Analysis

July 20, 2015

US Vehicle Sales and NAFTA Vehicle Production in June 2015

Written by Peter Wright

Following the exceptional rate of vehicle sales in the US in May the June rate fell from 17.8 million annualized to 17.2 million which is a more sustainable rate. The June pace was still higher than the 16.9 million units average of the past 12 months. Demand is being supported by easier credit terms, sustained job growth and an increase in average wages. Light trucks accounted for 55 percent of total sales in June. Auto sales were 7.8 million, LT 9.4 million and imports were 3.7 million for an import market share of 21.5 percent. Import market share has been trending down this year and is well below the 30 percent level reached in early 2009.

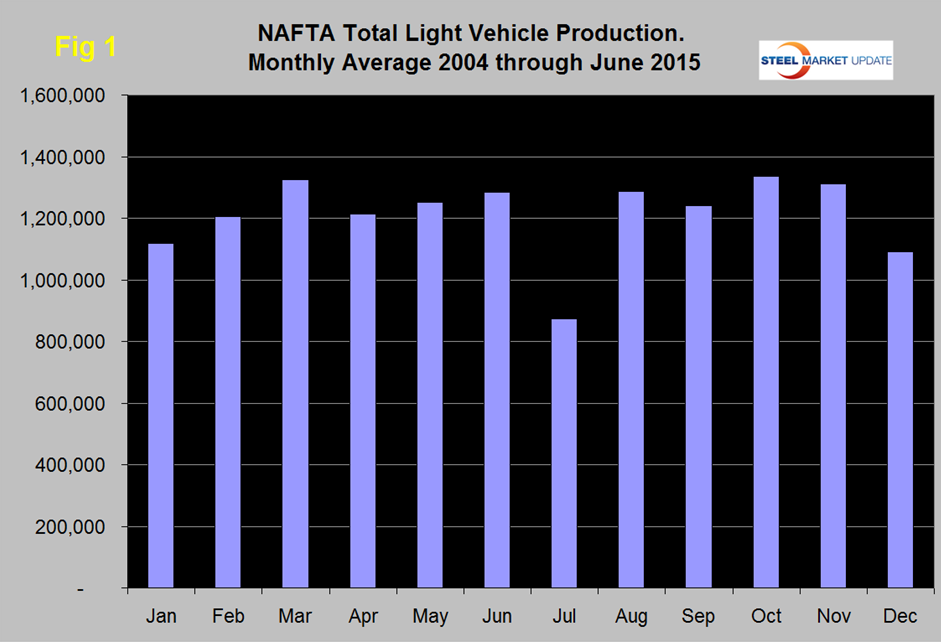

Total light vehicle (LV) production in NAFTA in June was at an annual rate of 18.543 million units, up from 17.656 in May and the second highest in eight months. On average since 2004, June’s production has been 2.7 percent higher than May, this year June was up by 5.0 percent (Figure 1).

Note: these production numbers are not seasonally adjusted, the sales data reported above are seasonally adjusted. History predicts that production will decrease by 32 percent in July but there have been reports in the press that some auto companies plan to curtail their summer maintenance shutdowns this year so July will probably exceed expectations.

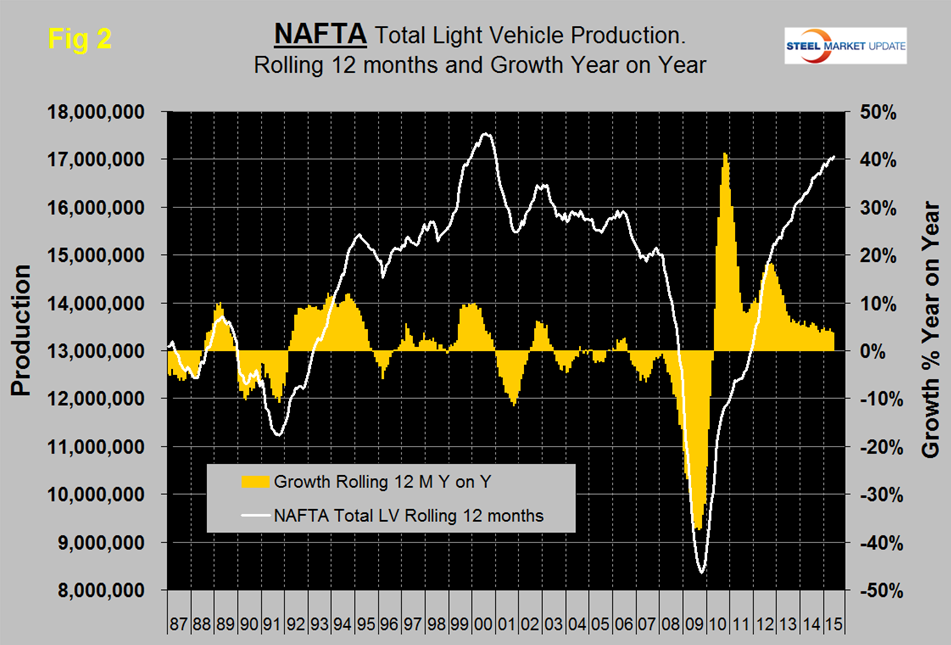

On a rolling 12 months basis y/y LV production in NAFTA increased by 3.8 percent through June. LV production in NAFTA is now well above the pre-recession peak of Q2 2006 and is heading for the all-time high of mid-2000 (Figure 2).

