Government/Policy

August 27, 2015

Galvanized Imports Surge by Any of the 5 Countries Named in Antidumping Suit?

Written by John Packard

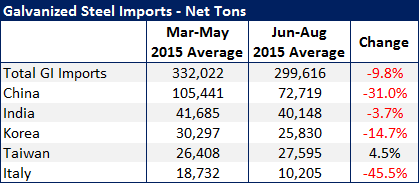

Out of curiosity SMU took a look at the galvanized steel imports from the five countries named in the corrosion resistant (CORE) antidumping trade suit filed by the domestic steel mills on June 3rd of this year. The countries are: China, India, Taiwan, South Korea and Italy.

We took a look at the previous 3 months prior to the petition being filed (March, April and May) and then looked again at the months of June, July and August to see if there were any indications of a surge in shipments.

The results of our quick analysis (August number is based on license data thru the 25th of August so the numbers will change modestly when final census numbers are released) we are not seeing any of the countries pushing significantly more galvanized tonnage than what they averaged the three months before the filing.

Actually, what we are seeing is a reduction from all but Taiwan during the projected June-August time period.

The domestic steel mills have asked for a finding of critical circumstances on coated steels (majority being galvanized and Galvalume) and have asked that the beginning date be moved back to March rather than June when they filed the petition.

The critical circumstances investigation is under way at this time.