Prices

August 27, 2015

Steel Buyers Basics: Galvanized and Galvalume Coating Costs

Written by Mario Briccetti

Recently Steel Market Update produced information related to the changes in the LME spot price for zinc and the costs associated with applying the Zinc to steel substrate in order to make galvanized product. It has been normal for the domestic steel mills to react to significant adjustments in the cost of zinc by adjusting their coating weight extras. US Steel did this as recently as April of this year.

However, this adjustment doesn’t happen all the time, only when the spread (up or down) puts either the mill or their customers (who can buy products overseas) at a competitive disadvantage. Also Mill extras tend to be “sticky” – if an adder was $6.80 and was raised to $8.20, then when the adder is reduced the Mill tends to drop back to $6.80 and doesn’t move it to an in-between number. The domestic mills publish their extras in their price books and Steel Market Update has them on their website so buyers can compare one mill against another (as the extras may vary from mill to mill).

One of my three rules of purchasing is: Information Is Power. So, last year I wrote an article on how to calculate the $/cwt cost of Zinc for galvanized sheet steel (available on SMU’s or my website). This cost is only for Zinc metal and ignores all other factors. As the market changes for Zinc (and Aluminum for Galvalume) buyers can use this calculation to judge if the Mills are changing their coating extras appropriately. (I have a formula for Galvalume but it’s a bit complex since the Galvalume’s lb/sq ft changes with thickness and coating weight — I review the calculation in SMU’s Steel 101 workshop.)

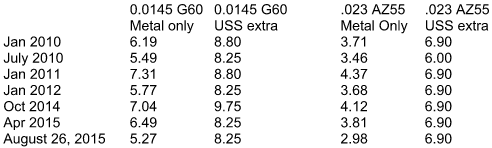

Below is a table of calculated metal costs vs. the US Steel extras for 0.0145 thick G60 Galvanized sheet and 0.023 AZ55 Galvalume sheet over the last six years. I used historical Zinc and Aluminum ingot prices that were current when USS published their revised extras and added the current price. Note that the adders for Galvanized changed on a regular basis but the adders for Galvalume have not — Galvalume extras have not been adjusted since January 2011.

(We used US Steel’s extras since a number of other Mills follow their lead.)

As you can see, today’s metal coating only cost is the lowest it has been in the last six years (although not as low as it was in in March 2009).

In some ways this analysis is not fair. Mills have to buy Zinc and Aluminum months in advance and often hedge these purchases out for months and even years. Still the fact remains that coating costs have dropped significantly recently so it is fair to ask your supplier for a consideration on the coating extras – especially for Galvalume.

Of course, any price is a negotiation between the buyer and the seller. Mills are not in the business of giving away their material and, especially right now, need to try to keep their cost savings on Zinc and Aluminum. Still buyers should always be informed on the actual cost of coating extras and not simply accept them but make them part of any negotiation on the total price of the steel they purchase. Information is Power!

Written by: Mario Briccetti of Briccetti & Associates and an instructor for Steel Market Update (Steel 101 & Sales Training workshops). He can be reached at: Mario@mbriccetti.com. The next Steel 101 workshop will be held in Davenport, Iowa on October 6-7, 2015 and will include a tour of the SSAB mini-mill. Details are on the SMU website or you can contact their offices at: 800-432-3475. I will also be available to speak with those of you who will be attending the SMU Steel Summit Conference which will be held in Atlanta next week.