Prices

June 7, 2015

Final April Steel Imports at 3.5 Million Tons

Written by John Packard

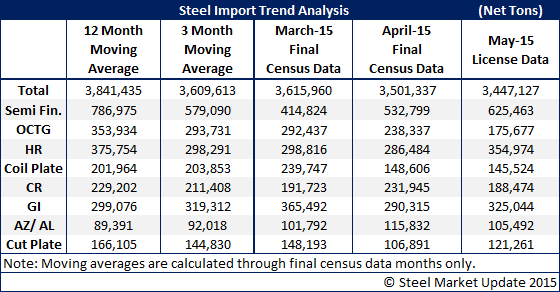

The US Department of Commerce release Final Census Data regarding April steel imports which were reported to be 3,501,337 net tons in total, down 3.2 percent over March data and down 6.3 percent over the level seen one year ago.

Semi-finished (blooms, billets, and slabs) imports recovered 118,000 tons from the four year low we saw in March, coming in at 532,799 tons. Semi-finished steels are purchased by the domestic mills and the vast majority of the slabs are going to mills such as California Steel, AM/NS Calvert, NLMK USA and others.

Imports of oil country tubular goods dropped to 238,337 tons. This is the lowest level seen since December 2013.

286,484 tons of hot rolled steel were imported in April, slightly lower than what was seen during March. The last time HR imports were this low was during the month of April 2014.

Cold rolled imports increased 40,000 tons in April over March and are now back in line with what we’ve been seeing over the last 12 months.

Galvanized imports declined to 290,315 tons in April after March’s much higher level of 365,492 tons.

Imports of other metallic coated products (mostly Galvalume) rose to the highest level in our recorded history: 115,832 tons.

Plates in coil imports dropped nearly 90,000 tons from March to April coming in at 148,606 tons.

Imports of plates cut lengths declined to 106, 891 tons in April, this is much lower than January 2015’s 210,119 tons.

All of the data in the table below is Final Census totals with the exception of May 2015 which is based on license data. As we have explained in the past, license data can vary from the Final Census data by as much as 200,000-300,000 net tons (+/-). At the moment it appears May will come in approximately 50,000-100,000 tons below the April number.

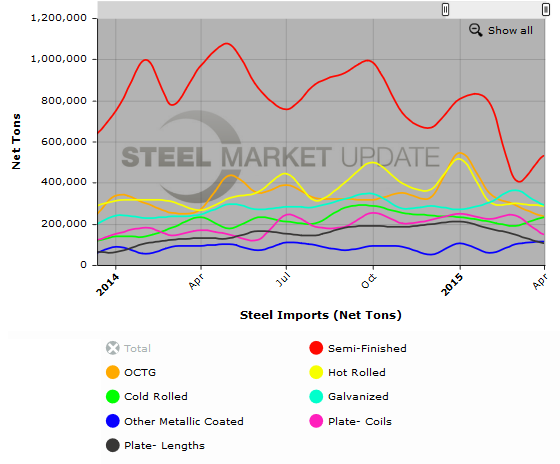

To see an interactive graphic of our Steel Imports History by Product, visit the Imports History page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475. Below is a screen-capture of the interactive graphic, click it to be directed to our webpage where you can show and hide select products, adjust the date axis wider or narrower, hover over lines to get see exact numbers, see the data in chart form, etc.