Prices

August 14, 2015

Net Imports of Sheet Products through June 2015

Written by Peter Wright

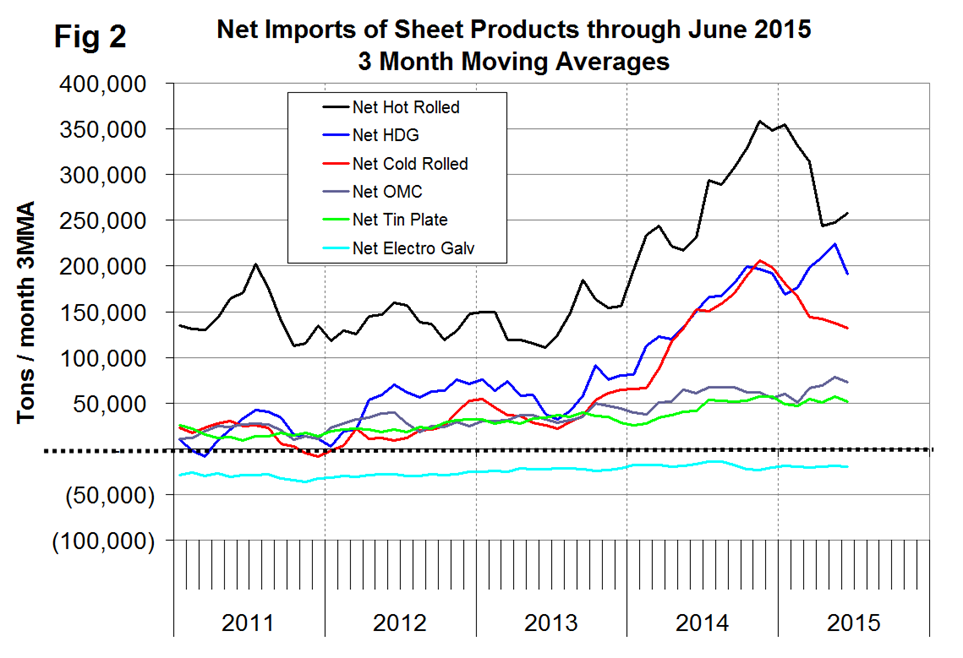

Net imports equals imports minus exports. We regard this as an important look at the overall trade picture and its effect on demand at the mill level. Figure 1 shows that net sheet product imports on a three month moving average (3MMA) basis in June continue to be more than double that which existed before the recession.

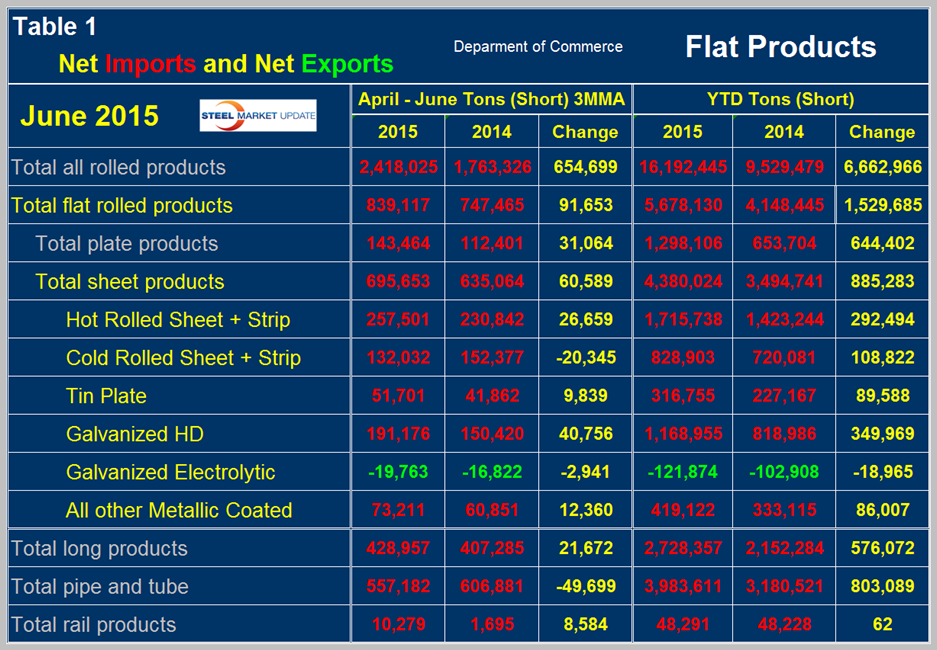

The deterioration in net has been almost entirely an import effect, exports have been fairly consistent though drifting down slightly since Q2 2012. Table 1 shows net imports by product.

