Government/Policy

August 9, 2015

SMU Survey: Will Trade Suits Hurt or Help the Industry?

Written by John Packard

Recently, Steel Market Update had a conversation with trade attorney Lewis E. Leibowitz and we spoke about the purpose behind the U.S. trade laws. He told us that the impacted industry, in this case the steel industry, should be using the trade laws in order to get the “breathing room” or time needed in order to improve their processes and competitiveness. The laws were not intended to permanently prevent foreign steel or international products from being freely traded in the United States.

We understand there are differences of opinions as to whether or not the filing of the recent trade suits (and expected hot rolled suit) will actually hurt or help the U.S. steel industry. We posed a couple of questions on the subject to those who participated in last week’s flat rolled steel market questionnaire.

The questions were presented to the entire group that participated in our survey. Of those participating 43 percent were manufacturing companies, 43 percent were service centers/wholesalers with the balance consisting of trading companies (6 percent), steel mills (5 percent) and toll processors (3 percent).

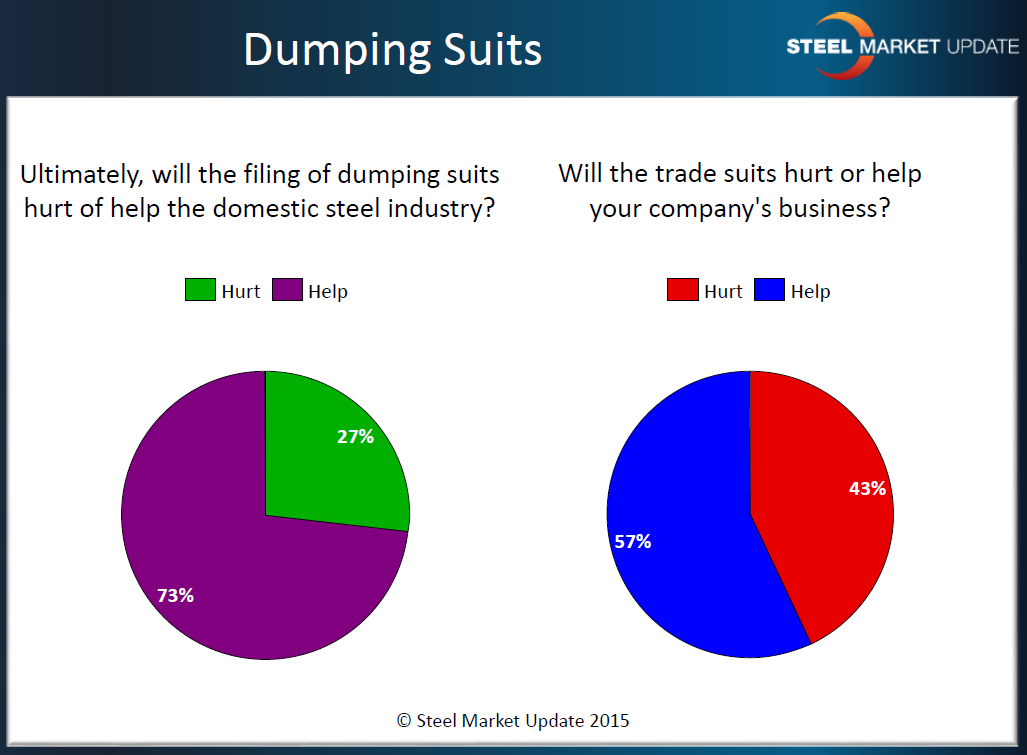

We asked two questions, “Ultimately, will the filing of dumping suits hurt or help the steel industry?” and “ Will the trade suits hurt or help your company’s business?”

Here is a quick look at the results:

Will Dumping Suits Help the Steel Industry?

We had an overwhelming response from those responding to these questions as almost 40 percent of the respondents decided to leave comments during the survey process. We will break out the comments based on each question with the first being if the filling of dumping suits will hurt or help the steel industry:

“It’s short sighted. This only leads to more products being produced outside our borders. We need to figure out a way to become global competitors. [Which is] much more complicated.” Service center

“As other traders have mentioned, it may hurt manufacturing much more and the mills may see no real long term benefit.” Trading company

“We need to establish better FREE TRADE and better discipline before these ever go this far. There may or may not be any benefit from these filings but the act of filing disrupts business trends which in the immediate hurts the industry.” Service center

“Of course it will hurt them, as we saw last year they had healthy pricing and margins and record imports. The balance has to be allowed to happen. The issue in NA is one of capacity and once that gets addressed so they are right sized everything will settle down. Cheap HRC should come from elsewhere and domestic mills will focus on high strength and specialty markets.” Manufacturing company

“At least the mills are expecting it to help them by stopping the import of steel at lower cost. However, I don’t think the demand for steel is strong enough to get them where they would like to be.” Manufacturing company

“They will help the domestic steel producers initially but in the long run they will, along with the strong dollar, further incent manufacturers who use steel to move their operations out of this country so that they can buy lower cost steel with which to make their products. The result of that will be less consumption of steel in the US which will be terrible for the producers of steel.” Service center

“As demand is weak, domestic oversupply coupled with non-dumped origins will continue to glut the US market. Any agonizingly predictable attempt to raise prices subsequent to a HR filing will likely fail and therefore cause even more uncertainty and frustration.” Service center

“Even a limited win, against a couple of major exporting nations will have a lasting impact.” Steel Mill

“It will help the mills but hurt the end users.” Manufacturing company

“More semi and finished steel products will be imported and as a result the domestic manufacturers will either fail or they will ship tooling overseas to get the cheaper steel.” Manufacturing company

“Personally, I feel as though the threat to file is better than actually filling.” Service center

“But only if we use the opportunity to reduce capacity and continue with consolidation.” Service center

“Clearly that will have some success in these filings. The more success the better it is for the domestic industry.” Service center

Will Trade Suits Hurt or Help Your Business?

“Initially there will be no impact because as a service center all we need to be able to do is to compete with other service centers who will be buying from the same mils as we are. But in the long run more A.D. suits mean less customers of steel and that is bad for our business.” Service center

“It may hurt in the short and panic/fear it puts in the mind of buyers. But long term I think we will survive.” Trading company

“Any artificial change to pricing hurts anyone with inventory. Pricing should be left to the economy not politics.” Service center

“It will be very difficult to pass along any price increase in the business climate.” Service center

“We don’t buy steel from any of the countries named in the dumping suits and we already have steel pricing firmed up into 2nd qtr. Maybe our competition won’t be so lucky.” Manufacturing company

“Should keep steel pricing from falling further which will allow us to keep the savings. Savings can then be applied to other cost increases such as wages, health care, paper goods, etc.” Manufacturing company

“This will eventually increase foreign competition since they would have access to cheaper steel.” Manufacturing company

“Steel prices will go up slightly or stay flat, both of whcih we can deal with better than a freefall in prices.” Service center

“In the West Coast the market will require more imports in the future as Midwestern mills will stay in their local geographical market–NO excess capacity to ship to West Coast.” Trading company

“Less options = less competition.” Manufacturing company

“I wish I could answer both. Steel prices being higher will drive higher top-line dollars; however, if the market isn’t played just right, we can get caught with some supply shortfalls. Supply will be tighter, and the mills don’t have the capacity for many lighter-gauge materials.” Manufacturing company

“We have been primarily domestic sourced and our competitors foreign. It will raise their cost basis.” Service center