative picture.

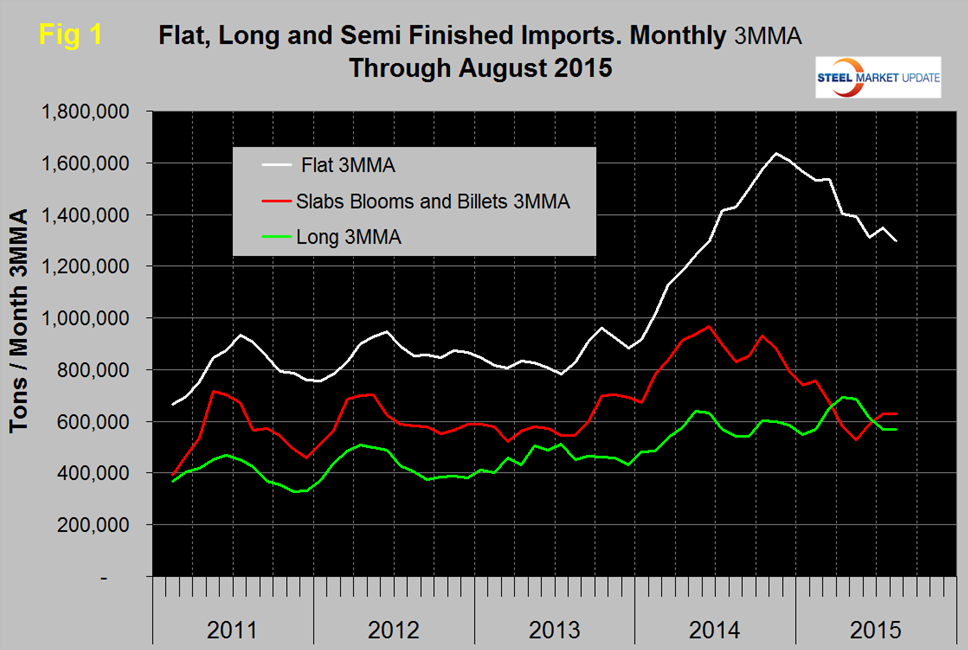

Figure 1 shows the 3MMA through August licenses for semi-finished, flat and long products.

Flat includes all hot and cold rolled sheet and strip plus all coated sheet products including tin-plate plus both discrete and coiled plate. The 3MMA of flat rolled imports peaked at 1,634,000 tons in November last year and has since declined to 1,298,569 tons in August. Last October the 3MMA of semi-finished imports was 930,000 tons and this volume declined to 627,394 tons in August. Long product imports have been stuck in the range 519,000 tons and 772,000 tons since March last year with no particular trend evident.

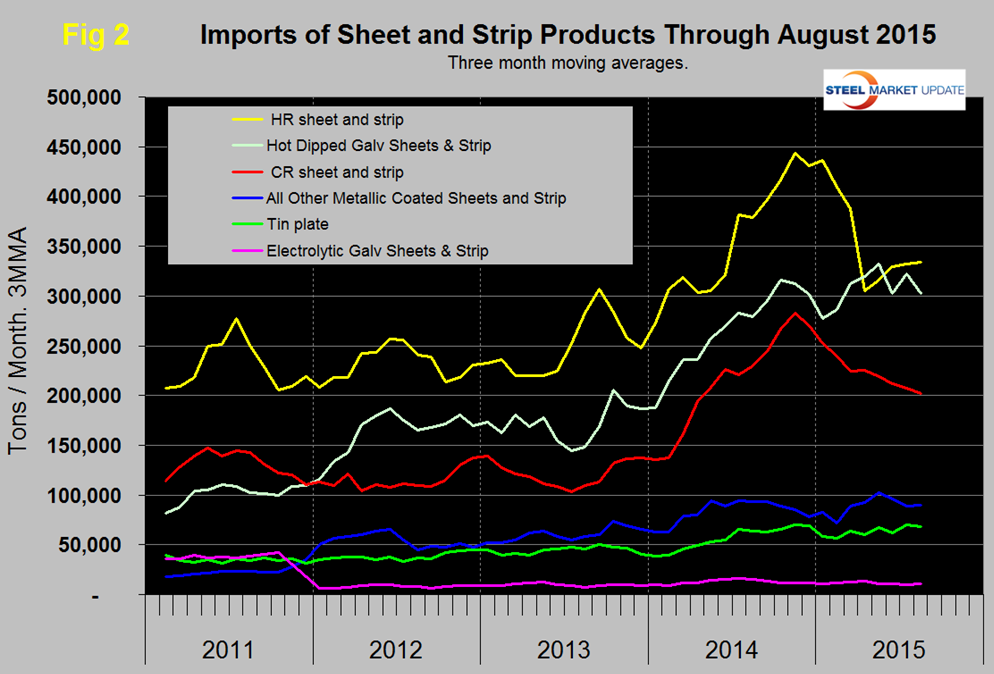

Figure 2 shows the trend of sheet and strip products since January 2011 as three month moving averages.

