Market Segment

July 21, 2015

Steel Dynamics Optimistic on Steel Pricing for H2

Written by Sandy Williams

Steel Dynamics expressed concern about imports during the company’s second quarter earnings call.

“On the trade front, we’re pleased the ITC has confirmed the flood of unfairly traded imports of corrosion-resistant sheets deal has materially reduced our shipments, pricing and profitability. I believe in fair trade, but the U.S. has become a dumping ground for world excess steel capacity. We are confident that such actions will create a more positive pricing environment for us going into the second half.”

On the near term impact of recent trade enforcement legislation, Millett said he doesn’t expect to see an improvement right now from a pricing perspective and that benefits will be realized in the long term.

Margin compression was a problem in second quarter but was offset by solid demand and increased shipments.

“The second quarter 2015 market environment remained extremely challenging for our steel and metals recycling operations,” said Mark D. Millett, Chief Executive Officer. “The ongoing flood of steel imports continued to pressure steel product pricing to a greater degree than the benefit realized from lower scrap costs, compressing second quarter steel margins. However, due to continued solid U.S. steel demand, our second quarter steel shipments improved, which offset most of the margin compression. Steel pricing has recently stabilized and domestic steel consumption from the automotive, manufacturing and construction sectors should support a stronger domestic steel industry in the second half of the year, predicated upon the expectation of reduced levels of imported steel and sustainable lower raw material costs.”

Steel Dynamics reported an adjusted net income of $53 million or $0.22 per diluted share. Adjusted operating income was $120 million.

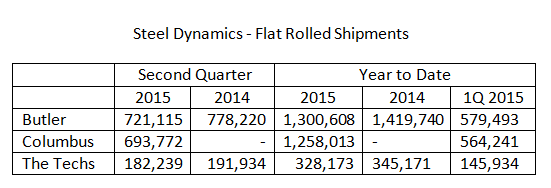

SDI shipped 2,078,685 tons of steel in Q2 compared to 1,518,882 tons year over year. Average price of steel per ton was $662, down from $833 in Q2 2014. Second quarter steel utilization rate was at 87 percent.

SDI fabrication operations achieved record profitability on strong demand from the construction industry in second quarter. Operating income was 27 percent higher than the previous record and operating income of $252 per ton was 30 percent higher than Q1.

Scrap pricing volatility subsided in second quarter, improving metals recycling results. Metals recycling sales totaled $391 million down from $580 million in Q2 2014. Average ferrous cost per ton melted was $255, falling from $364 per ton melted in the second quarter 2014.

Shredders continue to have significant overcapacity, said Millett, and are competing for the same material.

“Scrap export levels have fallen in the past two consecutive years to volumes significantly lower than recent historical norms,” said Millett. “With the expectation, our continued strong U.S. dollar reducing scrap exports and the resulting ample scrap supply, we don’t see any of the likely drivers for significant increases in ferrous scrap prices in the near term. Based on this difficult operating environment, we believe there will be consolidation and rationalization of smaller scrap companies in the near future.”

“I think the trend is definitely going to be down,” said Russell Rim, Executive Vice President of Steel Dynamics and President and Chief Operating Officer of OmniSource Corporation. “I think you’ve got no exports. The strong dollar limited exports and actually has incurred some imports of scrap, which again is going to mean that excess scrap or the scrap supply in the U.S. is going to plentiful, which logically will put downward pressure on scrap price in the near term.”

Despite low scrap prices Millett thinks higher steel prices are possible in the second half with domestic pricing between $480 and $500 per ton more than reasonable as imports are mitigated by trade cases and domestic demand remains strong.

Inventories were another topic of discussion during the question and answer segment of the conference call.

“From my perspective, you still have a large inventory that has to be consumed. Again, as we said earlier, the customer base is currently not – they’re reluctant to take a position. They’re patching holes and you just see that the inventory levels are slowly coming down. Once they get back into market, and those imports are not available to them, I think is when you start seeing the price appreciation.”

SDI is pleased with operations at Columbus and the collaboration between the Butler and Columbus teams. The $100 million investment at Columbus is expected to provide 250,000 tons of annual coating capability for the facility. The higher quality product will increase value-added shipments and regain customer base, said Millett.