Prices

July 9, 2015

Futures Markets Shrug off USS Price Increase Announcement

Written by Spencer Johnson

The following article is written by Spencer Johnson of FC Stone LLC. With six years of experience, Spencer provides his customers strategic and tactical advice on protecting themselves against commodity price volatility in the steel markets. Spencer will rotate weekly futures articles with Andre Marshall of Crunch Risk, LLC. Spencer can be reached at spencer.johnson@intlfcstone.com.

As is so often the case, US Steel has chosen a particularly interesting time to begin a push for their $40/ton price increase on all flat-rolled products, and that’s without even diving too deep into the fact that a looming Grexit is stoking fears of an economic contagion in Europe. You know it is not a good sign when a huge financial crisis potentially looming in Europe doesn’t even make our top 3 reasons to be skeptical of pushes for higher steel prices. Granted, spot prices have stagnated around the $460/ton mark and mills would no doubt like to see a little rally, but the fundamental story behind this increase is weak, which is likely why no rationale was given by USS in their original increase letters that we have seen. Those letters, which came on Tuesday, had been more than welcome on the part of the bulls but we see the deck being stacked against the US mills on this issue for three reasons. Note that we do believe prices will indeed get a $40/ton boost, we just don’t see this happening in the short-term but instead as part of a long slog that will likely get us there sometime in the fourth quarter (in short, we are in agreement with the NYMEX HRC contango levels as being a fair estimate, more on that below).

First and most obvious among the reasons to be skeptical of this increase is that it is never particularly easy for a mill to push pricing higher when key steelmaking raw materials are in the midst of an incredible collapse. Iron ore prices have shed nearly 25% of their value in less than a month, with July iron ore futures reaching a high of $62.75 back on June 11th and then promptly slumping to settle at just $47.75 on July 8th, an even $15/ton decline (just shy of 24%). Iron ore is bouncing back modestly in today’s session, but the sentiment in the market has turned quickly against iron ore as Chinese steel markets (and China’s markets in general) are now experiencing an unprecedented amount of turmoil. This doesn’t even begin to touch on scrap pricing, where US export demand is totally stagnant and prices are down substantially this month (in most cases, at least $20/ton). The scrap issue makes perfect sense; domestic output is down along with capacity utilization, which makes the case for higher steel prices all the more difficult.

That brings us to the second concern with the success of price increases, which is the potential acceleration of Chinese steel exports and continued chaos in the Chinese economy. If we are to believe some of the bears, the reality in China is such that this turmoil may only be starting, which begs the question of how much lower iron ore prices can go from here. We had long thought that $45/tonne would be key support given the nature of the mining cost curve, but a prolonged Chinese slump may change those metrics as the demand reductions now possible are not something many models were looking to account for. Equally troubling have been some of the blurbs we have been hearing from panicked Chinese traders and analysts. The Platts IODEX iron ore index touched a new all-time low this week at $44.50 and Platts had quoted an anonymous Hong Kong based trader as saying that “what we have seen now is similar to the global financial crisis in 2008, or even worse”. This is not the kind of sentiment that makes for a solid backdrop to a substantial price increase, not here in the U.S and not anywhere.

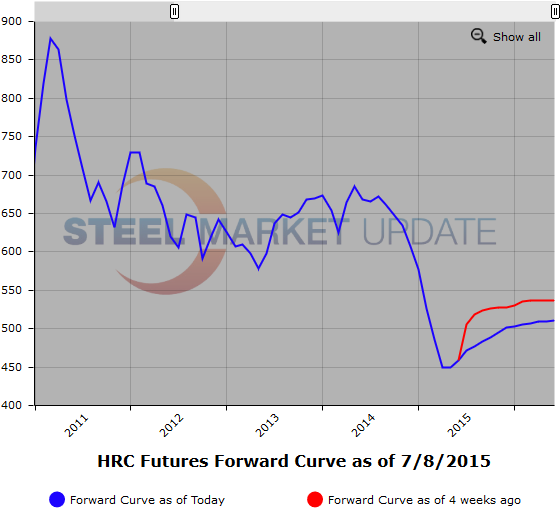

The third reason we are skeptical on these hikes is that the futures market has told us to be skeptical. The last time we wrote for this site we discussed the solid premiums for Q4 2015 months of nearly $60/ton over spot. Those premiums, related to pricing in trade cases and potential labor disputes looked a bit wide to us at the time. And sure enough, that premium has been reduced by just over one third as contango to Q4 has shrunk to just under $40/ton (Q4 is likely to settle below $500/ton again today based on Nov/Dec trades at $498/ton). The fact that sellers have been willing to offer Q4 at what is now sub $500/ton levels speaks to the amount of confidence on the part of stockholders and their lack of faith in a significant rally. We should note that those premiums may still be very attractive to many service centers looking to hedge spot purchases.

There is of course one major caveat to all this and that is of course the potential for more trade cases. The only reason we haven’t made more of this, and the reason we don’t see it as an inevitably bullish move, is that mills have fooled us so many times before on these trade cases. It is clear that a CRC case focused on China would be far more impactful on the market than the HDG and coated cases that have already been filed this year, but does anyone really know if we will see them in the next month? Rumors suggest a high probability, but if domestic mills are still pinning the success of a price increase on additional trade protectionism, we see that as a poor sign for market fundamentals. In our mind, if it wasn’t for the specter of another case, we likely would NOT be seeing even the reduced $40/ton contango to Q4 we currently have. When it comes to trade cases, we would likely see more upside priced in should anything more concrete emerge. Until then, it could be a longer road between $460 and $500/ton than the mills would prefer.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

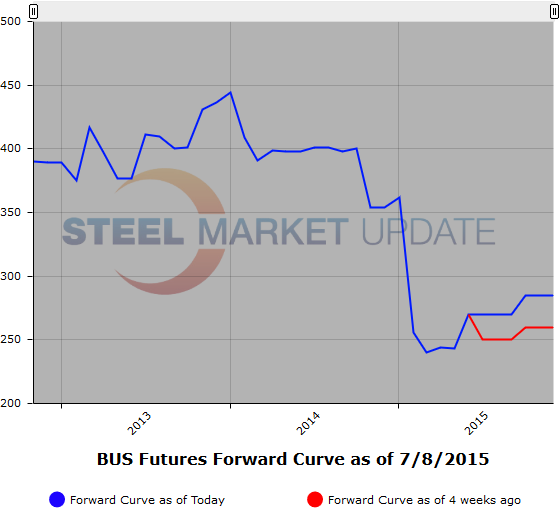

Below are two graphics of the HRC and BUS Futures Forward Curve. The interactive capabilities of the graphs can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.