Of the big three tonnage items, HR, CR and HDG, hot rolled which was down by 21.2 percent in April steadily increased in May through August. Cold rolled peaked at 283,000 tons in November and has since decreased to 201,822 tons in August. Hot dipped galvanized imports increased in February through May and have been erratic in the last three months with not much direction. All other metallic coated (mainly Galvalume) peaked in May at 102,000 tons and through August had declined by 12.04 percent. Tin plate had been trending up for all of 2014 but has been range bound this year. Electro-galvanized keeps on rolling along with little change in three years.

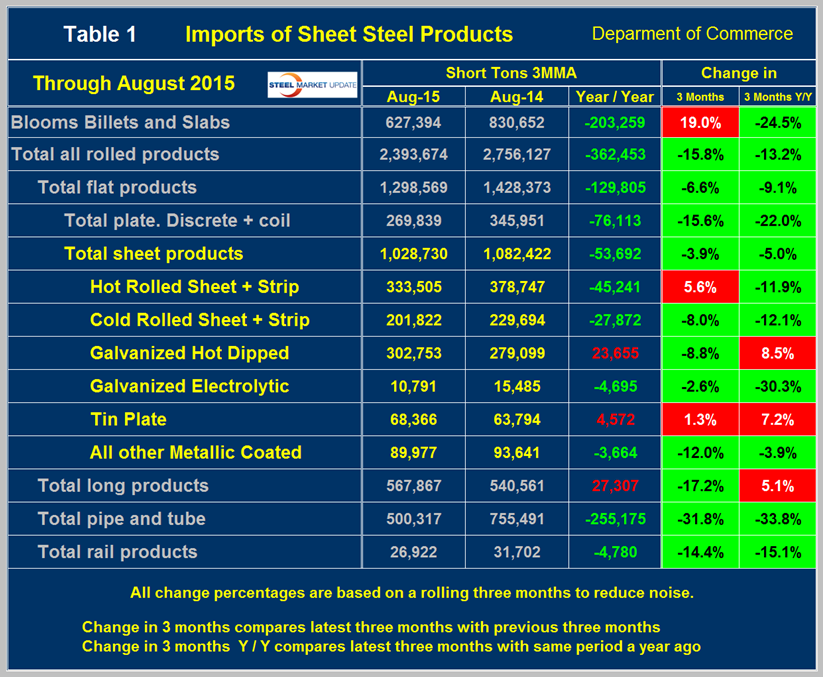

Table 1 provides an analysis of major product groups and of sheet products in detail.

It compares the average monthly tonnage in the latest three months through August with both three months through May (3M/3M) and June through August last year (Y/Y). Semi-finished slabs, blooms and billets were up by 19.0 percent 3M/3M but down by 24.5 percent Y/Y. The total tonnage of hot worked products was 2,393,674 tons in August on a 3MMA basis, down by 362,453 tons from August last year. The three moving average was down by 15.8 percent from the average of three months through May and down by 13.2 percent from a year ago. These trends indicate that in the big picture the peak of import volume has passed but this is not necessarily true for individual products. The color codes in Table 1 for the three month and year over year change show which products are improving and which are still experiencing import volume increases.

