Market Data

June 18, 2015

SMU Steel Buyers Sentiment Index Surges to Yearly Highs

Written by John Packard

SMU Sentiment Index Jumps

Since our last flat rolled steel market analysis and evaluation of how buyers and sellers of steel feel about their company’s ability to be successful both three to six months from now (Future) as well as in today’s economic environment (Current), we have had a second price increase and a dumping suit filing.

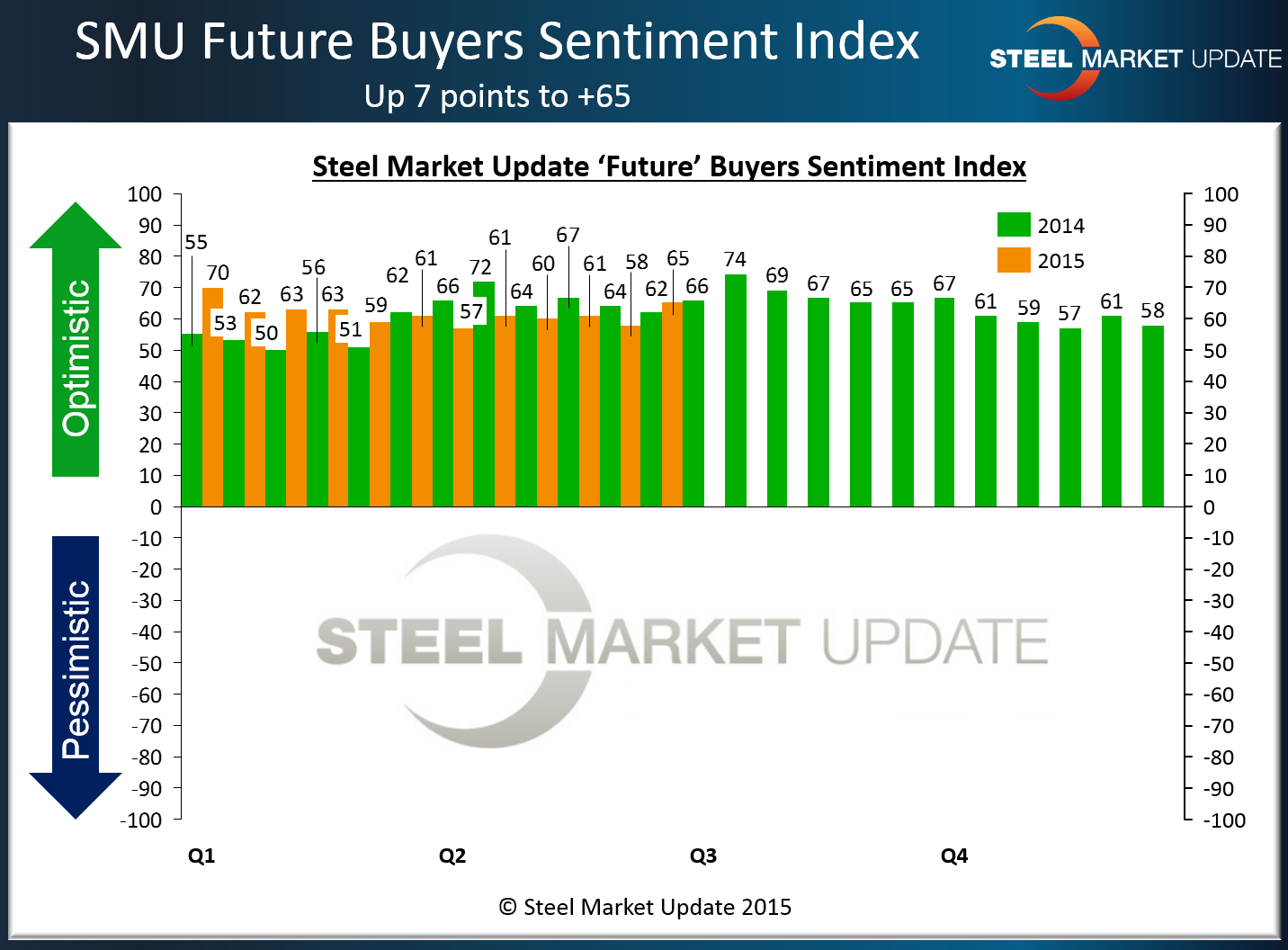

The result of these two actions is to have Sentiment rise on both indexes. Future Sentiment is being reported today as being +65 which is +7 points better than what we saw at the beginning of the month and 9 points away from the all time high achieved in mid-July 2014. The +65 is the most optimistic we have seen Future Sentiment going back to the first week of January 2015 when we posted a +70 on our index.

We go into a full explanation of our index at the end of this article but what is important to understand is any positive (+) measurement is considered to be optimistic and negative (-) numbers are pessimistic.

Looking at the Future Sentiment 3 month moving average also improved from +59.67 to 60.33. The 3MMA is not yet back to the yearly high which was +63 recorded during the middle of March 2015.

Current Sentiment Rises to +4 points to breaking through to +61 which is the highest level reported going back to the first week of November 2014 when we reported a +62.

Steel Market Update opinion is the stabilization of pricing and the filing of the anti-dumping suit is helping to create a more optimistic environment. Price stabilization stops the months long struggle of companies who had to deal with inventories which were constantly losing value. The expectation is for prices to move higher from here which would be net positives for service centers and others. The long rumored dumping suit being filed takes one level of uncertainty out of the market which is perceived to be a net positive for the market.

What Our Respondents Had to Say

“Imports should begin drying up tightening up supply slowly.” Service center

“OEM business is good, construction is moderate.” Manufacturer

“We are a manufacturer buying on contract pricing through a service center tied to CRU. We have seen good favorability so far in 2014 and a good price lock for 3Q. That will offset any 4Q increases.” Manufacturer

“June is shaping up to be a strong month.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 47 percent were manufacturing and 39 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.