Prices

June 4, 2015

SMU Analysis of Galvanized and Galvalume Imports

Written by John Packard

Steel Market Update (SMU) wants to provide as much detail as possible regarding imports of coated steels into the United States. In particular, we are focusing on galvanized and Galvalume imports from China, India, Taiwan, South Korea and Italy.

Galvanized:

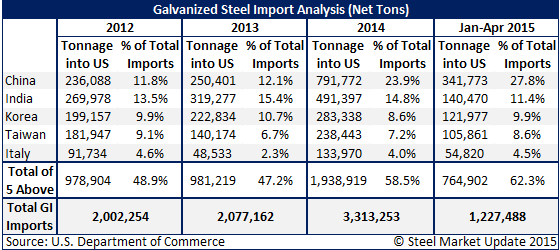

When looking at the data for 2012, 2013, 2014 and the first 4 months 2015, the growth in both tonnage and the percentage of the total is quite noticeable when looking at China’s data. India’s percentage of the total has remained about the same at 15 percent as have South Korea (10 percent), Taiwan (8 percent) and Italy (4.5 percent).

However, the total tonnage coming into the United States rose dramatically in 2014 and 2015 is on pace to exceed 2014 levels.

Galvalume (other metallic coated):

When reviewing “other metallic” data produced by the US Department of Commerce (the vast majority of this material being Galvalume), we noticed that the total tonnage has been rising each year since 2012 and exceeded 1 million net tons for the first time last year. At the current rate (based on the first 4 months of the new year) 2015 would exceed last year’s total.

Taiwan is the largest supplier of Galvalume and has been for some time. Since 2012 the country exports about 40 percent of the total Galvalume sent to this country. Taiwan is on pace to meet 2014 levels during 2015 based on the first 4 months of receipts.

South Korea has been becoming a much larger player in the Galvalume (and aluminized) markets and for the first 4 months 2015 accounts for 32 percent of the total other metallic shipped to the USA.

India and Italy are very small players in the Galvalume markets with Italy being less than one-half a percent of the total and India moving from less than one percent to 2.2 percent in 2014.