Prices

June 30, 2015

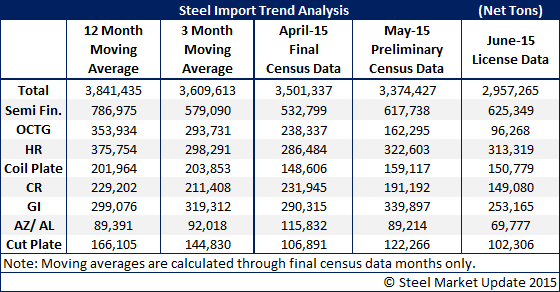

June Import Licenses: Under 3 Million Net Tons

Written by John Packard

The U.S. Department of Commerce updated the June license data late this afternoon. Based on the latest results the total foreign steel import trend appears will be below 3.0 million net tons. Last week the trend was suggesting imports of 3.0-3.2 million net tons and the week before that the trend was 3.2-3.3 million net tons. At this point steel imports could end up as low as 2.8 million net tons with 3.0 million net tons being the high side of the range.

As we mentioned in last week’s import trend analysis if June comes in at, or below, 3.0 million net tons when the Final Census data is released it will be the lowest volume month since December 2013 when the total imports number was 2.5 million net tons. In June 2014 the U.S. imported 3.6 million net tons of steel products.

Based on our analysis OCTG, cold rolled, galvanized and Galvalume (other metallic) products are all dropping compared to the last two months (April and May) as well as the 3 month and 12 month moving averages. With the coated suits and the threats of further trade action SMU expects the total tonnages to drop below 2.5 million net tons in the coming months.