Prices

June 4, 2015

Let's Talk Anti-Dumping Trade Case (Part 1)

Written by John Packard

The following article was the first of a two part series of articles on how the anti-dumping (AD) and countervailing duty (CVD) systems work regarding any steel trade case that might be filed. Since we now have a filing on corrosion resistant steels (galvanized, aluminized and Galvalume) we thought that our readers would be interested in better understanding the US Department of Commerce (DOC) and International Trade Commission (ITC) and what needs to be proven as well as the timetable. The article below, which has been edited to better fit the current coated steel suit, was originally published on March 17, 2015 (SMU volume 10, issue 33).

…Steel Market Update wanted to understand more about what injury is (from a legal perspective) so we asked trade attorney Lewis Leibowitz (and a speaker at last year’s Steel Summit Conference) to help us better understand injury as it relates to the domestic steel industry.

“Injury requires “material injury” or threat of imminent injury where imports of dumped or subsidized merchandise were a cause of injury or threat. Sounds vague, and it is. Injury really is whatever three members of the ITC say it is (there are six members). There are many arguments that can be made supporting or refuting injury in any individual case. That’s why extensive knowledge of precedent and the industry concerned are important considerations.

“The injury must be to the industry taken as a whole, not [just] individual firms. When the entire industry is losing money over a three-year period, injury is likely (but not automatic). Where the industry is losing money for some of the period (generally about three years) but making money in other periods, the outcome is much less certain. Given that the AD/CVD laws are intended to protect domestic industries, some companies may be excluded from the injury analysis if they are depended on imports. It’s unusual but not unheard of to exclude domestic producers affiliated with foreigners.”

It is Leibowitz’s next comment that we believe will be the crux to any trade action taken against light flat rolled products:

“Injury can be shown by a lack of market share—if increasing imports are accompanied by decline in financial performance of domestic firms, injury is more likely. But there are no hard and fast rules.”

[SMU Note:] We have seen significant gains in market share on cold rolled and coated steels. One mill recently shared a graphic depicting the overall Galvalume market in the United States. In the graph the U.S. producers now have less than 50 percent of the total Galvalume market due to foreign imports both bare and prepainted.

The second question SMU has been fielding from our readers has to do with timing. What is the process and how long do importers/manufacturers who are importing affected products have to respond to a new anti-dumping (AD) action?

We got the following questions from a manufacturing company recently:

“I know that a dumping order requires both dumping (found by the Commerce Dept.) and injury (found by the International Trade Commission) for a penalty to be applied.

“If a case is launched, what is the typical timeline for dumping to be found or not?

“If it is found, what is the typical timeline for the ITC to then rule on injury?”

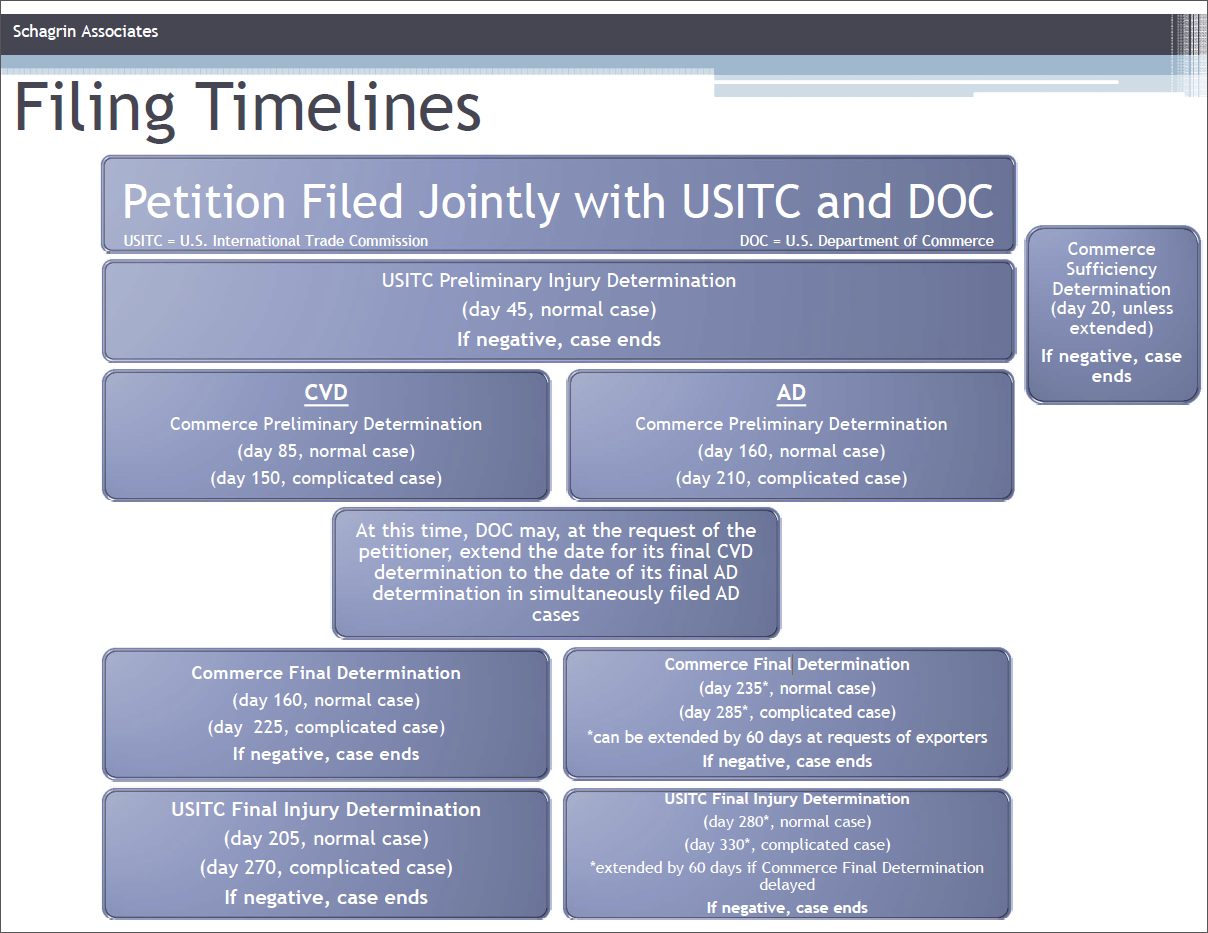

SMU checked with attorney Roger Schagrin who supplied us with an excellent chart on what happens when an AD (anti-dumping) or CVD (countervailing duty) case is filed with the US Department of Commerce and the International Trade Commission.

Our reader continued with one more question:

“If both dumping and injury are found, then what is the timeline for the anti-dumping rate to be defined and when is it back applicable to? For instance, if China is found for thin gage sheet galvanized steel, and a 20% anti-dumping rate is applied, when is it applicable to? Does it go back to the date the Commerce Department finds that dumping is occurring, or is it some other date?”

[The answer to that question is in the next article in tonight’s newsletter]