Prices

June 23, 2015

June Import Licenses Continuing to Trend Lower

Written by John Packard

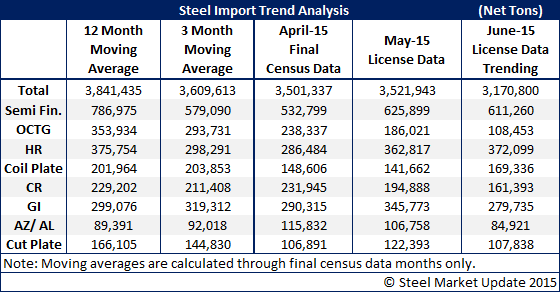

The U.S. Department of Commerce (USDOC) released the latest foreign steel import license data through the 23rd of June. Based on the latest data, the trend is for steel imports to continue to slide towards the magical 3.0 million net tons mark. Last week the data was suggesting imports would be about 3.2-3.3 million net tons. This week it is a little lower and we think when all the data shakes out that imports will be somewhere in the 3.0-3.3 million net ton mark.

June is looking to be well below the 3 month and 12 month moving averages. If the month comes in with a final number at, or about, 3.1 million net tons, that will be the lowest import volume since December 2013 at 2.5 million net tons. In June 2014 we imported 3.6 million net tons.

The item which is of concern is hot rolled coil which is trending at, or above, the 3 month and 12 month moving averages as well as above the April and May tonnage levels.

Galvanized, which had been trending well over 300,000 net tons took a bit of a breather in the newest data and is now under 300,000 net tons (but still way to high).

Galvalume is also below the previous two months but still way out of whack with the approximately 50-60,000 tons per month that used to come in on a monthly basis.

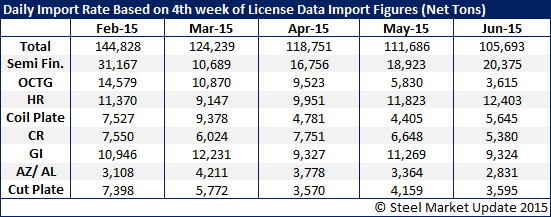

In the table below we are showing what the daily license import rate was for each of the past four months as of the fourth week of each month.