Market Segment

June 21, 2015

Trade Attorney Weighs in on Antidumping Suit

Written by John Packard

Written by: John Packard, Publisher, Steel Market Update

Last Thursday evening Ray Culley (SMU) and I attended the Chicago regional meeting of the Association of Steel Distributors (ASD) at the Hotel Sofitel Water Tower in downtown Chicago.

The speaker for the evening was Chicago based trade attorney Larry Friedman. His practice concentrates on the representation of the importers and exporters facing challenges relating to compliance with the U.S. laws and regulations covering international trade. These issues include the classification and valuation of merchandise, country of origin marking, investigations, audits, and penalty proceedings. In addition, Larry, who holds an LL.M. degree in intellectual property law, has assisted U.S. trademark and copyright holders in protecting their intellectual property from infringement by imports. He has also assisted importers resisting attempts to bar the importation of merchandise for alleged copyright and trademark infringement. Litigation is an important part of his practice. Prior to joining Barnes, Richardson & Colburn in 1991, Larry served as a law clerk to the Honorable Dominick L. DiCarlo of the United States Court of International Trade.

Mr. Friedman pointed out that in order for the domestic steel mills to receive any relief from foreign steel imports the industry must prove that one (or both) of the following conditions exist:

1) Dumping: Dumping is defined as selling steel into the U.S. market at pricing less than what is being sold (or less than the cost to produce the product) in the countries home market.

2) Subsidies: The government in the home country is providing subsidies which could be in the form of loans that don’t get repaid, tax relief, etc.

After proving that one or both of the conditions exist above then the industry must prove “injury” which Mr. Friedman defined as “losing sales, falling prices or not being able to raise prices” in the domestic mills’ home markets.

The are many risks associated with the filing of antidumping suits (he informed the ASD attendees that anti-dumping with a hyphen is the English spelling and there is no hyphen used in the U.S.). One is for the offending country to move the product through another country and scrub the origin and then send it on the United States.

More common is for other countries that are not affected by the dumping order to increase their tonnage to the United States and supplant those named in the suit.

The U.S. industry also has to take into consideration if the countries named will retaliate against the U.S. exporters of other products.

Once the U.S. mills have gone through the process and proven their case then duties/penalties are placed on the offending countries for a period of five years. It is expected that during that five year period the domestic industry will improve their competitive position so as to prevent future antidumping filings.

After the initial five year period expires there is an administrative review and the antidumping measures can be extended for another five years and so on.

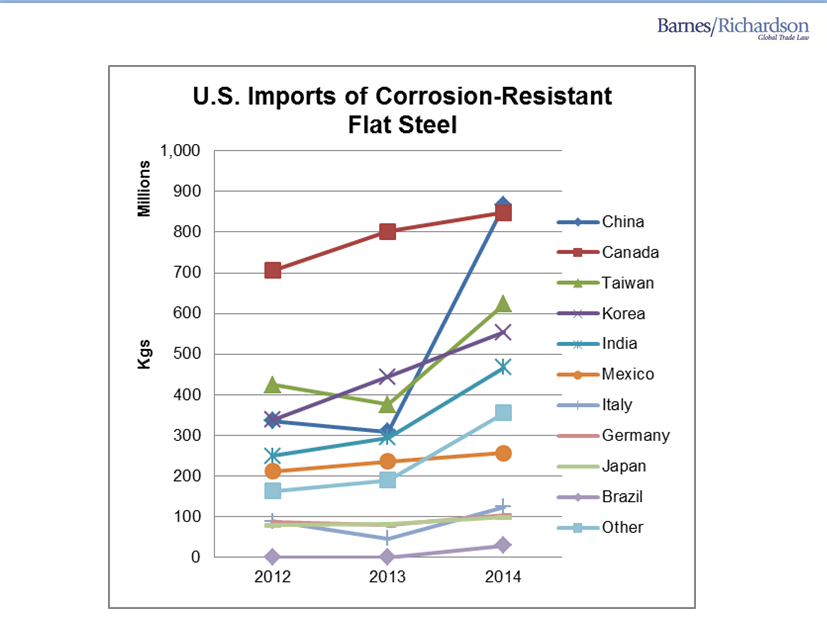

Mr. Friedman spoke specifically about the coated steel filing which was filed on June 3, 2015 against China, Taiwan, India, South Korea and Italy. He showed a slide of a number of exporting countries to the United States during 2012-2014 and pointed out the “surge” or extreme changes in the five countries named in the suit.

I will discuss this graphic in more detail later as Steel Market Update did more research, which we will share with our readers, on the five countries named in the AD/CVD suit.

In the petition filed by the domestic mills, the alleged dumping margins for each country were: China at 120.2 percent; India at 71.09 percent; Italy at 123.76 percent; South Korea at 80.06 percent and Taiwan at 84.40 percent.

In conclusion, Mr. Friedman pointed out that trade cases are complicated and expensive to file. Just because a suit is successful there are still enforcement issues.

He pointed out successful petitioners:

1) Do their homework on pricing and injury

2) Recognize that relief may be short lived

3) Actively use the period of relief to focus on what comes after

4) Work with government and privately to enforce the order

During the Question and Answer period, Mr. Friedman pointed out that the domestic mills do take into consideration changes in the value of the U.S. dollar against foreign currencies prior to the filing of any antidumping petition.