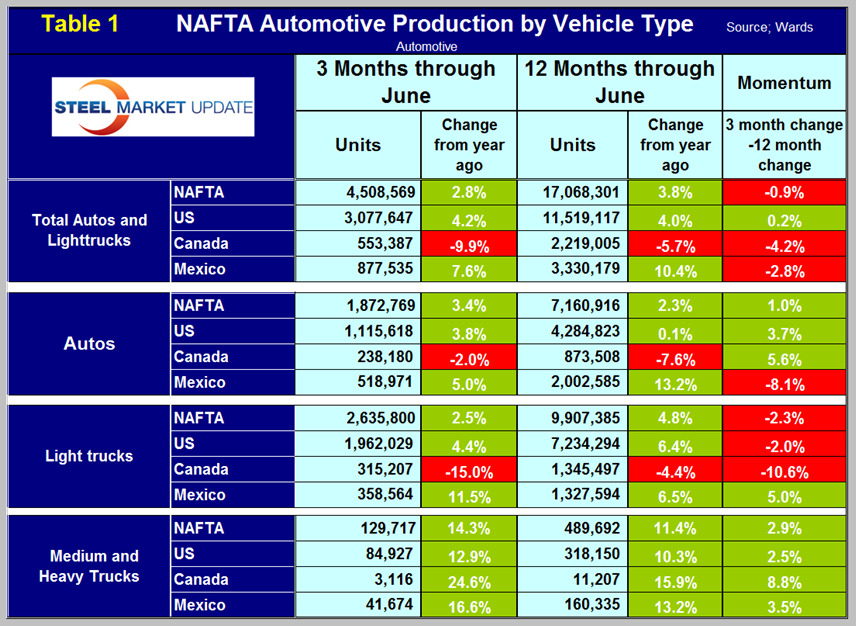

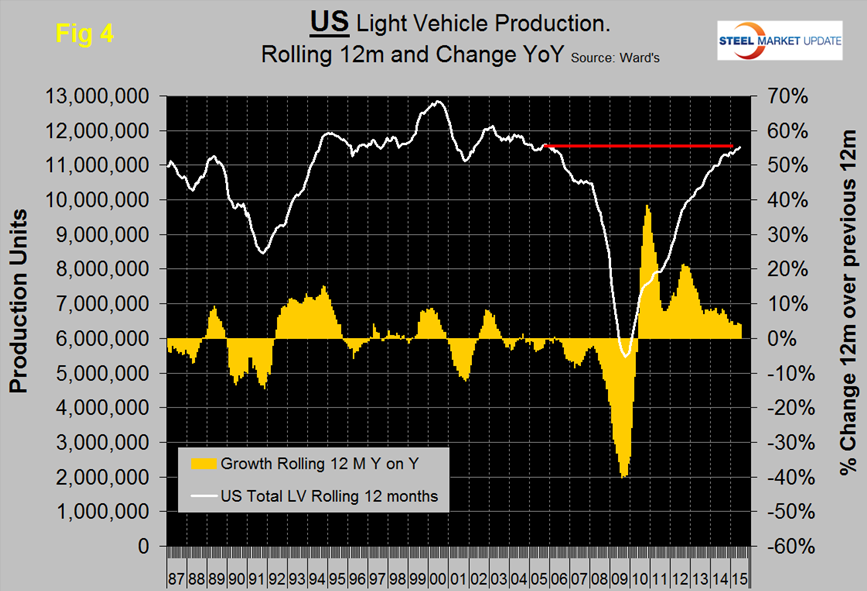

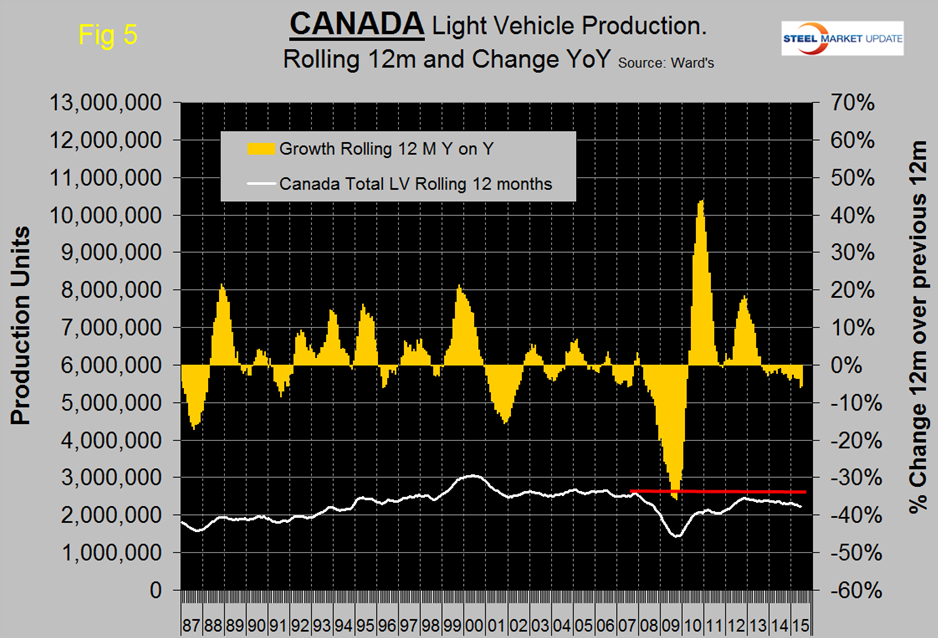

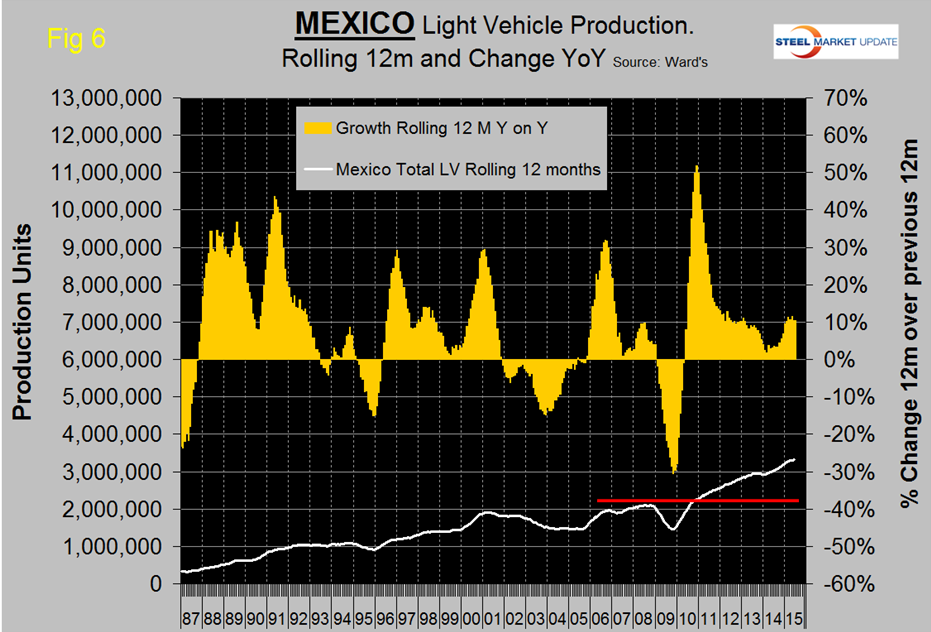

On a rolling 12 months basis y/y the US is up by 4.0 percent, Canada is down by 5.7 percent and Mexico is up by 10.4 percent (Table 1).

