Prices

August 20, 2015

August Imports Trending Toward Another 3 Million+ Ton Month

Written by John Packard

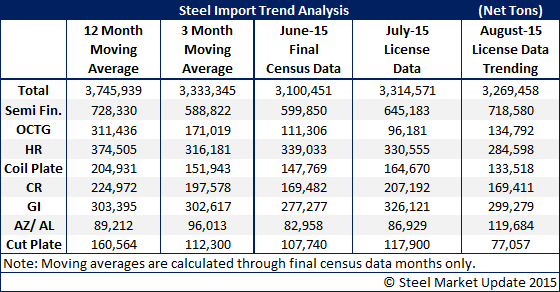

On Wednesday of this week the U.S. Department of Commerce updated license data for foreign steel imports for the months of July and August. Based on only 18 days worth of data, August imports are trending toward another 3.0 million net ton month. The current trend line is for total steel imports for August to be approximately 3.2 million tons but we think that number will pull back slightly as the month progresses. The last time the U.S. saw monthly imports less than 3.0 million tons was December 2013 when imports totaled 2.5 million tons.

July license data continues to indicate the month will come in at 3.3 million net tons (+/- 100,000 tons). Preliminary Census data is due to be released on August 24th for the month of July.

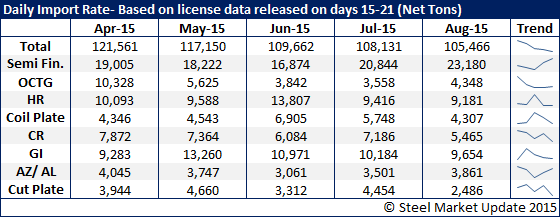

We thought we would share with our readers a table that we keep for ourselves which shows where imports were based on licenses requests submitted by the middle of the month. What we are watching more than anything is the trend line and, as you can see from the table below, the trend for total imports is (and has been) in decline going back to April of this year. As you can see not every product is following the overall trend. Semi-finished imports of slabs have actually been rising as has Galvalume (other metallic coated) although the tonnages there are quite small.

With the dumping suits having been filed on hot rolled, cold rolled and coated products (galvanized and Galvalume) we expect these numbers to continue to drop over the next few months. The first major drop should be in coated steels since that was the first trade suit to be filed (June 3rd).