Prices

June 25, 2015

Hot Rolled Futures: Uncertainty Ahead

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

On the S&P 500 we are last 2095 on the September futures, the low end of the range. On June 22nd we failed to take out the old high set May 25th @ 2125 with a 2122 high this time around. So, we retest recent lows before the market can move higher. A lot of conflicting drivers in the market with shrinking IP, increasing employment, strong dollar and declining economic activity in Asia. All that said this 401K investing community is not going into any other asset classes as long as those returns are poor and there appears little sign that the Fed will raise interest rates in the immediate term for fear of upsetting the apple cart.

In Crude, we are still going sideways with the market trading either side of $60/bbl. As I mentioned before, crude will either rip up [move higher] as the shorts, which have built up, run for cover or, crude will bleed back down to test the lows. The fundamentals of increasing supplies and improving conditions in production in the Middle East suggest the latter, but large short positions and technicals could provide a bit of an explosion ahead of that. I feel like crude may show us its colors quite soon.

Copper meanwhile is in a downward trend at this point. We are last $2.6250/lb on the July contract and that resistance trend is just above at $2.64 /lb. area. Base metals are suffering under the weight of lack of demand from China and in some instances massive exports like in steel products.

Steel:

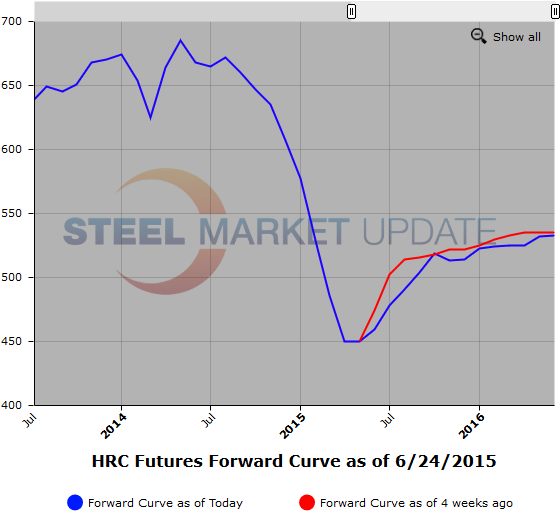

We had a solid week in steel futures with 804 lots or 16080 short tons (ST) trading. The week brought an about face on the perspective of nearby futures values with the Q3 period losing $22/ST from a week prior. Q4 meanwhile has dropped a healthy $10/ST and Q1 dropped about $7/ST. Meanwhile CRU lost $3/ST in the week, which has the audience glum again. I think in this environment $3 up or $3 down doesn’t really matter. The trend is still positive albeit modest and lead times appear to be creeping out a bit.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

A tale of two cities here, with the Chinese mills living so hand to mouth they are relying on the spot market which is not consistent in its deliveries and thus is causing volatility on nearby price. Meanwhile the forwards are under constant pressure of sellers who are bearish due to the overwhelmingly poor fundamentals, i.e. declining consumption at a time when more capacity is due to come on stream. So as a result we got more backwardated with Juy to August above $2/MT differential at times. The forward curve remains backwardated with far forward period below $50/MY again. Let’s call July either side of $58.50/MT, August either side of $$56/MT, Q3 either side of $56.25/MT, Q4 either side of $53/MT and Cal 16 either side of $49..75

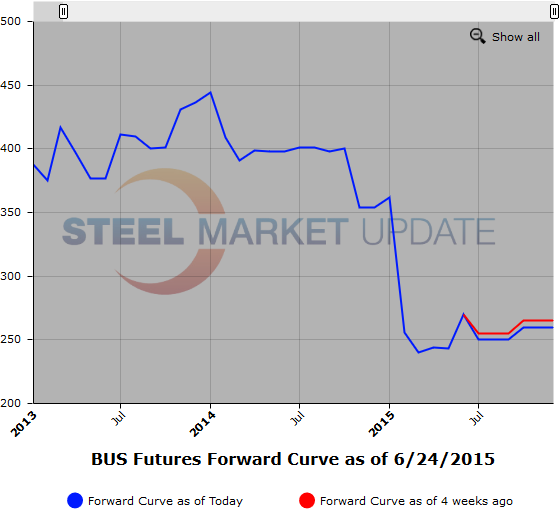

Scrap:

Scrap is a mixed bag. In Turkey, which had moved up first, it’s under pressure with the CFR now $272/MT, down from the $290’s we had a few weeks back. Turkey is being bombarded with Chinese billet which is pinching mills appetite for raw materials. Meanwhile obsolete here continues to be scarce as prices are too low while at the same time the mills’ appetite increases. Estimates are for up $10-20/GT depending on region and type. Scrap is what supports steel price here, and if lead times increase, and they probably will as inventories drop, watch out.

Another graphic is below, to use it’s interactive features you must visit this page on our website.