Prices

July 21, 2015

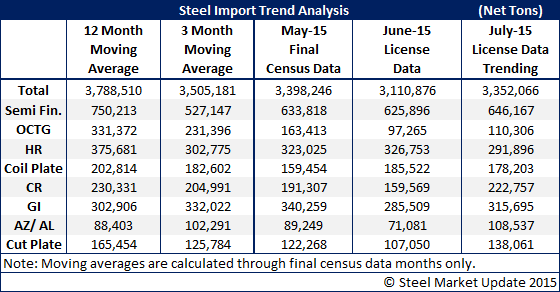

Steel Import Licenses Remain High for July

Written by John Packard

The U.S. Department of Commerce updated July license data as of 5 PM today (Tuesday, July 21st). At the moment, the license data is “suggesting” that July imports will exceed those of June (June had 22 days and July has 23 days) by 100,000 to 200,000 tons. The daily license request rate for July is 108,131 net tons while the rate for June at the same point in time during the month was 105,693 tons. The good news is the daily shipping rate for both June and July are well below the daily request rates of March (124,239 tons), April (121,561 tons) and May (117,150 tons).

Galvanized imports (coated products) continue to be trending over 300,000 net tons for the month of July. This is a very large number for the U.S. market to absorb. The same can be said for the Galvalume which is trending to exceed 100,000 tons for the month.

The top three exporting countries for galvanized (based on license data requests) during July are: China, India and Korea. We can expect these countries to drop dramatically by the end of August due to the dumping suit.

Galvalume exporters are: Korea and Taiwan. Both countries are involved in the dumping suit which includes Galvalume products.