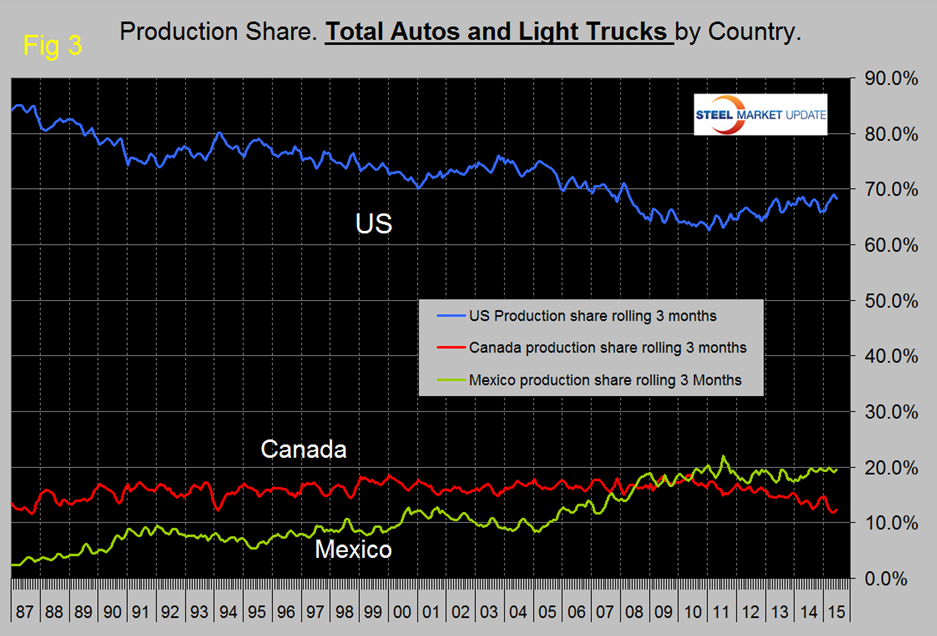

Growth rates in 3 months through June y/y indicate that the US has slight positive momentum but that of Canada and Mexico is negative. The US has gained production share in the most recent 3.5 years (Figure 3) and so far in 2015 that gain has accelerated at the expense of Canada.

On June 22nd GM announced its intention to invest $245 million at its Michigan plant in Orion Township to produce a new yet to be named vehicle. The Orion facility currently assembles the Chevrolet Sonic and the Buick Verano. In November 2014, GM committed $160 million for the future production of the Chevrolet Bolt electric vehicle at the Orion plant. A close examination of Canadian and US share this year in Figure 3 shows that they are a mirror image of each other suggesting that the auto companies routinely move production from one side of the border to the other. In June on a rolling three month basis, the US production share was 68.3 percent, down from 69 percent in May which was the highest since March 2008.

Figure 4, Figure 5 and Figure 6 show total LV production by country with y/y growth rates and on each the red line shows the change in production since Q2 2006.

Note the scales are the same to give true comparability and that Mexican growth is surging at more than twice the rate in the US and Canada continues to contract. In the last two years US growth has slowed and contraction in Canada has accelerated. Mexico experienced a strong growth surge last year but has been stable in the 10 percent range this year.

The decline of both the Canadian dollar and the Mexican Peso must be causing auto assemblers to look at moving production to Mexico in particular. We believe there is spare capacity both sides of both borders for the automotive manufacturers to play this game. This isn’t happening so much in Canada in spite of the depreciation of the Loonie because (in our opinion) the labor relations situation in Canada is causing manufacturers in general to reduce their exposure. US steel is a case in point.

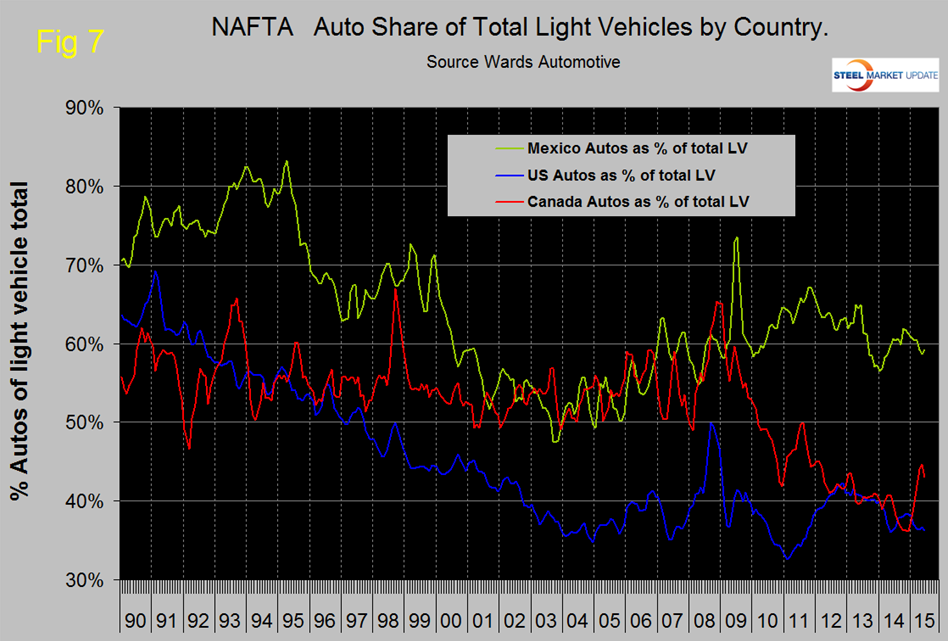

The mix of light vehicles is very different by country (Figure 7).

The percentage of autos in the Mexican mix in the last three months was 59.1 percent but only 36.2 in the US and 43.0 percent in Canada.

Ward’s Automotive reported on Monday that total light vehicle inventories in the US increased by 4 days of sales from 56 at the end of May to 60 at the end of June, 1 day more than the end of June last year. Month over month FCA (Fiat Chrysler Automotive) was up by 8 days to 78, Ford up by 6 days to 67 and GM up by 7 days to 70.

The Steel Market Update data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production, growth rate and production share by country.