Government/Policy

July 30, 2015

US Steel Mills Ask for Finding of “Critical Circumstances” Against Coated Steel Exporters

Written by John Packard

On June 3, 2015, six U.S. steel mills filed an antidumping and countervailing duty petition against corrosion resistant (referred to as CORE, which are coated steels such as galvanized and Galvalume products) steels from: China, Taiwan, South Korea, India and Italy.

Late last week, attorneys representing Nucor Corporation, US Steel, Steel Dynamics, AK Steel , ArcelorMittal USA and California Steel filed paperwork with the US Department of Commerce alleging that imports of CORE products have “surged” since the filing (above the 15 percent threshold). According to the mills’ attorneys the alleged surge of galvanized and Galvalume products since the filing means the countries named are trying to circumvent potential duties by rushing the steel into the United States. If true, this then opens the door for “critical circumstances.”

What happens if the government finds that the foreign countries named did, indeed, increase the number of tons of coated steels shipped to the United States since the June 3rd (and the mills suggest that the date be moved back to March 2015) petition date and the amount of tonnage meets critical circumstances criteria? The government can collect duties 90 days prior to the publication of the preliminary determination but no further back than June 3rd.

In other words, tonnage that is being received now that the trading companies (and their customers) considered safe from any potential duty hit would instead be included.

![]() The mills have filed their request for a finding of critical circumstances earlier than usual and they are asking that the determination be made “on an expedited basis.” The requested decision due date is 45 days from the filing which was dated July 24th. The date requested would be September 7th.

The mills have filed their request for a finding of critical circumstances earlier than usual and they are asking that the determination be made “on an expedited basis.” The requested decision due date is 45 days from the filing which was dated July 24th. The date requested would be September 7th.

However, according to trade attorney Lewis E Leibowitz, “…Commerce is not required to make findings by that date. They are required to issue a CC finding by the date of the preliminary determination. The preliminary determination date for dumping is currently 140 days from the publication of the initiation notice (June 30). That would be October 7. The CVD preliminary determination is earlier: 65 days from June 30, or September 4. Those dates are approximate and can still be extended up to November 26 and October 24, respectively. Those dates are approximate also. The CC retroactive period is 90 days from the date of publication of the preliminary determination. If the CC determination is published earlier, the retroactive date can be 90 days before the determination, but no earlier than the petition date (June 3).”

What has to be proven/exist in order to have Critical Circumstances applied?

In the mills’ letter to Commerce alleging Critical Circumstances, “…in order to find that critical circumstances exist in an antidumping duty investigation, the Department must first find ( 1) evidence of a history of dumping and material injury by reason of dumped imports in the United States or elsewhere of the subject merchandise, or (2) knowledge by the person by whom or for whose account subject merchandise was imported that said merchandise was sold at less than fair value and that such sales were likely to cause material injury to an industry in the United States. 7 The Department need only find that one of these conditions is met in order to make an affirmative critical circumstances finding. 8 Based on information that is readily available, Petitioners believe that section 733(e)(l)(A) of the Act is satisfied in the instant cases.”

Mills Say March 2015 Should Be Date of Consideration & Use SMU Article to Support Their Claim

As mentioned above the six mills are requesting Commerce to look at the data using March 2015 as the starting point as opposed to June 3rd when the actually antidumping filing was made. One of the key sections to the mills’ claim is that the countries named in their CORE petition knew that a trade case was coming. The mills’ attorneys cited a Steel Market Update article to support their claim:

“…By March 2015, this speculation had turned to a widespread belief that a proceeding was imminent. Indeed, on March 10, 2015, industry source Steel Market Update published the following:

Steel Market Update has received a number of inquiries recently asking questions about the potential for a trade case or anti-dumping filing by the domestic mills against foreign steel imports. In particular, the imports in question are cold rolled and coated steels and, the country mentioned the most is China, although if there is a case most likely other countries will be involved in the trade action. 35”

Other sources (including more from SMU) were also cited as the mills try to support their contention that Commerce should use March 2015 as the starting point.

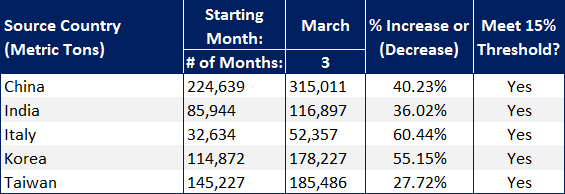

The mills then compared the 3 months prior to March and then March through May and produced the following table showing the percentage of change prior to March to after March:

The mills then go on to point out various “subsidies” received by each country counter to WTO rules:

“CORE producers and exporters benefited from at least the following prohibited subsidies:

• China: export loans, preferential income tax subsidies for export-oriented Foreign-Invested Enterprises, export assistance grants and export interest

• Korea: export credits and export loan guarantees;

• India: subsidies for “Export Oriented Units,” Export Promotion of Capital Goods Scheme and pre-shipment and post-shipment export financing;

• Italy: export credit subsidies and export insurance subsidies;

• Taiwan: Grants for International Development Activities.”

We also spoke with attorney Lewis E Leibowitz about the timing of the filing. He told us, “Critical circumstances allegations must be filed within 20 days before the FINAL determination. By waiting that long, petitioners are taking a risk. By filing this early, they avoid the risk that entries will be liquidated (finalized with no opportunity to reopen them) before the final determination, which will take place in about April-June of 2016).”

SMU expects this filing against the CORE (corrosion resistant) products to be a template for how they will handle the just announced cold rolled suit and the possibility of a hot rolled suit in August. Stay tuned and come to our Steel Summit Conference in Atlanta on September 1 & 2, 2015 as we discuss free trade, trade suits and government regulation with Kevin Dempsey of AISI, Richard Chriss of AIIS and attorney Lewis E Leibowitz. Details on our program and registration can be found on our website.