Prices

August 6, 2015

Steel Futures Continue to Show Expectations of Limited Upside for HRC

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

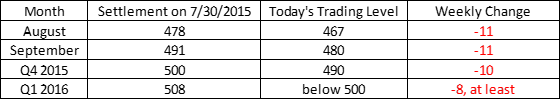

Steel mills are still struggling to get any traction on the price increases they have attempted and spot pricing has generally continued trending sideways. Let’s revisit the table again and take a look at where we were a week ago and what is trading today (8/6/15):

While no trades have been concluded at the time of this writing, for the first quarter as a strip, sellers at $500/ton for the full first quarter have not been met with any eager buyers at or above that level. There were some small trades (100 tons/month) on globex done at $503/ton, but those appear to be anomalous at this point in the day as that level has not been repeatable. With the market also now firmly below $500/ton all the way through the end of 2015, it seems safe to say that optimism is still quite scarce, even in the face of additional trade case filings (CRC joined the list of filings since our last note) and more rumored to be on the way. The market is fully dismissing those cases now as levels are very close to where they were before the case was filed.

It also looks like the mills will have to start thinking long and hard about adding rebar to their list of trade cases in the queue. We note this of course because rebar imports in the month of July skyrocketed by 93.3 percent month over month to 178,481 tonnes. That helped overall imports in July increase 5 percent from the month prior to 2.95 million tonnes. Trade cases continue to be the hammer in the whack-a-mole game, wherever they can smack down imports in one area, you can count on them to pop up somewhere else. That, in our best estimation, is what appears to be holding back a rally in the futures market, which continues to eye only modest gains through the end of the year. Hot-dipped galvanized sheet imports rose 13.5 percent to 285,620 tonnes as well, perhaps especially interesting because I was under the impression we filed a case against these coated products already? I guess those take some time to take effect of course, but interesting that this increase was largely driven by inflows from China.

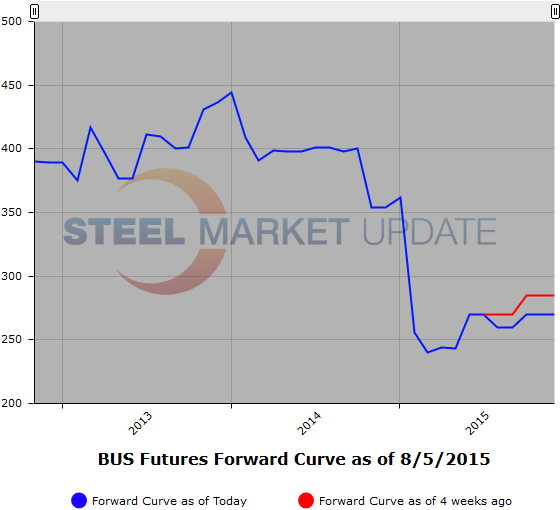

Also interesting is that scrap prices in August are posed to settle down across the board, giving up any recent gains and putting us back where we were after a $100/ton February collapse. Chicago area mills are heard to be buying shred as low as $230/ton (down $30t/on from the month prior) and busheling at about $250/ton, down $20/ton from July. It is never easy for a mill to be eyeing a significant drop in its own input costs while trying both pushing a trade case AND demanding higher prices from their customers. Scrap yards are clearly not happy, especially since mill utilization rates and overall raw steel output has actually edged slightly higher to nearly a six month high with 1.76 million tons produced last week.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

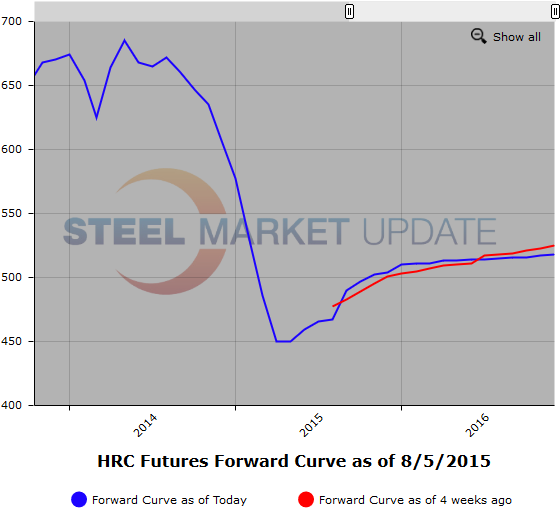

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.