Prices

June 16, 2015

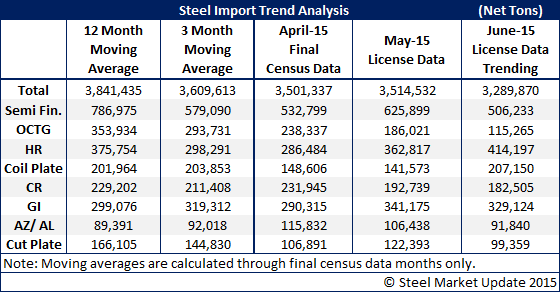

Import License Data Trending Lower for June

Written by John Packard

We are starting to see signs that the June import numbers could be significantly below those of April and May which were both at 3.5 million net tons. The daily import license rate for June is at 109,662 tons per day and if the actual imports were to come in at that rate the month would be around 3.2 million tons.

The trend, and our readers must understand that we are talking specifically about the trend now and not actual imports due to the volatility one can get from import license data alone, is for oil country tubular goods (OCTG) to be much lower than both their 3 month and 12 month moving averages (see table below). We are also seeing reductions in semi-finished (mostly slabs which go to the domestic steel mills for further rolling) which also could come in much lower than their 3 and 12 month moving averages.

The bad news continues to be on flat rolled as hot rolled is on pace to break through 400,000 tons if it continues at the current pace. We are seeing bigger numbers from Korea and Australia but most likely those tons are headed to domestic steel mills: USS/Posco and Steelscape.

Hot dipped galvanized is on pace to break through 300,000 tons again for the month. The 3 largest exporters of GI are: China, India and Taiwan so far this month. All three are named in the recent trade suit.

Galvalume (other metallic) import license data shows Taiwan as the largest exporter by far followed by South Korea with less than half the tonnage requested by Taiwan.

The estimate provided to our readers last week based off of the second week of license data saw imports trending toward 3.4 million net tons in June. Our latest estimate is down 3.4 percent from there and our opinion is we could see further erosion in the numbers as the month continues.