Prices

July 12, 2015

Imports of Sheet Products in May Double Pre-Recession Levels

Written by Peter Wright

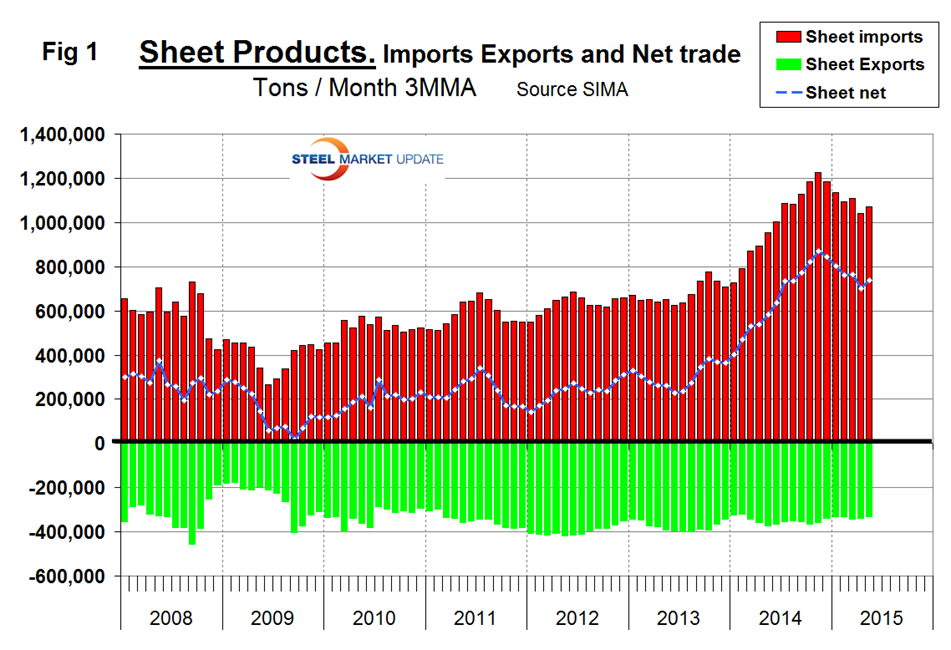

Net imports equals imports minus exports. We regard this as an important look at the overall trade picture and its effect on demand at the mill level. Figure 1 shows that net sheet product imports on a three month moving average (3MMA) basis in May, continue to be more than double that which existed before the recession.

The deterioration in net has been almost entirely an import effect, exports have been fairly consistent though drifting down slightly since Q2 2012. Table 1 shows net imports by product.

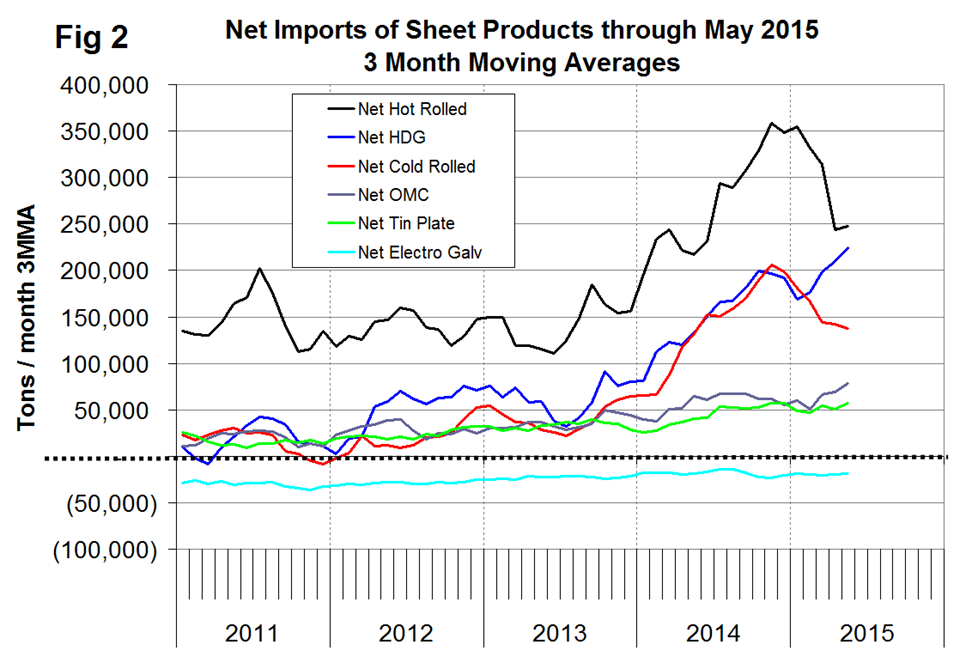

Year to date through May, total net flat rolled imports were 4,897,153 tons of which 3,744,419 tons were sheet products. On a three month moving average basis, March through May net sheet imports increased by 165,010 tons per month year over year. The 3MMA of net imports increased on all products except electro-galvanized and rail. Electro-galvanized is the only sheet product that currently enjoys net exports and in the latest data that surplus declined slightly. In Table 1 negative net imports (which means a trade surplus) are shown in green. Figure 2 shows the trend of monthly net sheet product imports since January 2011 on a 3MMA basis.

Hot and cold rolled net imports have been declining since Q4 last year but HDG has increased every month since January. The trade surplus of electro-galvanized has been fairly constant for the last five quarters.