Prices

August 9, 2015

Trade Suits Will Affect Steel Prices, The Question is When

Written by John Packard

Over the past two months the U.S. steel industry has filed antidumping petitions on corrosion resistant (coated steels like galvanized and Galvalume) and cold rolled steels. The rumor mill has been flush with talk that a hot rolled suit will be announced as early as this week. What will the impact be on flat rolled steel prices to all of these trade suits?

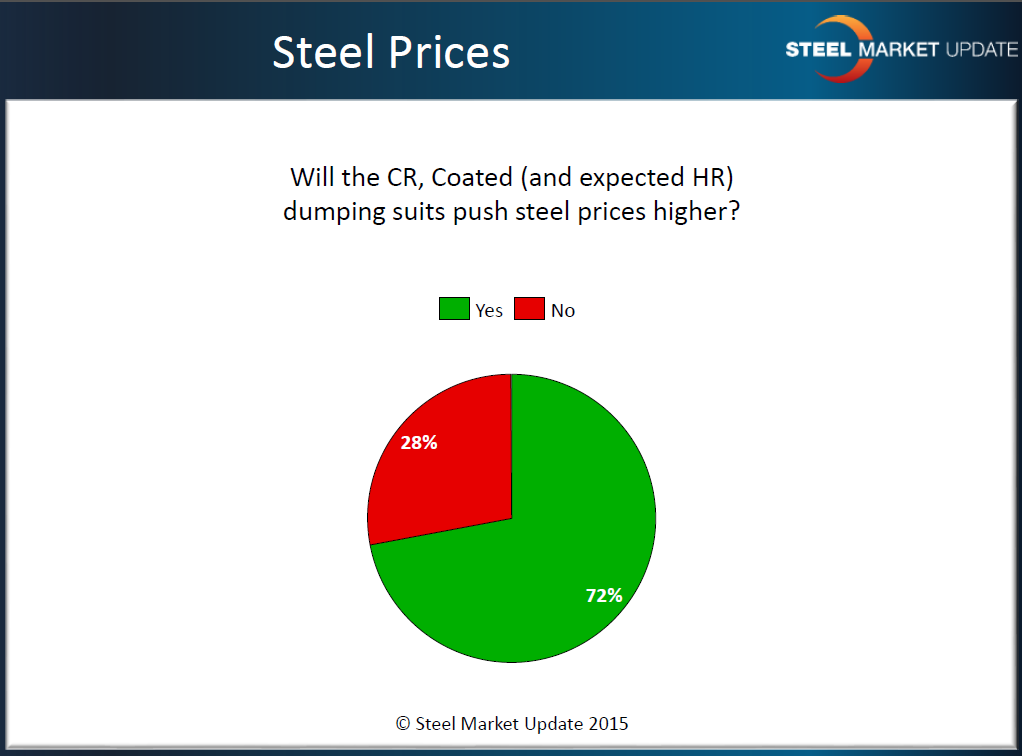

According to the results of our poll taken this past week, the steel industry expects flat rolled steel prices to rise due to the dumping suits. Seventy-two percent (72%) of those responding to our query on the subject reported that they believe prices will go higher. The question is not if prices will rise but when (and how much). Based on the comments received during the polling process not many in the industry expect any immediate impact related to the trade suits.

Here are some of the comments left behind during the survey process:

“The evidence is pretty clear that it will not happen immediately, but eventually these suits will have an upwards effect on NA pricing.” Manufacturing company

“Eventually, at the same time scrap prices continue going down. At the end the need for alternative import sources will push the price of our segment (import) up on these products.” Trading company who also made the following statement earlier in response to another question, “We feel very confident we have fulfilled all expectations of selling unfair trade basis and our analysis shows no dumping operations at all. This compared to other competitors will bring very competitive advantages once the HRC suit is announced.”

“I think that once the inventory pipeline is flushed out, the mills will take the opportunity to raise prices. The question is ‘How much will the market support?’” Manufacturing company

“Hope so! [prices will rise] There is so much “noise” in the market our customers tell us they have not had to pay any mill price increases, except some portion of the first, thus we are fighting that perception. This has a real effect on Margins.” Service center

“But I do not expect that for another couple months. CR inventory still out there that needs to work its way through the distribution channels.” Service center

“You can take it to the bank. Trade cases have never been to increase market share just to get higher prices.” Trading company

“This may take a while, but it certainly will happen. As the demand side of the equation isn’t strong, it will take some restriction on supply for the mills to get the increases they want to see.” Manufacturing company

“Doesn’t feel like it. Maybe very short term but unless demand really spikes it won’t be sustained.” Service center

“Not immediate, but expect an impact in Q4.” Service center

We had a number of respondents point to the 4th Quarter 2015 and into the 1st Quarter 2016 before they saw the domestic steel mills getting pricing relief. A number of our respondents pointed out the continued high levels of foreign imports (some unsold and at the docks) and high inventories at the service centers that need to be worked off.

Of course the wild card is the looming expiration of the USW labor contract with ArcelorMittal and US Steel. As one of our service center respondents put it, “I do not believe price increases will last unless there is a strike at the domestic mills, but there will be an attempt [to raise prices] once the filing is secured.”

Our sources have advised us that the hot rolled antidumping petition could come as early as Tuesday (August 11th) and, like the cold rolled suit filed a couple of weeks ago, this could be a wide sweeping filing against more countries than the market expects. Stay tuned to Steel Market Update for details.