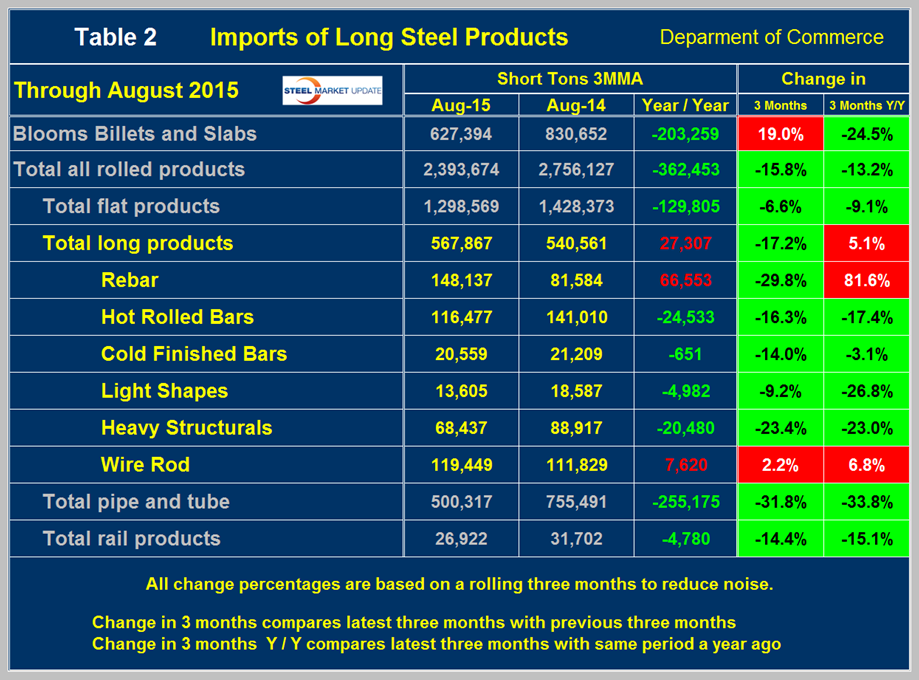

Table 2 shows the same analysis for long products.

For total long products the tonnage was down by 17.2 percent 3M/3M but up by 5.1 percent Y/Y. In the 3M/3M comparison, the only product having an import increase was wire rod. Imports of pipe and tube declined by 31.8 percent 3M/3M and rail products were down by 14.4 percent.

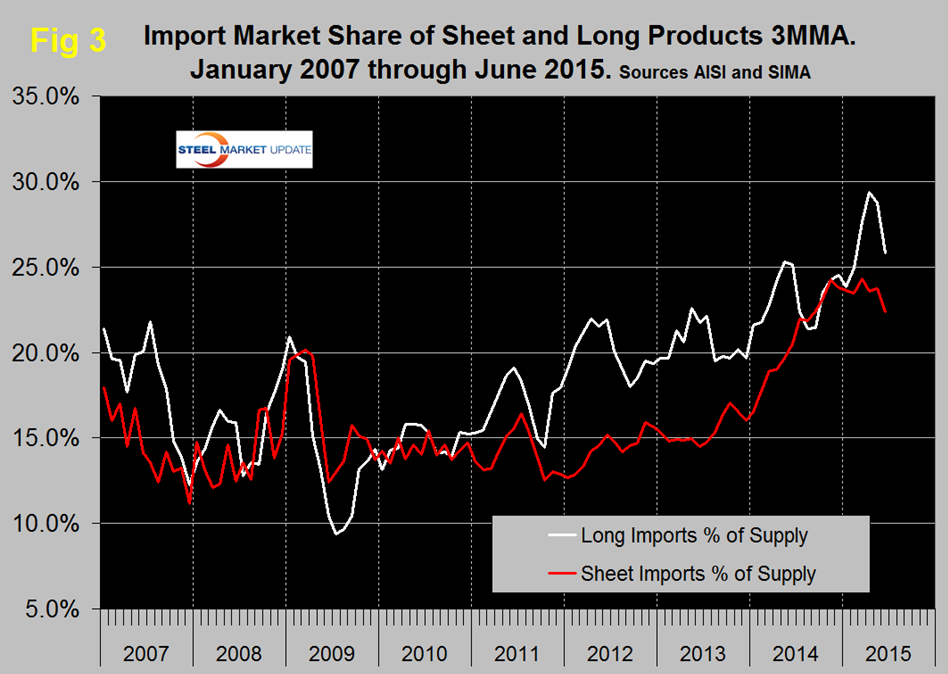

Figure 3 shows the import market share of long and flat products through June which is the latest data available for total steel supply.

For long products the import share skyrocketed in January through April then declined sharply in May and June. The import market share for sheet products peaked at 24.3 percent in March and fell to 22.4 percent in June.

If you would like to learn more about what Premium members receive, the cost to become a Premium subscriber and any specials that we may be running on Premium products please contact our office at: 800-432-3475 or: info@SteelMarketUpdate.com.