Logistics

July 21, 2015

US Ports Update

Written by Sandy Williams

U.S. West Coast and Gulf ports seem to be in pretty good operating condition right now. The Port of Houston received over 6 million tons of steel imports in 2014, making it a record year for the port. In a “normal” year Houston can expect to see 3.5 to 4 million tons annually. Our Houston source says the volume of steel imports has diminished in 2015. “The pull back is due to the energy sector—last year a lot of it was steel pipe.”

Steel imports were down 6 percent y/y in May to 497,000 tons. Container cargo increased by 23 percent to 2.1 million tons.

No problems were reported with logistics and warehouse availability in Houston. Although there has been a significant rise in container volumes that have shifted from the West Coast, Houston has not seen any steel cargo changes occurring from this year’s West Coast labor issues.

The Port of Savannah has seen “unprecedented and remarkable import growth in the past fiscal year,” according to Jeff Neil, at the Georgia Ports Authority. Factors causing the increase include: diversion from West Coast ports, the U.S. economic recovery, and regional gateway shifts.

In FY 15 (July 2, 2014-June 30, 2015) total tonnage through the port increased 7.8 percent to 31.7 million tons, compared to 29.4 million tons in FY 14. Total import tonnage increased 19.2 percent to 14.7 million tons from 12.3 million tons in 2014. TEU imports were up 19.8 percent to 1.782 million TEUs.

Iron and steel import tonnage rose a whopping 40.8 percent to 587,000 tons in FY 15.

Neil commented on changes in shipping volumes, “Our container operation has seen phenomenal growth over the past year, thanks in part to cargo diverted from the West Coast, but also from organic growth as existing customers move a greater share of their cargo through Savannah and new customers come online. Savannah’s ability to scale up quickly and effectively has enabled GPA to maintain a higher level of service without sacrificing on time efficiency.”

No problems were reported with congestion or other logistics issues. The Port of Savannah has over 45 million square feet of inventory industrial space and another 1 million is under construction. Warehouse availability is good.

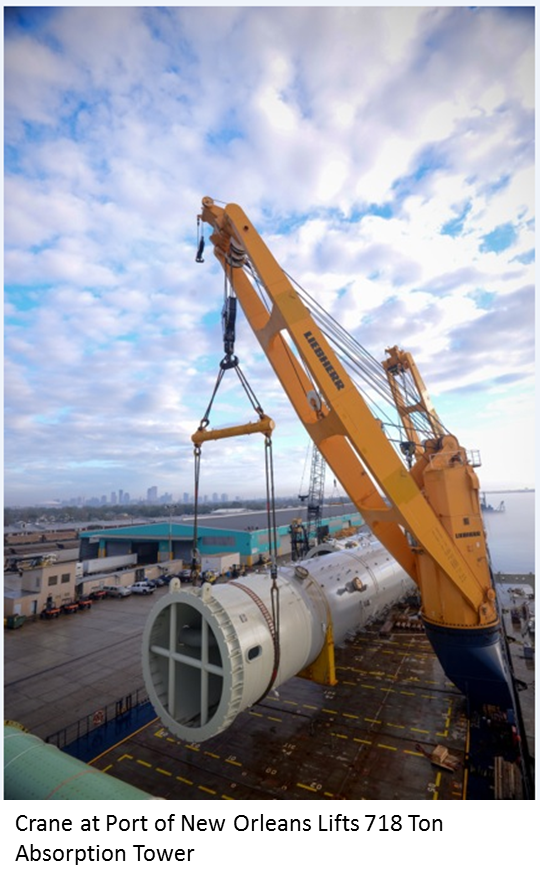

“The past 18 months have been very strong,” said Matt Greshman, Director of External Affairs at the Port of New Orleans. “We are currently experiencing the typical slowdown for the summer and we do anticipate some changes in the fall as potential anti-dumping and counter-veiling duties are levied against Asian producers. However, we anticipate the market will pick back up in the fall and potentially the country of origin of the steel products may shift.”

Gresham said cargo volume has been increasing across the board for the past several years and cannot be definitively attributed to shifts caused by West Coast labor issues.

No problems were reported with logistics. The port provides 13,511 feet of berthing space for breakbulk cargo, available at six facilities. Warehousing for includes 1.6 million square feet of indoor transit shed area.

Phillip Sanfield, Director of Media Relations for the Port of Los Angeles, said the labor issues plaguing the port earlier this year are mostly behind them.

“Labor has been working strong and steady,” said Sanfield. “We are currently working with the Port of Long Beach on improving the efficiencies of the port complex. We’re focusing on optimizing terminal operations, off-dock solutions, chassis, intermodal rail, drayage and key performance indicators/data solutions. There is also a Peak Season working group in place looking at ways to improve flow over the next several months.

The Port of Los Angeles reports that containerized cargo was down two percent in June compared to the previous year. The port moved a total of 721,802 Twenty-Foot Equivalent Units (TEUs) last month. The data is somewhat skewed, however, due to shippers moving cargo earlier than usual last June to avoid potential labor issues surrounding expiring labor contracts. Imports were down 3.65 percent and exports 10.7 percent.

Reports, however, indicate that labor shortages and trucking issue are causing delays at the Port of Oakland.

Import Volume Increasing on East Coast

A recent report by JOC.com shows that import volume is picking up at East Coast ports. According to data by PIERS, a sister product of JOC.com within HIS Maritime and Trade, Savannah heads the list for fastest growing port, with container imports up 33 percent in the first six months of 2015. Only Seattle and Long Beach on the West Coast made the top ten list. Miami tied Seattle with increase of 21 percent in the first half of this year.

At East Coast ports, overall container imports grew 3 percent to a 43 percent share of the market. West Coast ports saw their share slip 5 percentage points said PIERS.

The shift in cargo is due in part to aggressive infrastructure investment at ports and, in the case of Savannah, proximity to 44 percent of the U.S population.

Ports are also working to expand facilities to accommodate the larger ships that will be able to transit through the Panama Canal at the completion of the Canal expansion in Spring 2016.