Prices

August 20, 2015

Hot Rolled Futures: Oh Boy!

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

Oh boy we had a 48 point drop on the S+P 500 today along with the other indices. We breached the March 10th low of 2025 hitting 2024.50, so probably headed lower before this dip is over. A 2.5% correction. Not bad but we haven’t really seen meaningful correction in the stock market in the last 5 years so this seems pretty severe when in fact it isn’t. Story pages say that this is due to worries over China economy problems blah blah, but reality is that a market that has rallied over 200% in 6 years need to find excuses to sell eventually. So the headlines don’t really matter. This market is tired and has been staying the course because there have been few to no alternatives. Markets also have extreme volatility periods before a change in market direction ie bull to bear or bear to bull. We’re likely within 6 months-1 year of that eventuality, but may not yet have put in our eventual high. Stay tuned.

Copper and Crude are both depressed. We have had a little rally here in copper as the market had just gotten too short. Last $2.32/lb zone, after reaching $2.25/lb as the low. That said we could rally back all the way to $2.43/lb zone and still be in this current down trend resistance channel. Stocks have been pulled in Copper of late, whether needed or speculative. Crude is even more depressing because it’s that much more important to the health of the economy. We are pretty much at lows hovering right above $40/bbl. Good for consumers on one hand and bad for U.S economy on the other. Just look at effect to OCTG in our world and multiply that by 1000.

Steel:

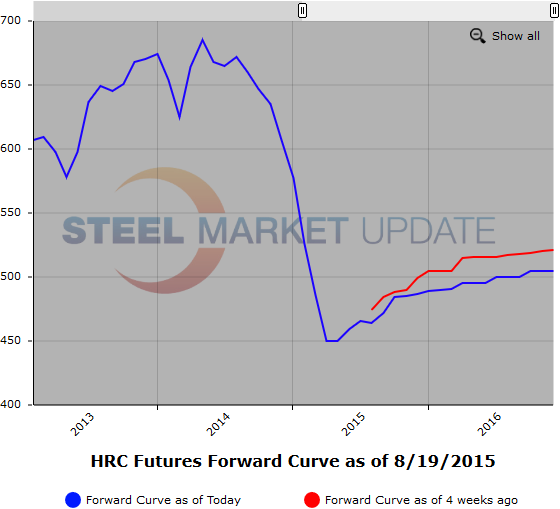

We had a good week in HR futures with 1615 lots or 32,300 ST trading in the week. It was downward move this week as the spot fundamentals turned sour again over the last two weeks. The front end dropped further about $10/ST on the week to $470 offered on Sep.. While Q4 was down $7/ST from a week back. However, it was the back end that got hit hardest with Q1 down $14/ST to $490 last traded, and Q2 down 12/ST to $495/ST offered last. Let’s just say the futures market has caught the spot market’s flu. Meanwhile CRU was down $7/ST @ $459/ST as some of these spot offerings were engaged. The lastest MSCI date suggest an increase inventory building back all that we had lost in the prior month and raising the moh back to 2.5 mos territory. Definitely not the news the market was looking for. What appears to have changed really is demand. Whereas ship rates been good to great most of the year, most are reporting to this author that demand is down. Whether it’s seasonal remains to be seen, but almost everything ex-auto is slowing. However, lots of kindling potential for a price rising fire, strike anyone? Import lever – gone pretty much. Despite the gloom inventory will adjust and will do surprisingly quickly when it does. We could be looking into 4th quarter for that reality now.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore

Same old same old here. Around $54/MT on the front, and backwardated through the curve as inventories on the ground are lean and spot cargoes are also lean causing prices on the front to be supported. However, despite low Iron inventory, clearly China steel production has been curtailed as many mills have been on care and maintenance, and it’s questionable whether they can actually come back on-line. This story, like China itself, has yet to play out. It’s certainly spooking our stock market. Let’s call Sep either side of $52.65/MT, Q4 either side of $48.90/MT, Q1 either side of $45.85/MT, Cal 16 either side of $44.75/MT and Cal 17 either side of $43.00/MT.

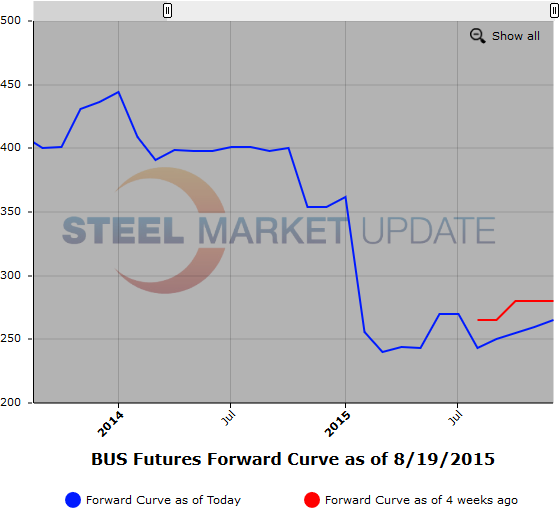

Ferrous Scrap (BUS)

Having dropped $20-25/GT in July depending on quality and region, the market may have oversold a bit as many expecting a rise in September. We’re now at a price point where the obsolete faucet is almost shut and the prime generation is slowing now too with poorer steel demand so pretty likely that dealers can push back this time around, and wait out the market if need be. We are also now pretty much at parity to the export market with CFR last $240/MT CFR Turkey. Also with Iran getting back $150 billion big ones whether the world ratifies the deal or not chances are there will be some demand coming out of the Middle east as a result to prop up the scrap market there. Scrap may be the unexpected floor in prices here.

Another graphic is below, to use it’s interactive features you must visit this page on our website.