Prices

July 23, 2015

Contango Evaporates as Steel Futures Markets Plunge

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

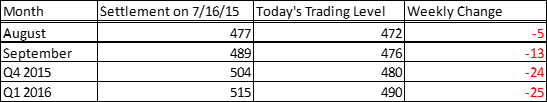

If this commentary came even one day earlier, it would look very different. Here is a quick rundown of the before/after on pricing from just one week ago, now that the mayhem has settled down somewhat ($/ton):

As far as the futures market is now concerned, US Steel’s $40/ton price hike will not be realized anytime in the next eight months. Our article from two weeks ago about the uphill battle US Steel is fighting on that front way be worth revisiting if any reader’s bullish hopes are not thoroughly dashed by the red ink above. Our initial article pointing out how significant the contango in the market WAS is likely also worth revisiting! All that said, the futures market is certainly far from being perfect in its forecasting accuracy, but today’s sell off does tell us something.

First and foremost it tells us the market is no longer as timid about the possibility of trade cases as it has been in the past. By our count, no fewer than 6 trade cases are either rumored to be in the works or have already been filed. The countries that would be involved are too numerous to sort through, so by product group trade cases have already been filed against coated products and structural tubing, while rumors continue that cases against Plate, HRC, CRC and stainless products are also in the pipeline. That would be a heaping helping of trade protectionism, so why doesn’t the market see more upside given that context? Our best guess is that a “boy who cried wolf” dilemma has crept in. In addition to that however there is also the unfortunate outlook for raw materials.

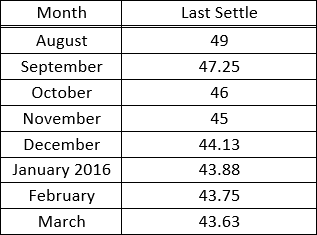

Buyers are likely living with minimal fear of a massive surge in steel prices while raw materials like iron ore and scrap continue to plunge, especially since that is what they are forecasted to continue doing. Despite a modest bounce in today’s session, the backwardation in iron ore markets has not subsided. By the time the calendar flips to 2016, iron ore is projected to be well below $45/tonne. Here is the current forward curve from NYMEX on last settlement ($/metric tonne):

So the current forward curve is projecting some that stability may find us… in 2016…just below $44/tonne. Given that context, perhaps the forward curve for steel is just catching up. We also can’t divorce steel from the broader commodity markets; Copper is down another 2.2% in today’s trading compared to yesterday’s close. That continues a disastrous run for the red metal which has seen the most active contract (September CMX) fall from a peak of nearly $2.95/lb in May to just below $2.38/lb today, nearly a 20% drop.

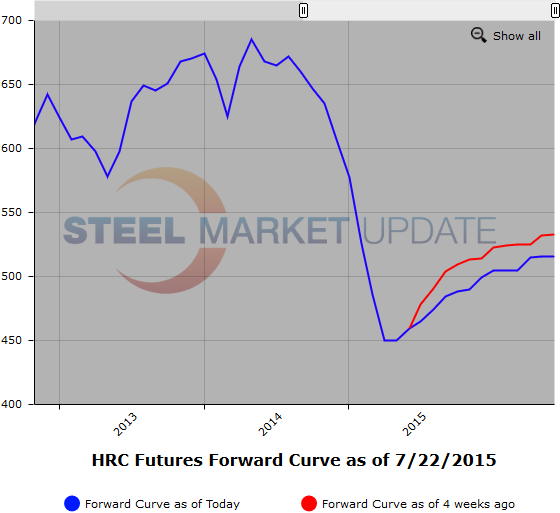

Dr. Copper, as it is sometimes called for its “degree in economics”, suggests that the pain in raw materials and perhaps even steel pricing may not be over just yet. Consider that while September copper has tumbled nearly 20% since May, September HRC futures prices have fallen by less than 9% over the same period. This is far from a one to one relationship, but it seems clear that sellers of HRC are seeing a very real possibility of additional downside risk. The large contango that was formerly priced in has been cut dramatically as a result.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

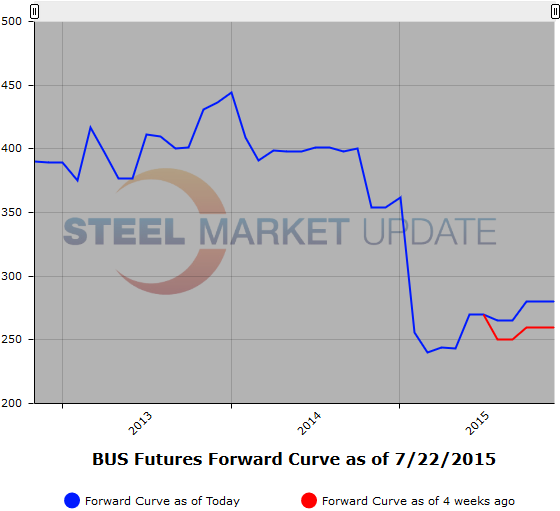

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.