Prices

July 26, 2015

June Preliminary Imports at 3 Million Net Tons

Written by John Packard

Steel Market Update (SMU) has discussed with our readers, on many occasions, that there are three kinds of numbers coming out of the U.S. Department of Commerce regarding steel imports on a monthly basis. First, there are the license data requests which are published every Tuesday evening after 5 PM ET. License data is the least reliable but it can give you a feel for how a month is trending. Second, is Preliminary Census Data which begins to provide some structure based on what has been actually arriving into U.S. ports. Then we receive the Final Census Data which is the final tally for the month.

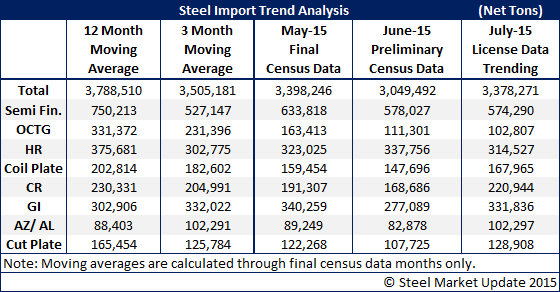

Late last week the US DOC released Preliminary Census Data for the month of June and it is showing the month as being just over 3 million net tons (remember that the government data when released is in metric tons and we convert it to net tons). The number is 348,754 net tons less than what was the final tally for the month of May. At the moment July 2015 licenses are trending toward a bigger month for imports than June. We believe this is due to a large number of tonnage arriving in galvanized and Galvalume due to the trade suit (tonnage needs to arrive before August 27th or face potential duties).

The rumor mill has the domestic mills filing an antidumping and countervailing duty petition against cold rolled before the end of this week (before the end of July). As you can see by our table below CR imports are trending back up after shrinking in June.