Market Data

June 14, 2015

Mill Lead Times History & Price Increase Announcements

Written by John Packard

Steel Market Update was analyzing data from our last flat rolled market survey just as the domestic mills began announcing price increases. We thought our readers might be interested in looking at the data with us and then guess as to whether the new price increases will “stick” or falter over time.

In our opinion, for the domestic steel mill price increases to have a prayer of being collected we need to see two things, 1) the direction of lead times would need to reverse and 2) mill lead times would need to begin to extend which signals orders are being taken at the new price levels.

A way of looking at what happens after flat rolled steel price announcements are made by the domestic mills is to look back at recent history to see what spot steel price increases stuck (and what happened to lead times after the announcements were made) as well as those that did not stick.

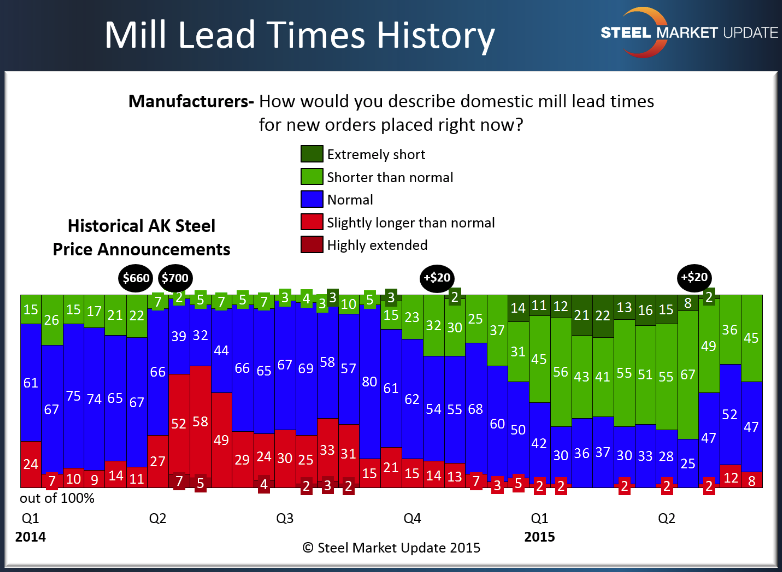

A good example were the announcements made back in late 1st Quarter and again in early 2nd Quarter 2014 by AK Steel (we use AK Steel only because they publish their increases under the “news” section of their website, so they are easy for everyone to trace back). As you can see by the graphic below, manufacturers reported lead times as extending shortly after the two increase announcements were made. The lead times continued to remain extended until late 3rd Quarter 2014.

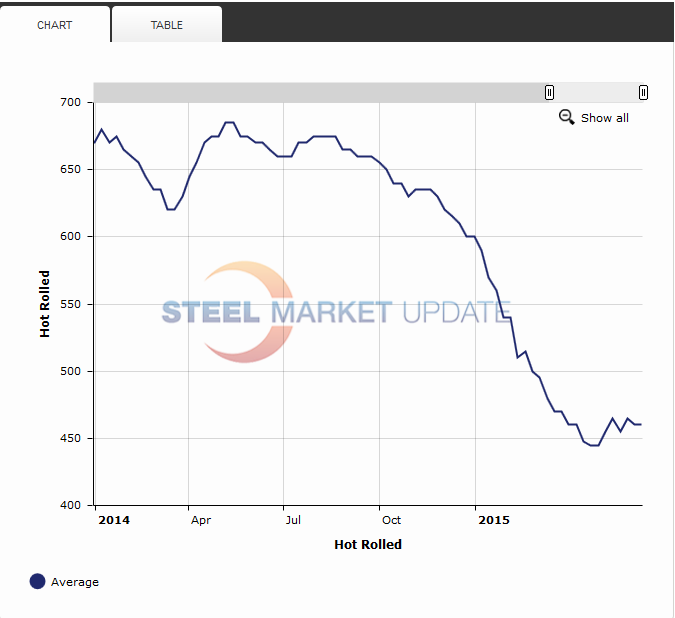

We then went on the SMU website under out “Pricing” tab and looked up hot rolled coil prices since the beginning of 2014. We have copied the graph for your review. The beginning of October is when we started to see the steel drop in prices which ended with the first price announcement at the end of April.

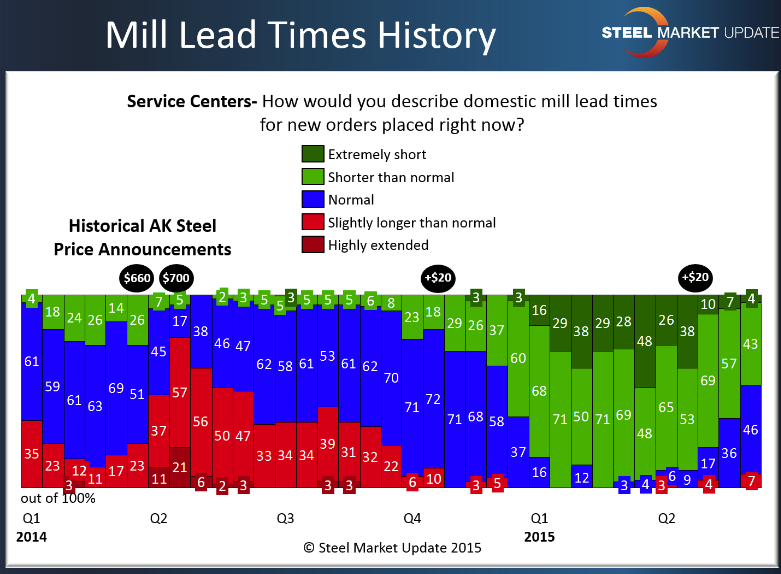

There was another flat rolled steel price increase announcement made during 2014 which was early in the 4th Quarter. As you can see by both graphs above (and the third below) lead times did not reverse course during that time period and, in fact, got much worse according to those responding to our flat rolled steel surveys. The early fourth quarter price increase resulted in a couple of weeks of sideways price movement before prices continued their long road lower.

As of last week we now have a second price announcement of +$20 per ton (AK Steel has not yet officially followed with an announcement of their own) which began with Nucor and ArcelorMittal late last week (as well as California Steel and NLMK USA). We also have an anti-dumping trade case having been filed. Both should have an impact on lead times.

As you can see by the service center lead time history graphic below. The first price announcement did move lead times off of the bottom and towards “normal.” This is a very similar result as what we saw above in the manufacturing lead time graphic.

Going forward, we believe lead times will continue to move in support of the steel mills, especially if we can get service center inventories down and see imports drop back to 2.5 million net tons instead of 3.4 million tons. We also have to be wary of the impact USW negotiations may have on the sentiment of buyers. Many buyers will want to protect their company by increasing orders as we go into August assuming the worse happens when contracts expires on September 1st.

We will know more early this week when the MSCI data comes out and we get the latest license data on foreign steel imports through the 16th of June. SMU is also conducting our mid-June survey beginning on Monday and we will report more on this subject later in the week.