Prices

July 28, 2015

SMU Analysis of Cold Rolled Imports

Written by John Packard

In light of the antidumping suit which was filed by five domestic steel mills earlier today (or last night if you received the USS email), we wanted to do some analysis for our readers and take a look at the eight countries named and their participation in the CRC market.

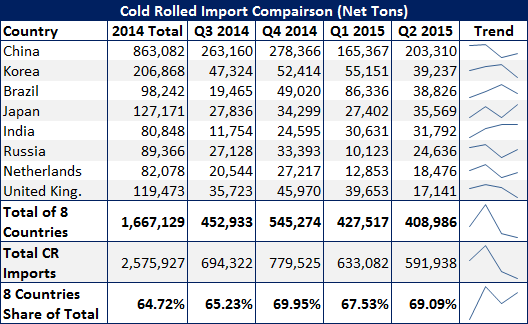

As you can see by the table below, the eight countries represented 64.72 percent of total cold rolled imports during calendar year 2014. So far this year, the eight countries represent 67.53 percent in Q1 and 69.09 percent in Q2.

We provided a visual (line graph) to give you a feel as to whether each individual country is building or reducing their participation in the U.S. cold rolled market.