Prices

August 11, 2015

SMU Price Ranges & Indices: Eerily Quiet

Written by John Packard

Talking to steel buyers this week was like listening to a broken record, “It’s quiet, it’s quiet, it’s quiet….” There has been very little activity and nothing pushing the markets which is quite amazing when you consider the domestic mills have filed three trade cases and are coming up on the September 1st deadline for the expiration of the labor agreement with USS and ArcelorMittal and the USW. What a crazy steel world we live in.

From a Midwest service center we heard, “Things are definitely quiet. Too quiet. And competitors selling at ridiculously below sensible levels for fear of losing market share.”

We heard this from a large galvanized service center, “Domestic order books remain weak…mostly because inventories are still inflated and imports continue to arrive (though at far less volumes). Market seems gun shy – waiting for something to happen that turns their psychology switch from uncertain to clear.”

The common theme appears to be short lead times, higher than necessary inventories and relatively little concern about supply interruptions be they domestic (strike/lockout) or foreign (trade suits).

Ho hum…

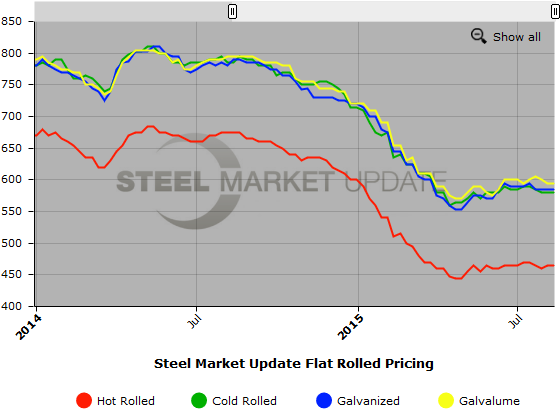

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over last week. Our overall average is the same compared to one week ago. SMU price momentum for hot rolled steel is for prices to remain range bound over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $560-$600 per ton ($28.00/cwt- $30.00/cwt) with an average of $580 per ton ($29.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over one week ago. Our overall average is the same compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to remain range bound over the next 30 to 60 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.00/cwt-$30.00/cwt ($560-$600 per ton) with an average of $29.00/cwt ($580 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton over last week while the upper end remained the same. Our overall average is down $5 per ton compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to remain within a narrow trading range over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $629-$669 per net ton with an average of $649 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$30.50/cwt ($580-$610 per ton) with an average of $29.75/cwt ($595 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over one week ago. Our overall average is the same compared to last week. Our belief is momentum on Galvalume will be prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$901 per net ton with an average of $886 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.