Distributors/Service Centers

July 28, 2015

Service Center Reactions to Cold Rolled Dumping Suit

Written by John Packard

As expected, five U.S. steel mills banded together and filed an antidumping petition against cold rolled steel from: China, Russia, India, South Korea, Netherlands, Japan, United Kingdom and Brazil.

Reaction from steel buyers about the scope of the cold rolled suit ranged from relatively muted to surprised. Those who had a muted response expected that a suit was about to be announced and they are not concerned about pricing or inventory over the short term as there is plenty of inventory in the system to support short term needs.

Those that were surprised were not caught off guard regarding the suit being filed but rather the fact that the Europeans (Netherlands and United Kingdom) were included in the suit.

One service center executive told SMU this afternoon, “People are a little surprised by the scope of this, especially including Europe. This could be a game changer. Steel could become tight.”

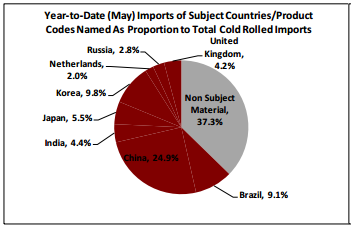

The reason why steel could become tight is other non-named countries have to be concerned about coming in and trying to fill the shoes of the eight countries named. According to a KeyBanc note to clients this morning, 63 percent of year-to-date cold rolled imports are from the eight countries named in the dumping suit.

Many believe it won’t be until sometime during the 4th Quarter 2015 before the impact of this new trade case will be felt in the marketplace.

As one East Coast service center put it to SMU this morning, “The announcement of the CR trade suits will create a large amount of conversation, but I do not believe it will affect the marketplace until mid-to-late 4th quarter. There is plenty of steel in distributors’ inventories and on the docks. As far as pricing with those holding inventories at the docks, the importers are not reacting to the trade announcements. They are still interested in moving their inventories. I believe that will remain that way until such time as the boats stop arriving. To the domestic suppliers…no one is saying a word. Lead-times remain short. Some producers are showing greater lead-times, but the material is ready earlier than quoted. Prices remain the same. No one is trying to collect the US Steel announcement.”

However, as AK Steel CEO James Wainscott stated in this morning’s earnings conference call, their expectation is that flat rolled spot prices will increase during both the 3rd and 4th Quarters of this year.

An upper Midwest service center echoed the comments made by Wainscott when we were told, “Should have a positive effect on pricing. Will help my business.”

A large national service center chain told us, “While the suit(s) are a longer term positive for mills, I’m not sure we’ll see impacts in the present. We need real lead-times to move out with momentum, in order for the mills to raise prices now. I’d imagine the labor negotiations would have a greater potential impact on pricing in the near term vs. CR suit (if there were to be real info that a stoppage was becoming likely).”

Keybanc metals and mining analysts Philip Gibbs & Tyler Kenyon reported to their clients this morning, “Year-to-date cold-rolled volumes through May from alleged countries (793,360 tons) – up 44% YTD YOY – accounting for roughly 63% of total cold-rolled imports, 17% of total sheet imports, and 5% of total finished steel imports. Of total cold rolled sheet imports (subject and non subject) subject material from Brazil accounted for 9%, China 25%, India 4%, Japan 6%, Korea 10%, Netherlands 2%, Russia 3%, and the U.K. 4%.” The graphic below was part of the Keybanc report/analysis.