Year to date through June, total net flat rolled imports were 5,678,130 tons, up by 1,529,685 tons year over year. Of this 4,380,024 tons were sheet products, up by 885,283 tons. On a 3MMA basis, April through June net sheet imports increased by 60,589 tons per month year over year. The 3MMA of net imports increased on all steel products except cold rolled, electro-galvanized and pipe and tube. EG is the only sheet product that currently enjoys net exports and in the latest data that surplus improved year over year. In Table 1 negative net imports (which means a trade surplus) are shown in green. Figure 2 shows the trend of monthly net sheet product imports since January 2011 on a 3MMA basis.

Net hot rolled imports declined in January through April but reversed course in May and June. HDG increased every month, February through May then declined in June. Cold rolled net imports have been steadily declining since November last year.

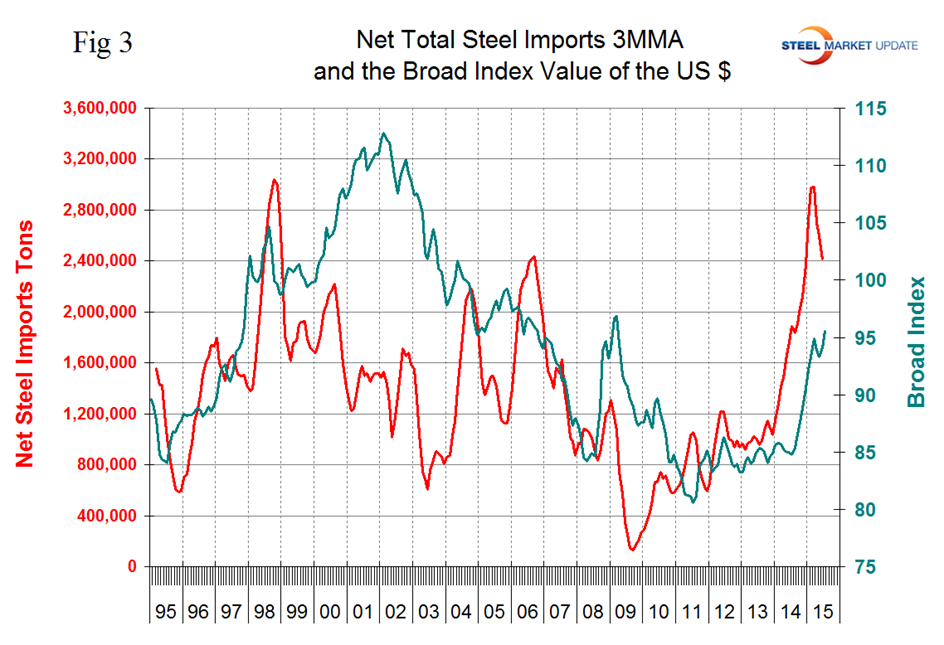

We believe there are two main drivers of the strength of net steel imports. The trade weighted value of the US $ is increasing which makes our exports less attractive to foreign buyers and makes the US domestic market more attractive to foreign sellers as imports are more attractive to domestic buyers. Figure 3 shows the relationship between net imports and the value of the $ since January 2011.

The divergence in the early 2000s was a result of trade cases, over stocked service centers and a strong decline in US demand. The strengthening of the dollar is expected to continue in the immediate future, particularly as a result of China’s devaluation this week and likely retaliatory moves by other East Asia trading nations. The second reason is that steel demand in the US is relatively strong at the same time as global demand growth has softened. This is exactly what happened in the late 1990s after the Far Eastern currency crash which was followed by a decline in the Ruble and the Euro. In the 2nd quarter of 2015, global steel production contracted by 2.4 percent year over year, as global steel capacity continues to increase. Declining steel demand abroad, decent demand in the US and a skyrocketing US dollar will be a headwind for US steel producers for at least the balance of 2015.