Prices

August 4, 2015

July Steel Imports 200,000 Tons Higher than June

Written by John Packard

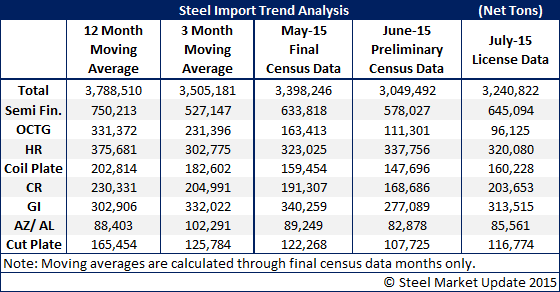

The U.S. Department of Commerce updated license data for foreign steel imports for the month of July. Based on the just released data it appears July imports will be approximately 200,000 net tons higher than what was received during the month of June. However, when looking at imports from a 3 month moving average and 12 month moving average, July’s tonnage will be below both.

We saw increases in semi-finished (slabs) compared to June. Semi-finished imports are almost always imported by the domestic steel mills.

Cold rolled imports continue to be quite strong exceeding 200,000 net tons. China was by far the largest exporter of cold rolled at 68,000+net tons. Canada was a distant second with 25,882 net tons.

Galvanized is another product which is at very high levels. GI import licenses exceed the 12 month moving average and are just below the 3 month moving average. If the numbers stand when the final tally is made galvanized imports will be 36,000 tons higher than the month of June (or about what Sharon Coatings is producing in a month…).

Other metallic, of which the vast majority is Galvalume or zinc-aluminum coated steel, is about the same as June and slightly below both the 3MMA and 12MMA.

The numbers do not suggest that inventories will be going down by significant amounts during the month of July.