Prices

July 14, 2015

July Foreign Steel Import Licenses Trending Higher Than June

Written by John Packard

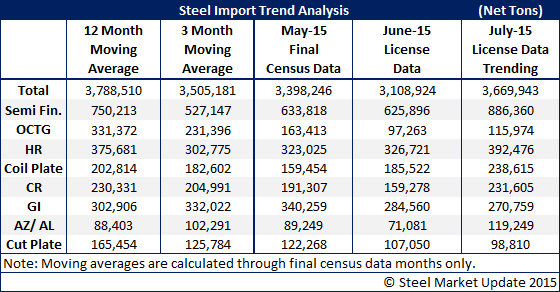

The U.S. Department of Commerce released the latest foreign steel import license data late this afternoon. The license data is suggesting that July steel imports will be higher than the 3.1 million net tons suggested by today’s adjustment to June’s license data. This is not a positive for the steel market.

Two items of interest (at least to SMU) are semi-finished imports which are trending above both their 3 month and 12 month moving average and hot rolled coil, which is also trending above its 3MMA and 12MMA. These are both items where the domestic steel mills are (semi-finished) or tend to be (hot rolled) large importers of the products which are then rolled at domestic steel mills like NLMK USA, California Steel, AM/NS Calvert, AK Steel, etc.

Oil Country Tubular Goods (OCTG) continue to trend lower (but are still high considering how poor we are seeing the energy markets).

Cold rolled continues to be trending toward its 12 month moving average and appears it will reverse the trend of lower that we saw in June.

Galvanized is trending toward lower levels although if the month ends up at 270,000 net tons that will still be a big month for the product.

Today we are going to share with you both the monthly projected numbers (based on current license data) which should not be considered as a final number. This number can move rather dramatically over the last couple weeks of the month. Our expectation at this time is that we will see July imports exceed those of June.

The second table is showing where we saw the daily license rate at this point in the month. As you can see by the table below, the July trend is greater than that of June but below all of the other months shown.