Analysis

August 14, 2015

June Heating and Cooling Equipment Shipment Data

Written by Brett Linton

Below is the latest release issued by the the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) regarding residential and commercial heating and cooling equipment shipments through June 2015. You may read the press release on their website here.

Residential Storage Water Heaters

U.S. shipments of residential gas storage water heaters for June 2015 increased 17.9 percent, to 413,536 units, up from 350,826 units shipped in June 2014. Residential electric storage water heater shipments decreased 6.0 percent in June 2015, to 322,059 units, down from 342,463 units shipped in June 2014.

For the year-to-date, U.S. shipments of residential gas storage water heaters increased 8.0 percent, to 2,453,831, compared to 2,272,607 units shipped during the same period in 2014. Residential electric storage water heater shipments increased 7.1 percent year-to-date, to 2,313,209 units, compared to 2,160,629 units shipped during the same period in 2014.

Commercial Storage Water Heaters

Commercial gas storage water heater shipments decreased 7.1 percent in June 2015, to 7,535 units, down from 8,111 units shipped in June 2014. Commercial electric storage water heater shipments increased 14.3 percent in June 2015, to 7,444 units, up from 6,514 units shipped in June 2014.

Year-to-date U.S. shipments of commercial gas storage water heaters increased 6.5 percent, to 52,928 units, compared with 49,713 units shipped during the same period in 2014. Year-to-date commercial electric storage water heater shipments increased 13.1 percent to 42,733 units, up from 37,779 units shipped during the same period in 2014.

Warm Air Furnaces

U.S. shipments of gas warm air furnaces for June 2015 increased 8.6 percent, to 257,321 units, up from 236,962 units shipped in June 2014. Oil warm air furnace shipments increased 28.5 percent, to 2,131 units in June 2015, up from 1,659 units shipped in June 2014.

Year-to-date U.S. shipments of gas warm air furnaces decreased 0.7 percent, to 1,221,416 units, compared with 1,230,521 units shipped during the same period in 2014. Year-to-date U.S. shipments of oil warm air furnaces increased 14.4 percent to 14,108, compared with 12,332 units shipped during the same period in 2014.

Central Air Conditioners and Air-Source Heat Pumps

U.S. shipments of central air conditioners and air-source heat pumps totaled 878,513 units in June 2015, down 8.2 percent from 957,238 units shipped in June 2014. U.S. shipments of air conditioners decreased 9.1 percent, to 611,900 units, down from 673,296 units shipped in June 2014. U.S. shipments of air-source heat pumps decreased 6.1 percent, to 266,613 units, down from 283,942 units shipped in June 2014.

Year-to-date combined shipments of central air conditioners and air-source heat pumps increased 2.3 percent, to 3,920,466 units, up from 3,831,136 units shipped in June 2014. Year-to-date shipments of central air conditioners increased 2.2 percent, to 2,588,401 units, up from 2,532,548 units shipped during the same period in 2014. The year-to-date total for heat pump shipments increased 2.6 percent, to 1,332,065 units, up from 1,298,588 units shipped during the same period in 2014.

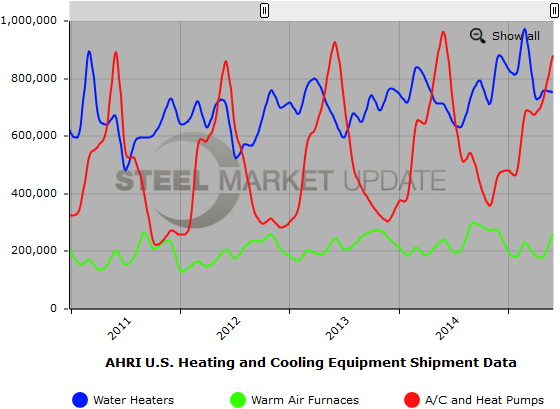

Below is a graph showing the history of water heater, warm air furnace, and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.