Government/Policy

August 11, 2015

Steel Mills Hit Trifecta as Hot Rolled / Plate Trade Suit Filed

Written by John Packard

Six domestic steel mills joined together to file a hot rolled trade suit today. This is now the third such suit since the filing against corrosion resistant (galvanized & zinc-aluminum or Galvalume) on June 3rd and the cold rolled petition of a couple of weeks ago. With the HR case the mills have hit the trifecta having filed against all of the flat rolled products followed by Steel Market Update.

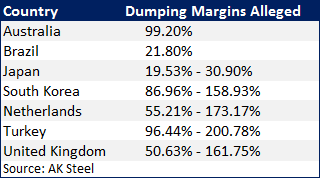

Earlier today, AK Steel, ArcelorMittal USA, Nucor, SSAB Enterprises, Steel Dynamics and US Steel collectively filed a petition with the US Department of Commerce for the “imposition of antidumping and countervailing duties on certain hot rolled steel flat products from Australia, Brazil, Japan, the Republic of Korea, the Netherlands, Turkey and the United Kingdom….”

This petition covers not only hot rolled coil but also plate in sheet and coils.

The bottom line being that the domestic mills that filed the case feel they have been “materially injured” by the subject imported steels. The injury comes in various forms including being forced to lower prices “…in response to competing bids from unfairly-traded hot-rolled steel imports from the subject countries. This evidence of lost sales and revenues ties the financial performance of the domestic steel industry to the injurious price and volume of dumped and subsidized subject imports.”

Part of the AK Steel press release on the filing said, “AK Steel and other domestic steel manufacturers have been significantly impacted by the onslaught of what we believe are unfairly traded imports of hot-rolled steel,” said James L. Wainscott, Chairman, President and CEO of AK Steel. “Imports have been flooding our shores, substantially reducing selling prices, shipment volumes, and earnings.”

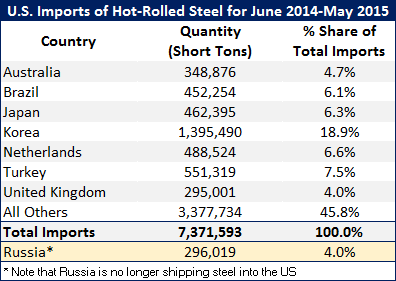

According to the documents filed by the steel mills, the seven countries represented 64.2 percent of the total hot rolled imports between June 2014 and May 2015. Steel Market Update re-created a table that was part of the petition presented to the US DOC by the steel mills. We added an extra line item which is Russia since the Suspension Agreement was repealed last year preventing Russian hot rolled from coming into the U.S. market.

When looking at the table above the total impact (including the Russian tonnage) is the mills are going after (or have already eliminated) 68 percent of the countries who were shipping material into the United States during the time frame suggested.

The domestic steel mills, in their filing, pointed to the increase in volume between 2012 and 2014 as well as the tonnage received between January and May 2015 compared to the similar time frame last year, as being excessive. The following came directly out of the public version of the petition filed by the steel mills:

“The absolute volume of subject imports from Australia, Brazil, Japan, Korea, the Netherlands, Turkey, and the United Kingdom is significant. Subject imports totaled 3,349,286 short tons and accounted for 48.3 percent of hot-rolled steel imports in 2014. See Exhibit 1-9. Subject imports also increased significantly over the POL The volume of cumulated subject imports increased from 1,932,529 short tons in 2012 to 3,349,286 short tons in 2014, or by 73.3 percent. Id Subject imports continued to surge between the interim periods, increasing from 1,199,663 tons during January-May 2014 to 1,844,236 tons during January-May 2015, an increase of 53.7 percent.”

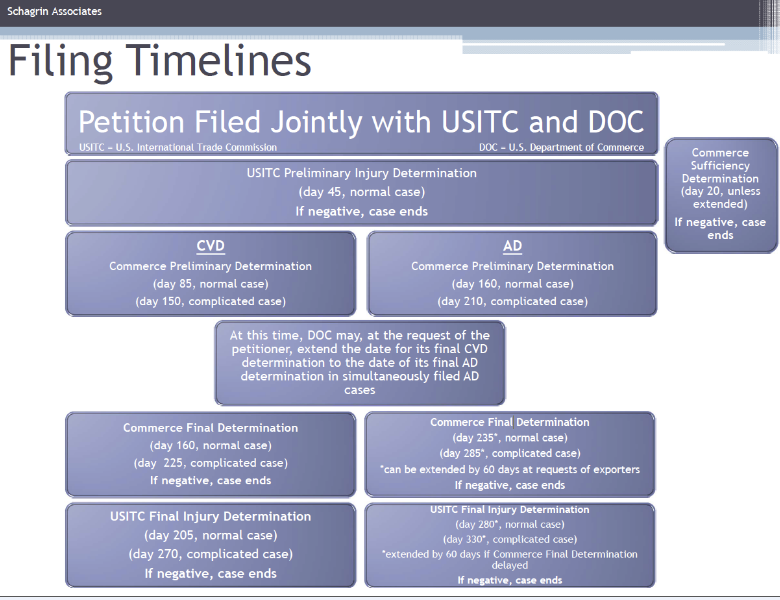

The next step in the process is for the US International Trade Commission (ITC) to determine if there is a need for the case to move forward. Their Preliminary Injury Determination is due 45 days from the filing of the petition. We have shared this timeline with our readers on previous occasions (after all this is now the third flat rolled petition since the initial corrosion resistant case was filed on June 3rd).